Treasury Bonds (T-Bonds) are Constructive

Treasury Bonds (T-Bonds)

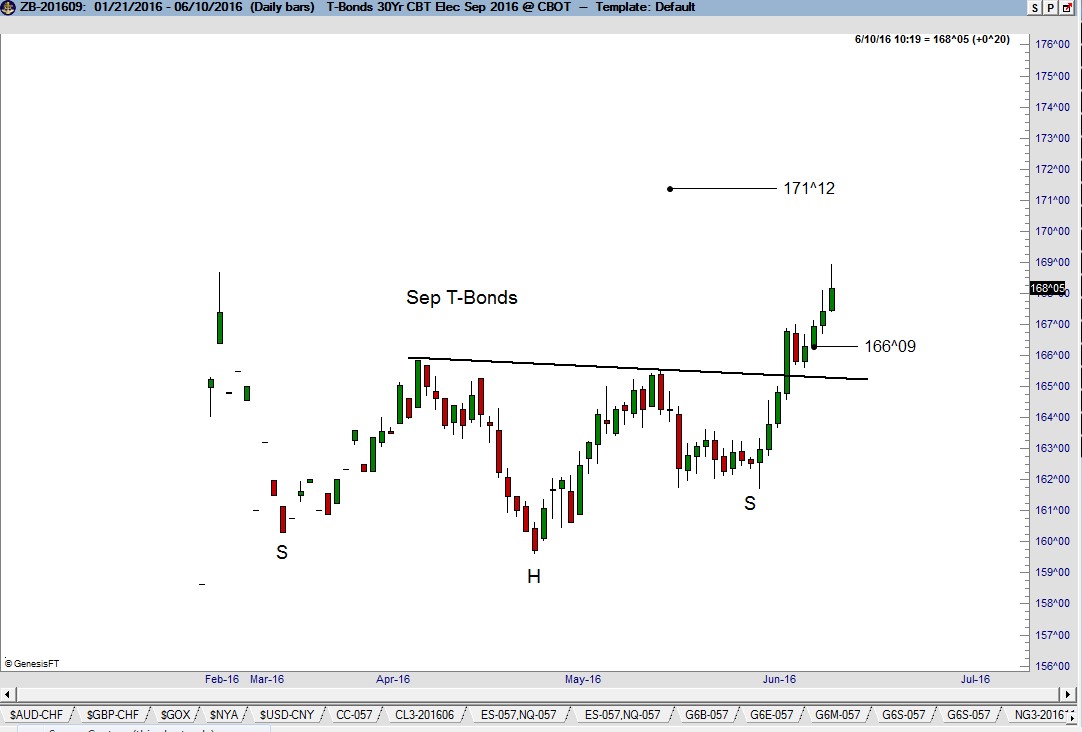

The dominant chart construction in Treasury Bonds (T-Bonds) is the 10-month symmetrical triangle completed on the weekly continuation graph in late Jan. The Sep T-Bonds futures contract has decisively completed a 4-month inverted H&S pattern on the daily graph. The advance this past week also completed the 4-month congestion zone on the daily continuation graph (not shown). Factor (see premium service here) is long the Sep contract. Stops have been advanced to just below Wednesday’s low.

Please forgive me for making a quasi-political statement. The behavior of the U.S. interest rate markets and the jaw-boning of the Fed are at TOTAL disconnect. This highlights two facts – the Fed is incompetent and totally out of control and Janet “The Felon” Yellon is way out of her league. I have known more about U.S. Treasury rates as a chartist than has Yellon as Fed Chief.

Factor Membership is now available. You could consider your membership in the Factor Service as just one more trade. If the Factor Service is not of value to you, well, it is just one more trade that did not work. Through the Factor Service I endeavor to alert novice and aspiring traders to the many pitfalls you will face – and to offer advice on overcoming those pitfalls. My goal is to shoot straight on what trading is all about. For more information, visit the home page here. Or watch my 30 minute webinar where we cover the Factor service in depth.

I hope you will consider joining the Factor community.

##