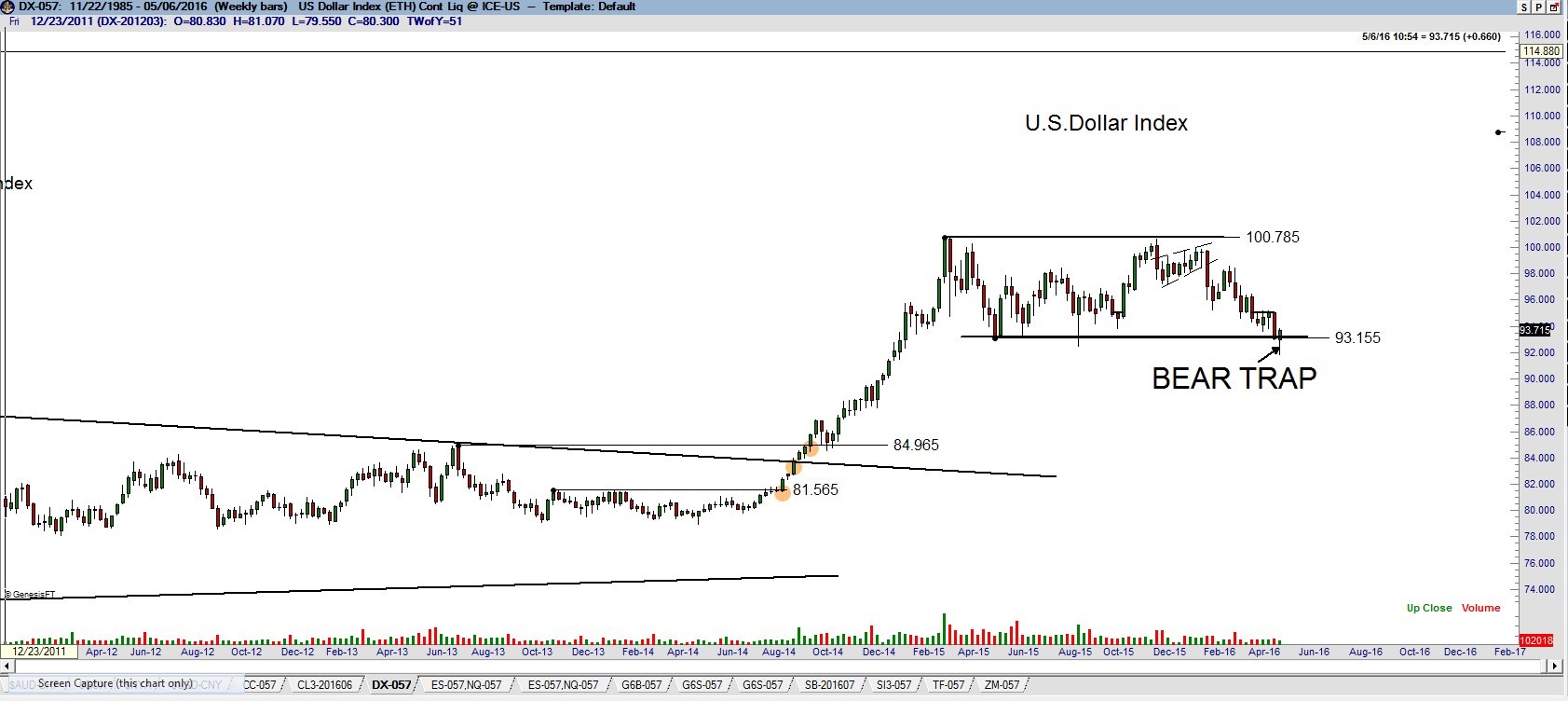

Bullish on the US Dollar Index

US Dollar Index

I remain bullish on the US Dollar index. Like every other chartist in the world, I am well aware that the DX penetrated the important line of support at 93.00 this past week. I had absolutely no desire to short the apparent breakout of this level. In fact, I believe the decline below 92.00 was a gigantic bear trap – bringing in new shorts and washing out stalled longs.

A chart showing the recent CFTC COT data is also shown. Commercials have the smallest short position and large specs (hedge funds) the smallest long position since June 2014 – the month of the last major low in the DX. I am willing to “bottom-pick” DX should the 93.10 level be retested. My goal is to establish a 60 BP position near the lower boundary of the rectangle in DX. My long term target in DX is 120.00. Along the way I would like to build to a 100 to 150 BP position.

Factor Membership is now available. You could consider your membership in the Factor Service as just one more trade. If the Factor Service is not of value to you, well, it is just one more trade that did not work. Through the Factor Service I endeavor to alert novice and aspiring traders to the many pitfalls you will face – and to offer advice on overcoming those pitfalls. My goal is to shoot straight on what trading is all about. For more information, visit the home page here.

I hope you will consider joining the Factor community.

##