Lessons from a difficult year of trading

This correspondence details lessons I have learned about myself, my trading and the markets as a result of a difficult year of trading.

Perhaps these lessons can benefit you, especially if you are a discretionary trader who uses chart patterns for trading.

I am not shy about hyping my good trades. I am also not hesitant to point out my unprofitable trades as well. In fact, traders who know me best would say that I am much more inclined to discuss my struggles than my victories in trading.

Touting only profitable trades is a violation of full disclosure because profitable trades are not representative of overall trading performance. On the other hand, an analysis and discussion of the trials and tribulations of trading can produce trading insight. In fact, I believe that the best thinking by traders occur during periods of adversity. It is during these periods that traders think most deeply about their trading and risk management protocols and practices, about market behavior and about the human dimension of market speculation.

I am presently experiencing a quite unpleasant 12-month period in the markets. It has been Chinese water torture. I have been forced to go back to the drawing board to re-examine every aspect of my trading.

Background

First, some perspective is in order.

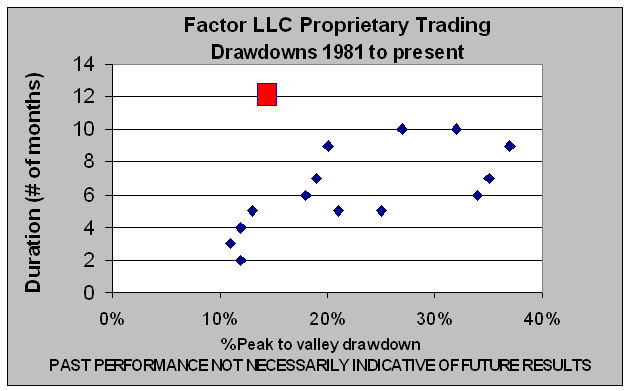

Coming into 2010, I had three pretty good years of trading. In 2007, my trading account gained 95 percent (due mostly to Gold). I was up 59 percent in 2008 (EURUSD and GBPUSD). Then, 2009 was an okay year with a 24-percent gain (due almost exclusively to a mid-year Sugar move). I had a fair first four months in 2009, up about 7 percent, but trading has been a struggle since then. I am in a 12-month drawdown of around 13 percent. The peak-to-valley magnitude of this drawdown (marked by red box) has been mild by historical standards, but the duration has been a 30-year record. The scatter graph below displays all my drawdowns in excess of 10 percent.

I have had some excellent trades in the past 12 months, but they have been too few and far between. As I stated earlier in this correspondence, this past year has been like Chinese water torture…drip…drip…drip! Of all the drawdowns I have encountered over the years, this one has without a doubt been the emotionally toughest to endure.

Since 1981 I have experienced more drawdowns than I can remember – at least two in excess of 5 percent every year I have traded. I have survived every drawdown. I have no doubt I will survive this drawdown – and that I will emerge as a better trader.

As has always been the case with drawdown periods, I attempt to ask (and hopefully answer) three questions.

1. Has my trading plan/guidelines/rules been out of synch with the markets?

- If so, in what ways? Has the drawdown uncovered some basic flaws of the plan? [Note: Basic flaws in trading plan are masked during profitable periods – they show their hand during drawdown periods.]

- What modifications could I make to address foundational flaws of the trading plan, not to optimize the plan against the recent time period, but to improve upon the plan. [By the way, I am not a believer in the optimization of indicators.]

2. Has the basic behavior of the markets changed?

- If so, might the change in market behavior be permanent?

- If permanent, what might be the reasons?

- If permanent, what are the implications for the trading plan?

3. Has my trading execution been out of synch with the plan? (Note: this applies more to discretionary traders than to systematic traders.)

- If so, in what ways has my execution been out of synch with my trading plan?

- Have there been any particular patterns in the breach of the trading plan?

- What changes are needed to bring execution back into line with the plan?

As I analyzed the past year, the answers to the three questions are YES, YES, and YES. My analysis attributes a percentage contribution to trading results by each item. Perhaps in a future post I will address the attribution analysis.

Over short periods of time nothing can really be done to address #1. All trading plans are cyclical in terms of their alignment with market action. Addressing foundational flaws of a trading plan is an ongoing effort for all traders. This is a healthy and needed process.

But a “Yes” answer to item #2 is a more complicated matter. I believe the basic behavior of markets has changed permanently. See my blog post here for my thinking on this matter. Yet, I also believe that my solutions for items #1 and #3 will address the changing nature of the markets.

Action plan

The bottom line issue for me is simple – What changes do I need to make to my trading plan (and the execution of the same) and to my risk management protocols to return my trading plan to consistent profitability? Without going into depth on each item, the following represents my action plan. Some of these items represent modifications, some new twists and some a rededication to basic principles.

Focus on charts from an elevation of 40,000 foot

Daily chart patterns have become increasingly unreliable. In fact, the changing nature of the markets (especially in forex and futures) has almost made shorter-term patterns things to be faded. This means that I will not look at an intraday chart and only look at a daily chart if the weekly or monthly charts have given me a reason to do so. Fortunately, the weekly and monthly charts have not been compromised by changes in shorter-term market behavior.

Decrease risk per trading event

My historical maximum risk per trade has been 100 basis points, with the entire position entered at once. I have readjusted this maximum risk to 60 basis points, with positions being established in halves or thirds.

Avoid range-bound markets

The past year has greatly reinforced the concept of “markets at rest remain at rest and markets on the move remain on the move.” I have lost a significant amount of capital in the past year anticipating breakouts that did not occur.

Be much more aware of the underlying trend

Defining “trend” can be a difficult challenge, but I have begun monitoring some moving averages – not in the sense of developing or using a moving-average trading system, but as a proxy for trend. A majority of the chart pattern trades that have cost me money in the past year have been countertrend (as measured by the moving average proxy).

Transition away from high/low/close bar charts to closing price charts

“Noise” has increased in my primary markets (futures and forex). I have had way too many orders executed at intraday price extremes, only to have the markets close at prices favorable to my trades. The most important price of the day is the closing price. The most important price of the week is Friday’s close.

Modify my protective stop protocol to reflect increased intraday noise

I have always believed in having protective stop orders in place at all times. I am no longer a strong advocate for this practice. I have been stopped out of too many positions only to see better exit spots within hours or days. Rather, I am now an advocate of the following protective stop protocol.

- No stops in overnight markets, including forex

- Mental stops based on closing price charts – the use of mental stops requires disciple to follow through with intentions

- Very wide actual stops (daytime session) to protect against a “worst case scenario”

Actively trade a portion of a position

Historically, I have held onto my entire position until the target was reached or until the initial protective stop was hit. This strategy has not treated me well during the past year, and, in fact, has negatively impacted my bottom line for the past two years. Rather, I have adopted a strategy to hold half of a position while trading half of a position, selling only on strength and buying only on weakness.

Avoiding ambiguous market situations

As a discretionary trader (as opposed to a systematic trader), there are always market situations that fall into a grey zone – “is there a set-up or isn’t there a set up?” I have historically erred on the side of giving a set-up the benefit of doubt, believing that I would benefit if just one in four questionable set-ups worked. My theory has been that making money is more important than being right. I have reappraised this trading strategy in favor of demanding more clarity from chart patterns. I still believe that making money is far more important than being right — but with less reliable chart patterns, erring on the side of caution is now part of this belief system.

Limit my decision-making time window

I have long had a rule to determine and enter my orders each afternoon and then avoid exposure to the markets during the trading session. At the same time, I love the markets and, like so many other traders, get caught up in the price-making process. The degree to which real-time decision making has negatively impacted my bottom line really hit home in the past year. I am NOT a good intraday trader – never have been, never will be. Paying attention to the markets during the trading session is detrimental to my financial (and emotional) health.

Another aspect of intraday decision making is worthy of note. There was a time in the markets when the trend of the first several hours would continue through the day. This is no longer the case. Directional price momentum during one time slot seems to have no correlation to momentum in subsequent time slots. Markets now routinely make new highs and lows frequently throughout the day.

Let me close this post with one other thought. I am in a drawdown. Yet, I am in no hurry for a new NAV peak. I have seen too many traders blow-up by “doubling up to catch up.” I can only control what I can control – but profitability during any given time period is not a controllable variable.

That’s it for now, folks.

Trackbacks & Pingbacks

[…] fitting within the daily chart patterns. This one may be a bit early — we'll see about it tomorrow.Wen long before close based on 60-minute chart patterns fitting within the daily chart patterns. Thi…WordPress › […]

[…] and I have had our fun with trading issues before (see here, and here and […]

[…] Lessons from a difficult year of tradingpeterlbrandt.comhttp://peterlbrandt.com/lessons-from-a-difficult-year-of-trading/ […]

[…] I’m in a drawdown of 3% since our accounts hit highs on May 10. For someone who treats every fraction of a % like it’s the last dollar we have, that feels like a crash. It’s not, and history tells me that with or without the market we’ll get back into record high ground sometime in the next 2-3 months. In 2010, it was 3.5% and we went just over 3 months without a high. In 2008, it was 6% and the recovery period was 6 months. It happens, I won’t write a drawdown analysis piece because Peter Brandt wrote the quintessential one here. […]

[…] Peter Brandt […]

[…] read this post by Peter L Brandt, Lessons from a difficult year of trading, and thought if someone who’s had that much success can have the balls to take a good look at […]

[…] abrupt change and I can’t tell if it’s my plan or the market’s plan that’s out of synch. I love this plan put out by Zortrades, but I’m not there without a change in the […]

[…] http://peterlbrandt.com/lessons-from-a-difficult-year-of-trading/ This entry was posted in Uncategorized. Bookmark the permalink. ← RISK On […]

[…] morning I posted “Lessons from a difficult year of trading.” The post detailed three major factors contributing to my current 13 percent drawdown and nine […]

[…] Lessons from a difficult year of trading (peterlbrandt.com) […]

[…] interesting links for your reading pleasure: • Lessons from a difficult year of trading (Peter Brandt) • Forefront: The Inflation Issue (Cleveland Fed) • Hedge-fund secrets to beat the market […]

[…] post is a must read for any serious trader or market professional. It isn’t every day that a 30+ year […]

Leave a Reply

Want to join the discussion?Feel free to contribute!