Time to be short global commodity prices through ETFs

A trade with a $10 to $1 reward/risk relationship

Major reversal patterns are predominant in all global commodity indexes. The ETFs offer a trading opportunity with a $10 to $1 reward/risk relationship. I will take these types of measured-risk trade set-ups all day long.

Background

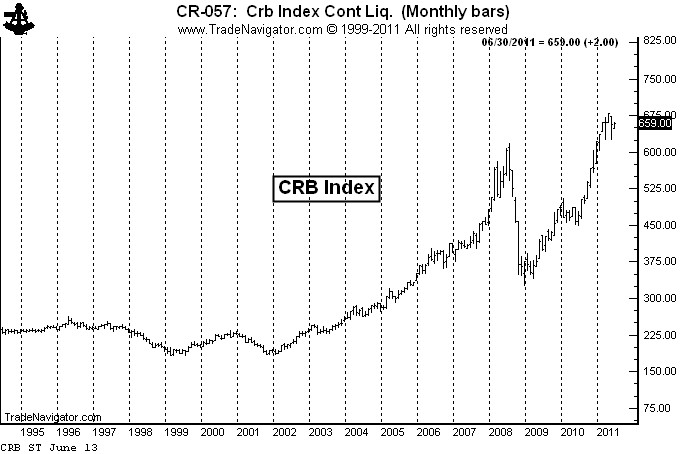

As shown by the long-term CRB Index, global commodity prices have been in an historic bull trend, with the Index advancing 107% from the late 2008 low and 269% from the 2001 low.

There is an old adage that, “Nothing cures high commodity prices like high commodity prices.” High commodity prices provide an incentive for manufacturers to find alternative and lower-cost production methods/components and for producers to bring new production on line.

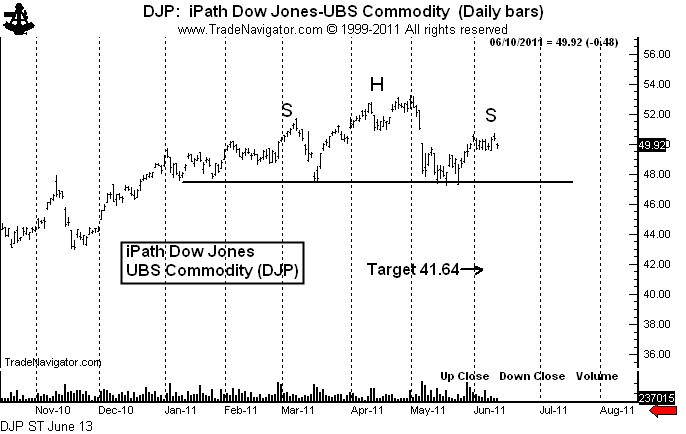

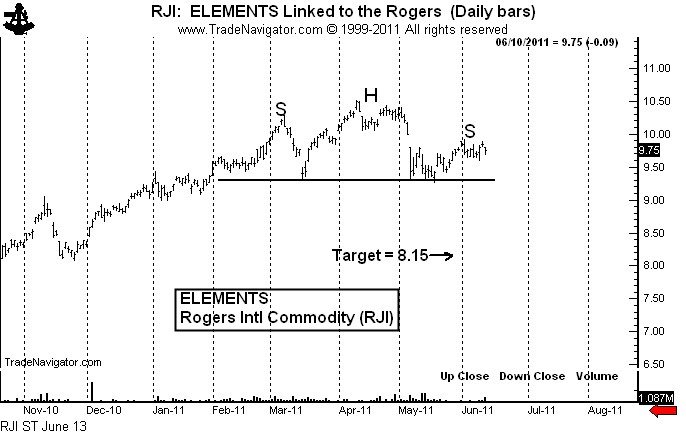

There are some signs that commodity prices are overextended – and that significant price retracements are possible. In fact, H&S chart formations are appearing in all commodity-based ETFs.

Below is the daily chart of the iPath Dow Jones-UBS Commodity ETF (symbol: $DJP). A decisive close below $47.00 would complete this top and establish an initial objective of $41.64.

The ELEMENTS Linked to the Rogers Commodity Fund (symbol: $RJI) also exhibits a H&S top pattern. A decisive close below $9.20 would set a target of $8.15. Note on the charts of $DJP and $RJI the appearance of large down gaps on May 5. That these gaps have remained open is a sign of weakness.

Laying out a trade

I will attempt to establish a short campaign with a reward/risk relationship of about $10 to $1 using selected commodity index ETFs. Keep in mind that the sizing stated below is per each $100,000 of trading capital.

The London Stock Exchange trades a short commodity ETF, symbol $SALL (quoted in US$). I will buy 300 shares of SALL at $52.12 stop. My risk on the trade is $.80 per share, or a total of 24 basis points ($.80 per share times 300 shares equals $240). The target would be $57.80. If reached, my profit would be 170 basis points (or $1,704 per $100,000 of trading capital).

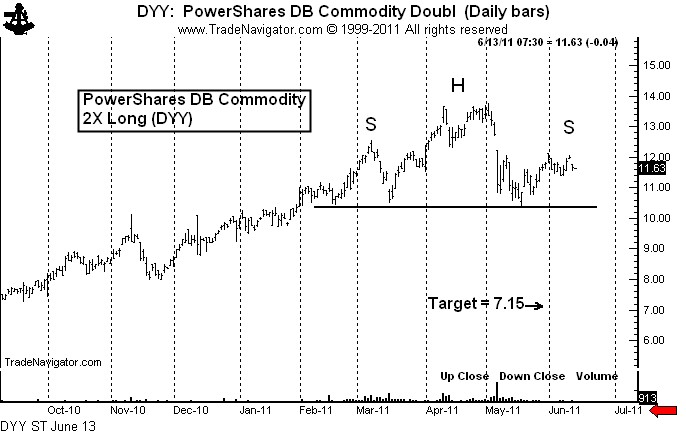

I will also short the Ultra 2X PowerShares DB Commodity Index ETF, symbol $DYY. I like the concept of being short the ultra-long ETFs because prices will erode if the underlying commodities drift sideways. Shorting an ultra-long ETF is similar to shorting an out-of-the-money call.

I have shorted the first layer of 200 shares today at $11.64 with a risk to $12.75 (22 basis points). I will short the second layer of 200 shares below the existing June low at $11.24 stop. If filled, I will risk the first layer to $12.22 (12 BP) and the second layer to $11.81 (11 BP). So, after two layers are established my total risk on $DYY will be 23 BP, or $230 per $100,000 of trading capital.

I will short a third layer of 200 shares of $DYY at $10.14 stop, and if filled I will risk my entire position to $11.06. This would lock in a profit of 11 BP in layer one and 3 BP in layer two. The risk on layer three would be 18 BP. The composite risk on all three layers of $DYY at the point of entry of layer three would be 4 BP.

The target of $DYY would be $7.15. If all goes according to the plan (and this seldom ever happens), my profit on the three layers combined would be 231 BP ($2,310 per $100,000 of capital).

I would anticipate that $SALL would be filled on the same day (+/- one day) as the third layer of $DYY. If all goes according to the plan, my maximum risk will be about 30 BP, or 3/10th of 1% of capital, and my profit potential is about 400 BP (or 4% of capital). Thus, my reward/risk relationship is at worst $10 to $1.

NOTE: If commodity prices rally from present levels and the symmetry of the H&S patterns is disrupted, then all aspects of this analysis and trading strategy will be nulified.

###

Leave a Reply

Want to join the discussion?Feel free to contribute!