Tag Archive for: ZL_F

DJIA travels 3,141 points in one week

/by Peter BrandtCharts I am watching the week of July 25, 2011

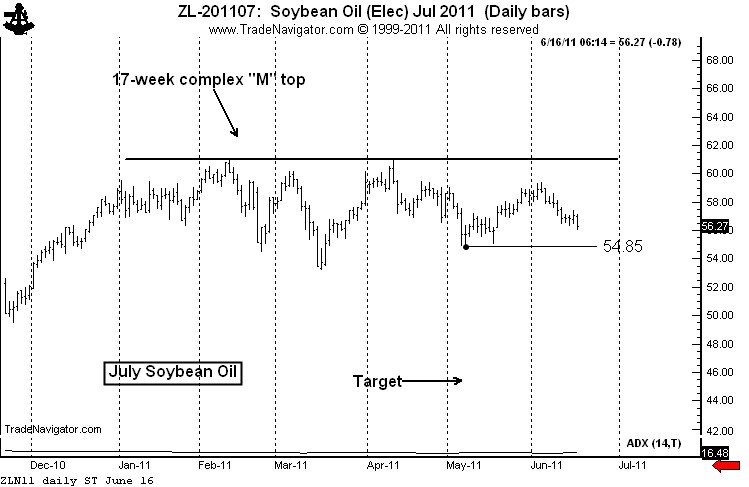

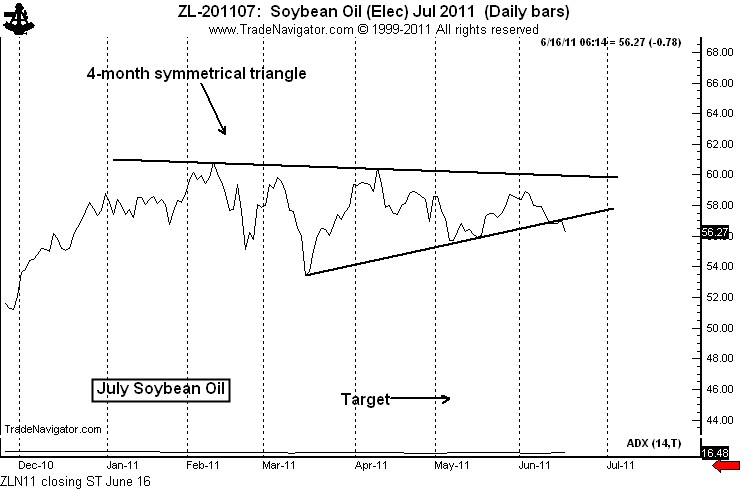

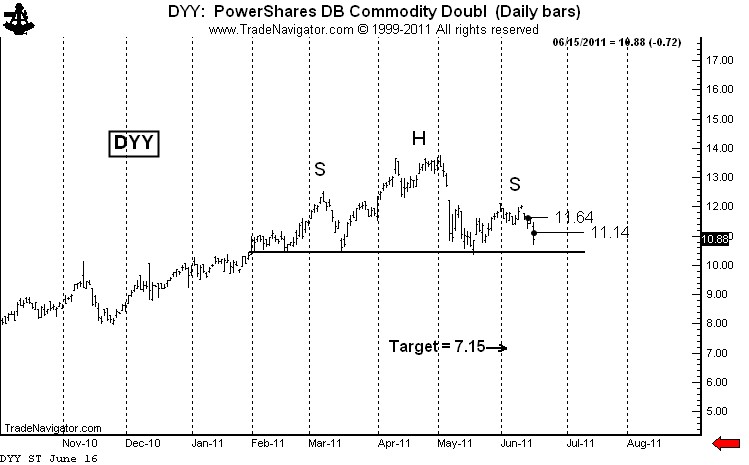

/by Peter BrandtSome charts I am looking at now – June 16

/by Peter BrandtThere are a few charts that really have my attention right now — although that does not necessarily mean I have a position or will enter a position in these markets. It does mean that I have a position or am looking at strategies to establish a position in these markets.

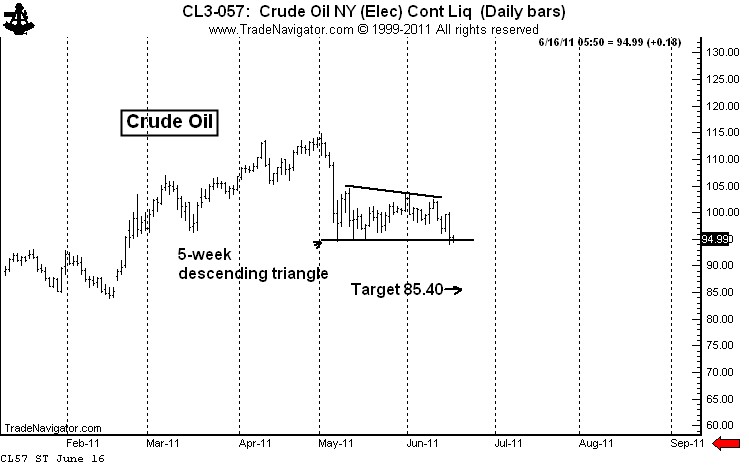

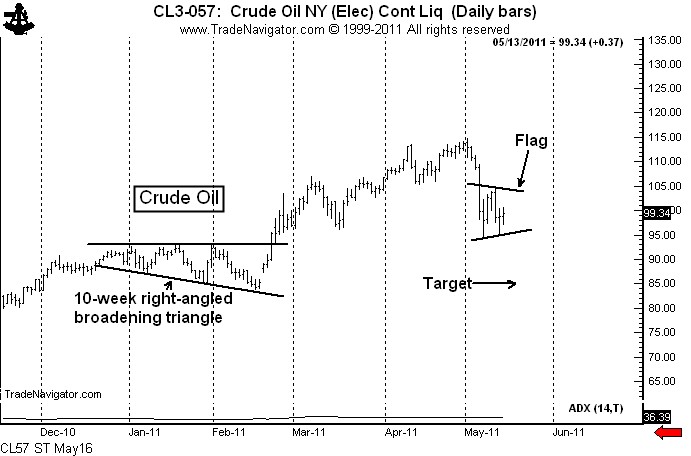

First, Crude Oil. I have commented several times in recent weeks via this blog or on Chart.ly on the recent consolidation zone. It now appears as though a descending triangle is being completed. Look for confirmation, but be aware that a bear trap could also occur. This is one of those patterns that could provide a head fake to the downside but provide big profits on the upside. But for now, I am short in my proprietary account with relatively tight stops.

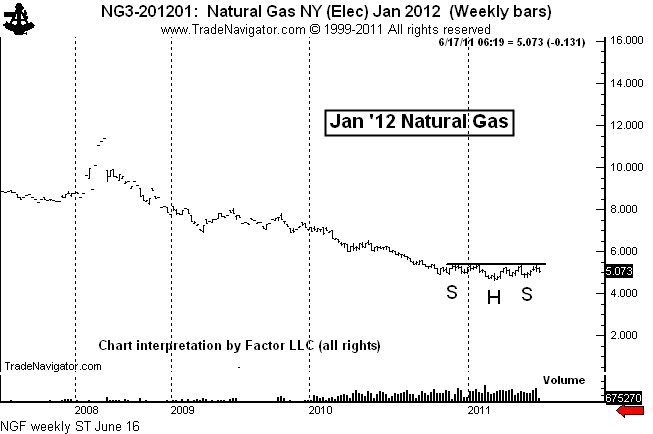

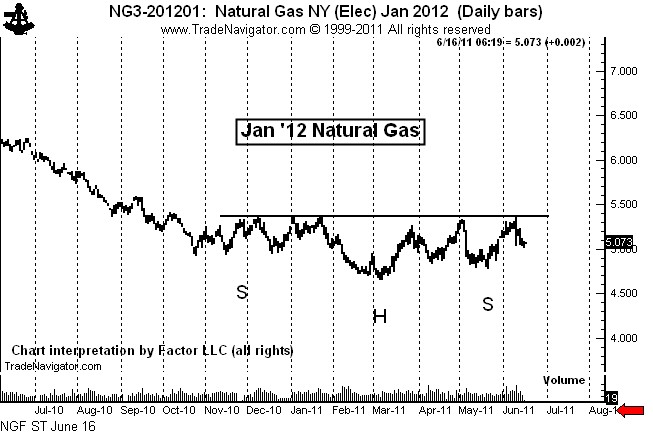

Next, I will focus on one of the best potential chart set ups I have seen in a year or so — Natural Gas. The January 2012 contract displays a classic H&S bottom on both the daily and weekly charts. A major bottom is being constructed in this market. I am sure I will comment many times on this pattern and the trading implications in futures and ETFs. [Note: Dan Chesler, an excellent energy market analyst, brought this chart to my attention. Dan’s web site is www.chesler.us]

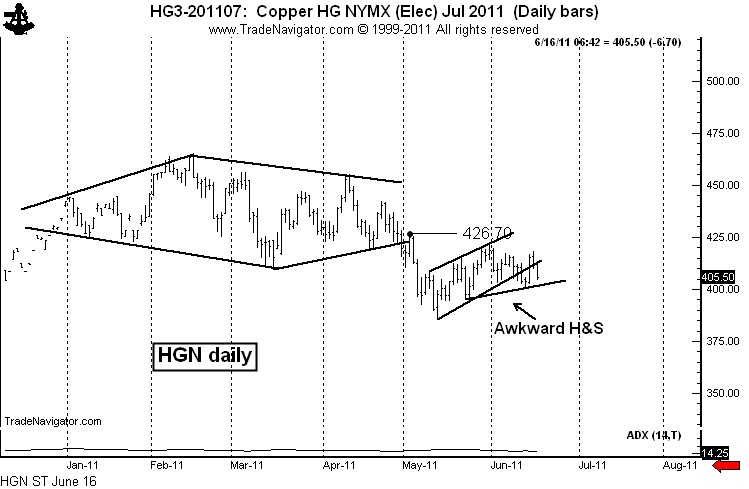

Next, Copper. I have been bearish on this chart for weeks, but the market is making it hard for position traders who sell weakness. Yet, the market is rolling over. What appeared to be a bear flag has now turned into an awkward 5-week continuation H&S pattern. If the trend has really turned down prices could easily drop $1 per pound in two months.

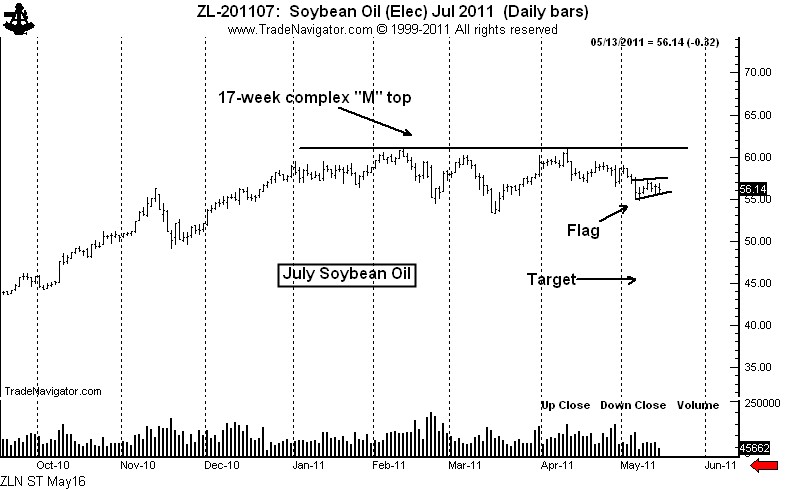

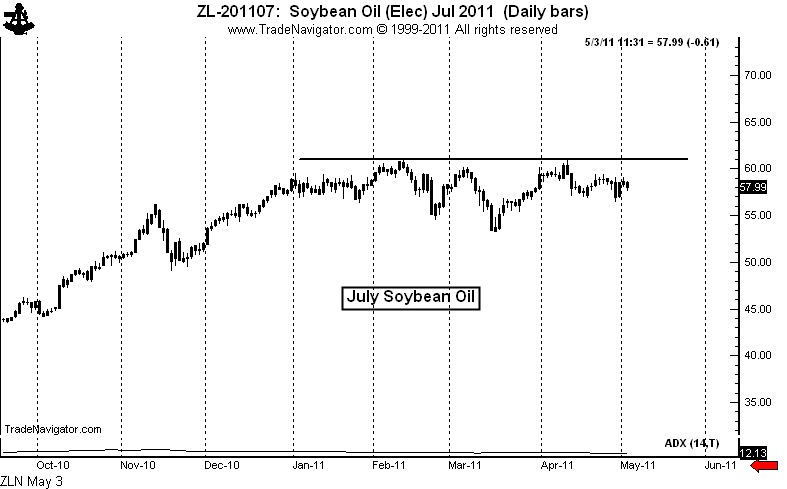

Next, Soybean Oil. I have had an upward bias in this market based on a possible continuation inverted H&S pattern. However, a sharp drop would complete a H&S failure sell signal. Also, the closing price chart (and I am paying more attention to closing price charts because of increased market “noise”) has completed a symmetrical triangle top. I am presently short Bean Oil, but I will remain flexible.

Next, July Chicago Wheat. If there ever was a H&S top pattern for the books, this is it. The problem is that H&S tops are supposed to occur after a large move up (i.e., tops are supposed to reverse a previous trend). This pattern does not qualify for this criteria in that the pattern itself WAS the move up. Nevertheless, this is a facinating chart worthy of following. I may or may not go short Wheat.

Next, July Silver. This market is in a major bear trend. The daily chart completed a H&S failure pattern on June 13 when the June 3 low was penetrated. I want to make a MAJOR point here, folks. I trade based on set-ups, knowing that 60% of my set-ups will fail over an extended period of time (over shorter time frames in the past, up to 80% of my signals have failed to produce profitable trades). I comment on set-ups, not on market opinions.

Finally, DYY (the ultra long commodity ETF). I am engaged in a short-selling campaign in this ETF. See previous posts here and here. I will pursue the strategy I have already disclosed. I am short two layers of DYY and will short a third layer if the H&S top is completed.

That’s all for now, folks.

Symbols related to this post: $ZW_F $DYY $NG_F $ZL_F $SI_F $SLV $CL_F $DJP $SIVR $GAZ $DBA $UNG

Disclaimer: I am a pure chartist. I do not trade based on fundamental or macro-economic factors.

###

Flags flying at half-mast – a sign of death!

/by Peter BrandtRisk On – Numerous charts show signs of a pending decline

In the markets, as in real life, flags flying at half mast symbolize death. A number of half-mast flags and pennants in the raw material markets indicate that the steep decline in early May was just Act 1 in a two-act play. The flags are symbolic of the intermission between the Act 1 (the first decline) and Act 2 (the next phase of the bear trend).

Bear flags or pennants are present in the following markets:

- Crude Oil

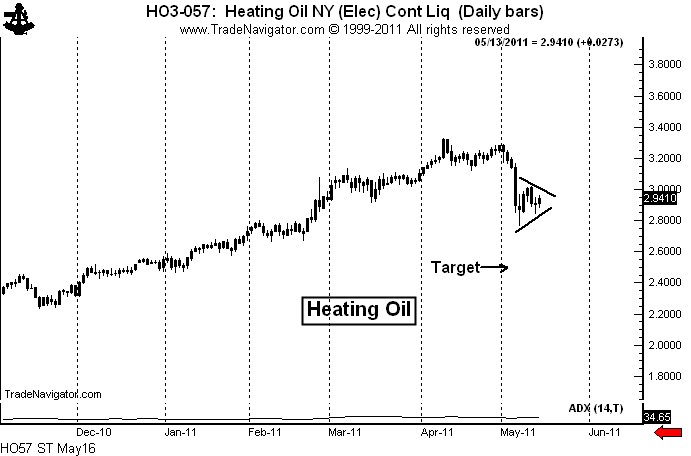

- Heating Oil

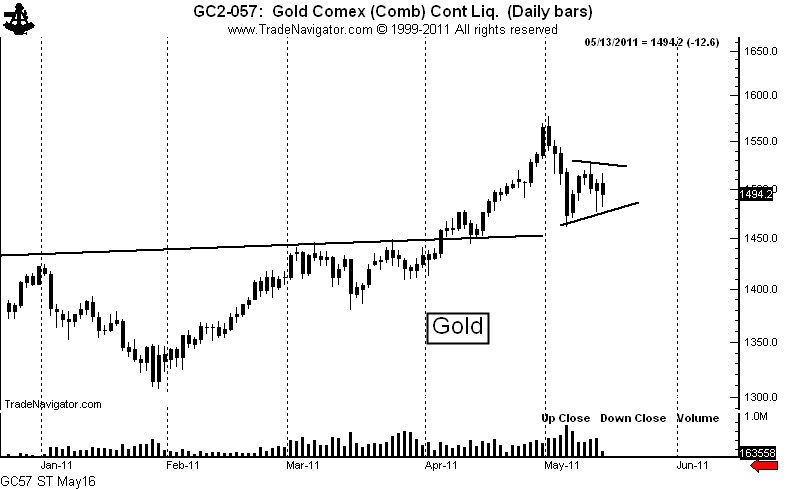

- Gold

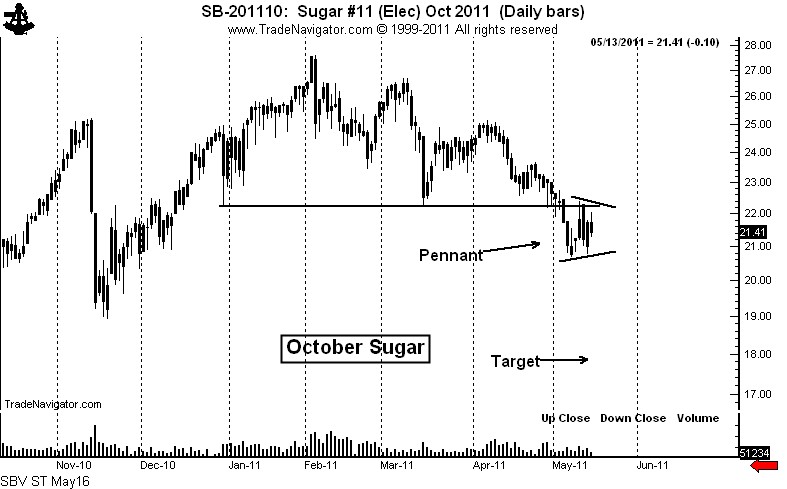

- Sugar

- Soybean Oil

Crude Oil and Heating Oil display classic pennants. Rallies toward the May 11 high (while not necessary) would be an excellent shorting opportunity. The target of the pennant is Crude Oil is 84.80.

The target in Heating Oil is 2.5060.

The Gold displays chart construction similar to the energy products with two exceptions. First, there is potentially enormous support under the Gold market in the form of a previously completed 4-month continuation inverted H&S pattern. However, old support sometimes has a way of disappearing. Second, the huge volume on May 5 could indicate accumulation buying by strong hands. However, if the energy pennants lead to a strong decline it will be difficult for Gold to hold up in a Risk On/Risk Off market environment.

Sugar also displays a classic bear pennant. This market is in a well-established bear trend and has been since early February. Notice that the pennant in the October contract is forming just below the neckline of a 5-month H&S top. The target in October Sugar is 17.83.

If my analysis is correct in Soybean Oil, the current pause in the form of a flag should be the last support before a sustained markdown in price. Once this flag gives way, prices should trend to 45.60. (Caveat: The pattern in Bean Oil could prove to be an extremely bullish continuation H&S pattern. Traders need to be flexible on this one.)

Additionally, a number of other markets present technically bearish potential. These markets include:

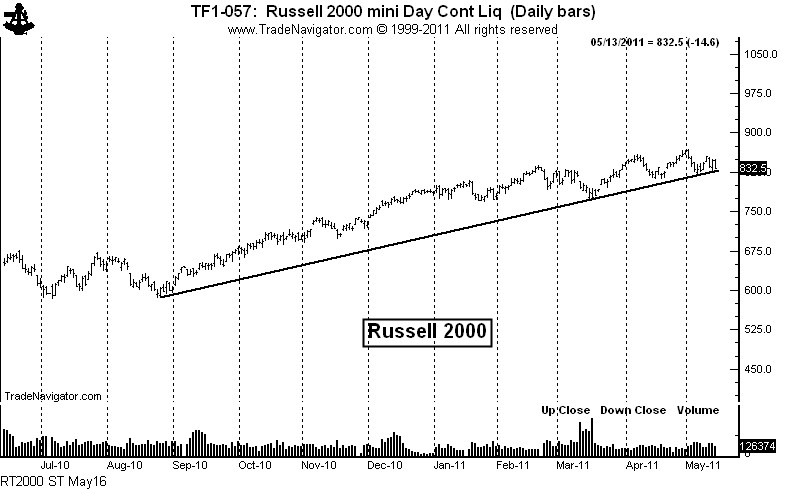

- Russell 2000

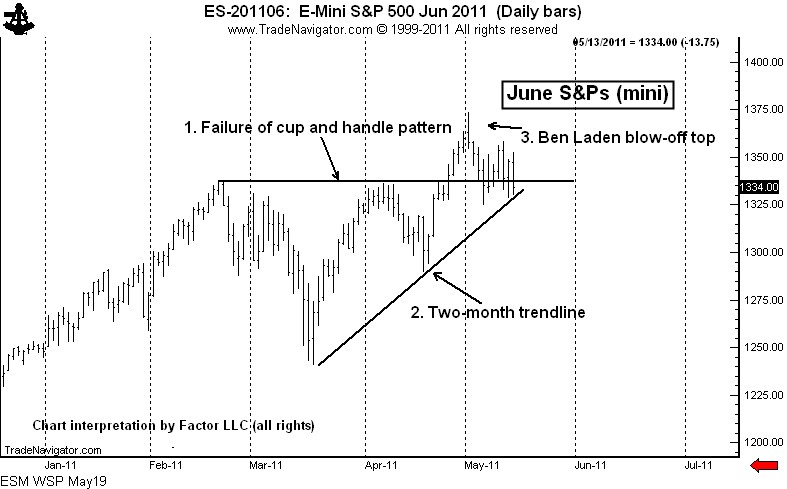

- S&P 500

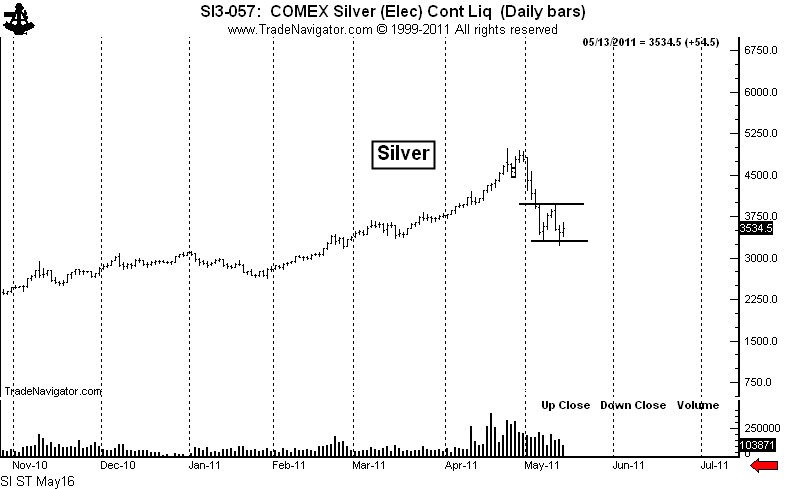

- Silver

- Corn

- Soybean Meal

The Russell 2000 is hovering right at the major 8+ month trendline. A violation of this trendline would indicate that the bull trend since March 2009 is seriously aging. The initial target would be 770 as part of the transition from bull market to bear market.

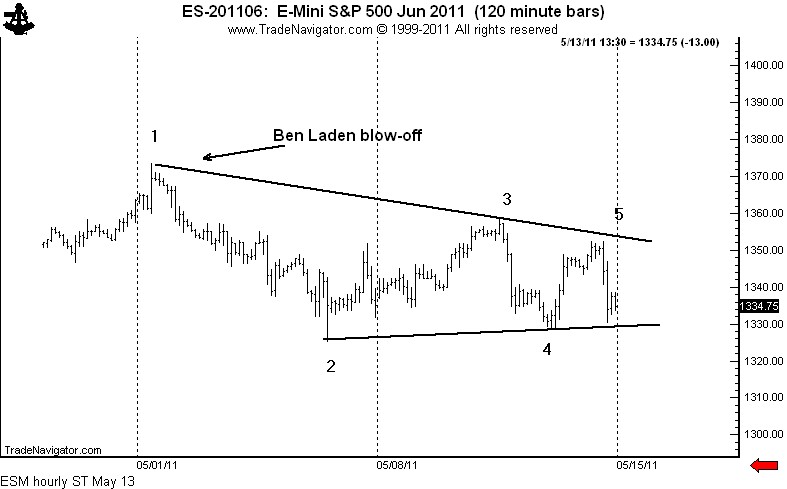

A confluence of technical developments can add to the legitimacy of a breakout. There are four factors that could trigger a sell signal in the S&Ps simultaneously by a decline below the May 6 low. First, the 2-month cup and handle bottom would fail; second, the 2-month trendline would be violated; third, the May 2 Ben Laden blow-off would be confirmed;

and, finally, the hourly chart symmetrical triangle would be completed.

I touched the third rail in late April when I announced that Silver was in the bubble phase. I was tarred and feathered on May 1 when I pronounced the previous week’s volume (7.5 years of global supply) was a strong sign that Silver had topped. The market has found support in the low 30s and a bounce into the low 40s is possible as Silver develops its own half-mast bear pattern.

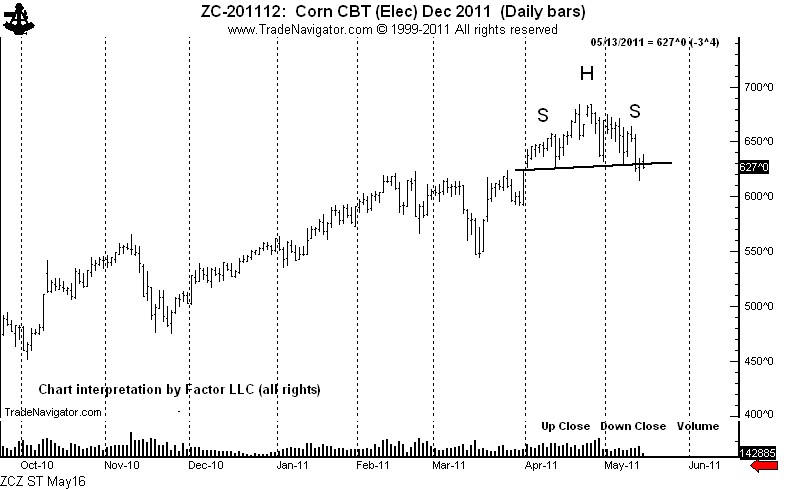

New crop December Corn has traced out a H&S top. It would not be unusual for Corn to top now.

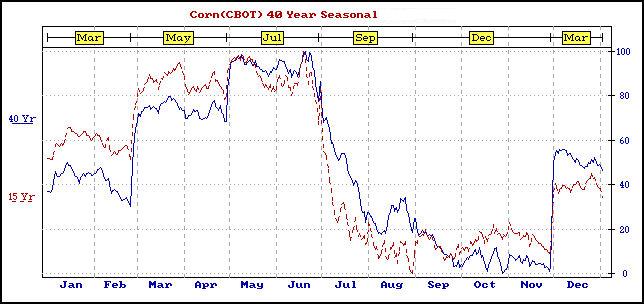

The seasonal chart shown indicates a strong tendency for new crop Corn to top in May or June.

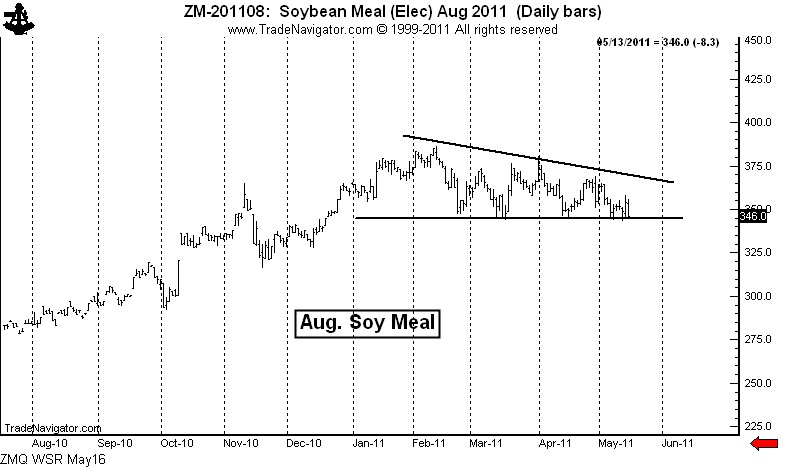

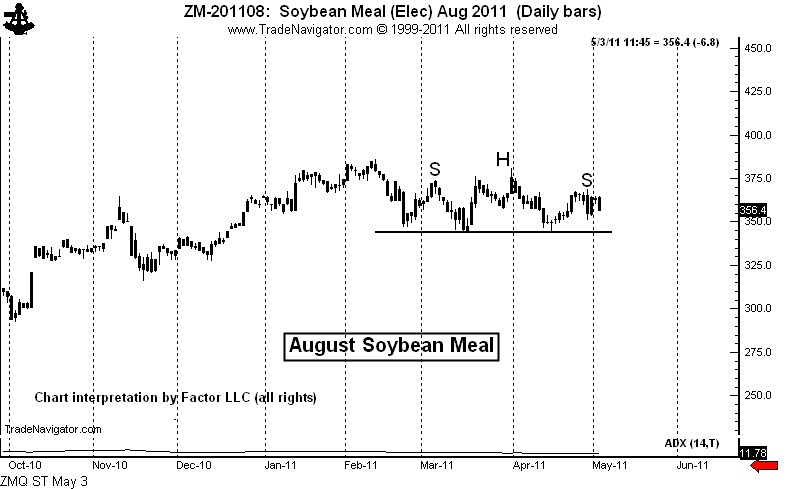

Finally, the daily chart of August Soybean Meal displays a very clear possible descending triangle. A close below the recent lows would complete this pattern and establish a target of 300.

Adding all things up, the period just ahead could be a tough life for raw materials (and stocks).

###

Turning a chart on its head

/by Peter BrandtSometimes a possible top gains clarity if one can flip the chart over and view it as a possible bottom. The easiest way to do this is to print a chart and flip it 180 degrees. But since I cannot do this with a blog post, I did the next best thing — convert a chart into its reciprocal value. Those of you familiar with spot forex know exactly what this means and how to do it. Forex trades can trade many currency pairs in the reciprocal.

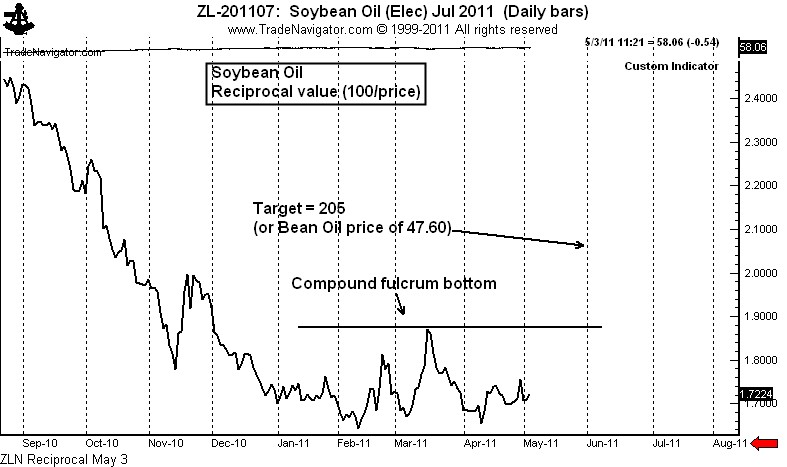

The possible top I am referring to is in Soybean Oil. First, let us look at the chart straight away.

My initial response to this chart is that a contiuation congestion is occurring and that a breakout into new highs would lead to another strong advance.

But when I “flip” the chart, my initial reaction is different. Shown below is the reciprocal value chart of July Soybean Oil. What can be seen very clearly is a possible bottom pattern known to point and figure chartists as the “compound fulcrum.” The compound fulcrum is a bottom pattern about 80% of the time, a top pattern the other 20%, and is a powerful chart formation.

A compound fulcrum bottom can best be described as a H&S top pattern that serves as a bottom. Keep in mind that a bottom in the reciprocal chart equals a top in the actual commodity.

This pattern in the July Soybean Oil would have a target of 205 which is equivalent to 47.60 in the price of July Bean Oil (compared to a current price of 58.00). There are two problems with this trade. First, more price action is needed to develop symmetry in the pattern — another two to three weeks of sideways movement followed up a gradual uptrend in the reciprocal chart would do the trick.

The second problem is fundamental in nature. Soybeans are VERY cheap compared to Corn, and Soybean Oil is likely to remain strong compared to Meal, because Meal is now competing in the feed market with the residual mash from the Corn ethanol process. While these factors do not seemingly bode well for a bear trend in Bean Oil, conventional wisdom is often wrong. Some of my best trades over the years have been trades flying in the face of conventional wisdom. The public is a major long in grains. The public is subject to shake outs.

The Soybean Meal chart is also potentially bearish. The August contract daily chart displays a possible top in place followed by a H&S pattern.

If these patterns develop more fully they would set up as trades for me. Remember, I am looking for patterns that will stand the test of historical scrutiny as among the best 10 to 20 classical patterns of the year. I think both of these charts are candidates. But the price action has not yet confirmed the signals.