Tag Archive for: SPY

Battle Lines are Drawn in World Stock Markets

/by Peter BrandtUpdate on the major top in U.S. stocks

/by Peter BrandtCharts I am watching the week of July 25, 2011

/by Peter BrandtCharts I am looking at for the week of July 18, 2011

/by Peter BrandtDue to a death in the family, this may be my only post of the week.

Following are the charts that have my interest coming into a new week.

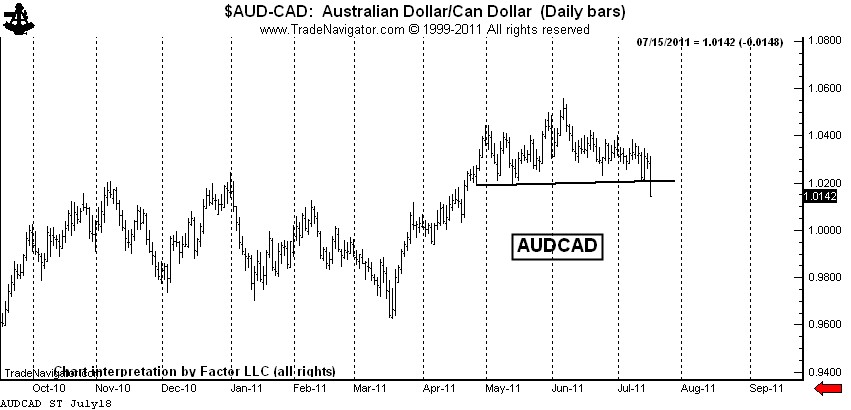

$AUDCAD — This forex pair completed a rounding top last week. I am short, but not as short as I would like to be. I will have orders in place to extend my leverage if the market can retest the top.

Silver: $SI_F, $SLV — The rally late last week completed a possible symmetrical triangle bottom. The bulls appear to be back in control in Silver. I do not have a position in Silver futures, but am long $SLV with a stop below last Wednesday’s low.

Was my forecast for $20 Silver wrong? Right now that is the way it seems. Trading is a marathon, not a sprint. I have some very bad news for all the Silver bulls who are such fond fans of my blog — I was NOT short last week. Sad, but true! I will let you know when I go short. By the way, I always trade with a stop and seldom risk more than 100 basis points per trading event (one percent of capital).

There is another intrepretation of the Silver chart that is not as immediately bullish. I have a great dislike for chart patterns with diagonal boundaries. The symmetrical triangle is my worst enemy. I much prefer a horizontal chart boundary. Silver has not yet completed a bottom if we use horizontal boundaries to define the trading range over the past 10-weeks, as seen below.

Gold: $GC_F, $GLD — The Gold market completed a text-book continuation symmetrical triangle this past week. I am long Gold futures and Gold ETFs. Gold, unlike Silver, may one day be monetized.

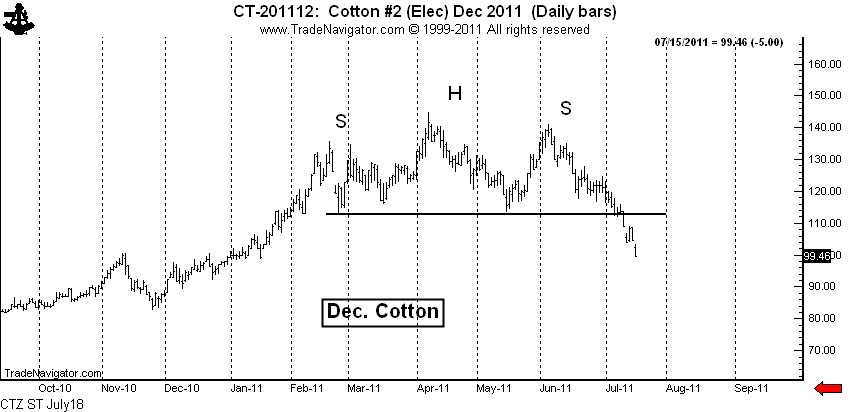

Cotton: $CT_F — I feel like an idiot. I shorted Cotton really well based on the H&S top. I felt like a genius when I covered on Friday, only to have the market go limit down. I really thought the market would cover the opening gap. I got cute — and I doubt the market will let me back in. Big profits are important. I let one get away in Cotton. I should have been adding, not covering.

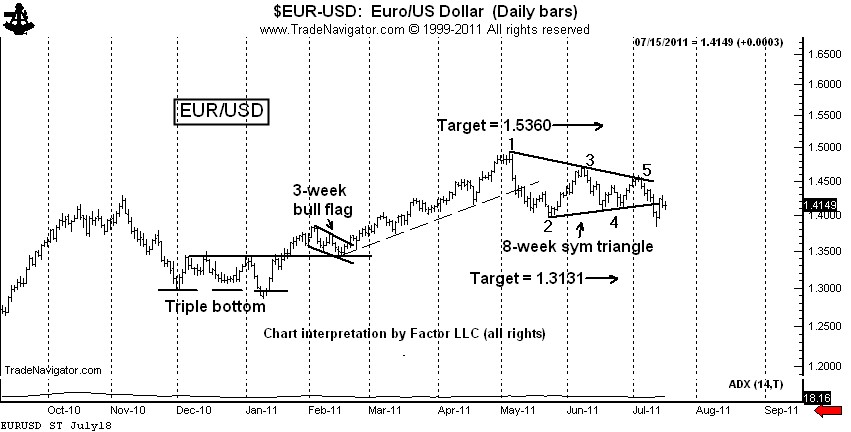

$EURUSD, $G6E_F, $UUP, $FXE — The decline on Wednesday completed a classic 6-point symmetrical triangle top. This completed triangle has been violated intraday, but not on a closing basis. I am short, using Thurday’s high as protection. I really thought I tagged a good one on Wednesday. The forex markets are vicious.

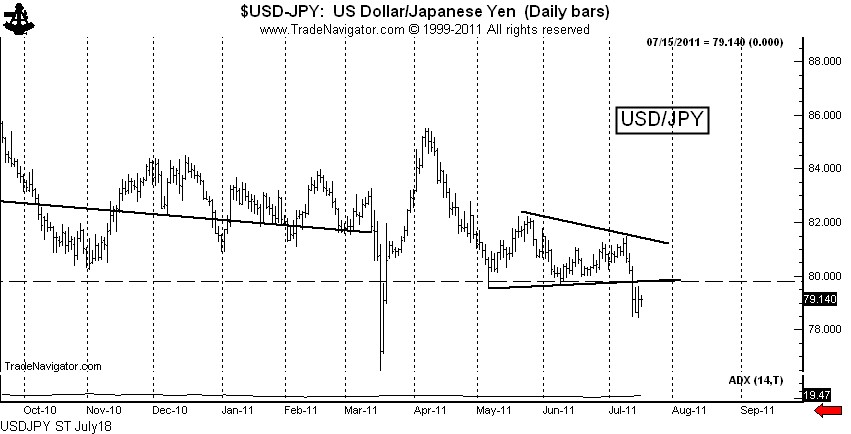

$USDJPY, $G6J_F, $FXY — The decline last week completed a triangle, but that is not the real story. Friday’s close is the lowest week-ending close in history, breaching the 1995 low (not shown). We may see Bank of Japan intervene next week, or it may be that the BofJ is capitulating until a lower price level is reached (such as 75.00). I am short $USDJPY and fully expect to have the BofJ run me out of the trade.

S&P 500: $SP_F, $ES_F, $SPY — This is my “pie-in-the-sky” chart. The daily graph displays a possible H&S top. If this analysis is correct (big IF), the right shoulder high is in place. This chart needs to be on everyone’s watch list. I am flat, tempted to go short under last week’s low. The CFTC Committment of Traders data released late last week was bearish.

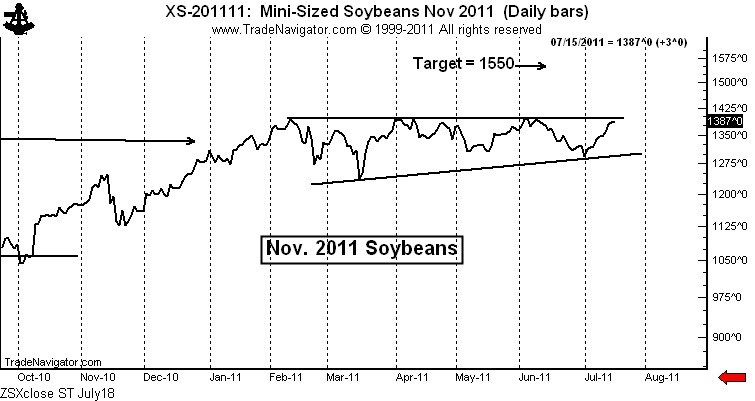

Soybeans: $ZS_F — This is an extremely intriguing chart. I fully expect that this chart pattern will be completed by an upside breakout — whether the breakout has follow through is a different story. I am lightly long Soybean futures with a stop below the July 12 low. I will add if the market breaks out intraday. I will add more if the market breaks out on a closing basis.

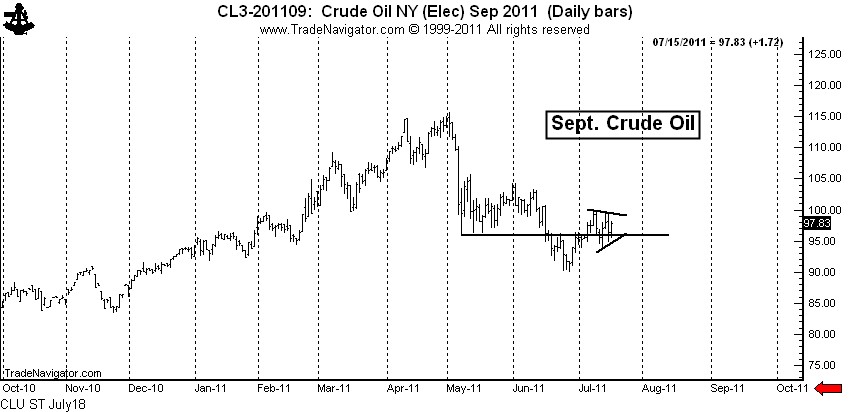

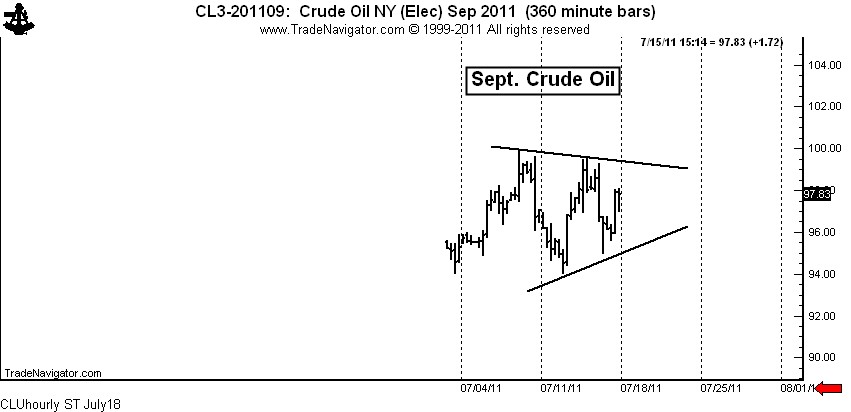

All the above charts are fairly long-term in duration. As a token to you shorter-term chartists, I leave you with Crude Oil. I am not in this market and probably will not become involved due to travel, but an interesting story can be told for getting long.

Crude Oil: $CL_F, $USO — If Crude Oil was in a “for-real” bear trend, then the May low should have turned back any and all rallies. Yet, the market has now climbed back above the May low. This is a sign that the May to June decline was a correction, not the start of a new bear trend.

On a shorter-term basis, the market is forming a 7+ day symmetrical triangle. A completion of this small pattern would probably lead to a test of the June 1 high at 104+. See the hourly chart below.

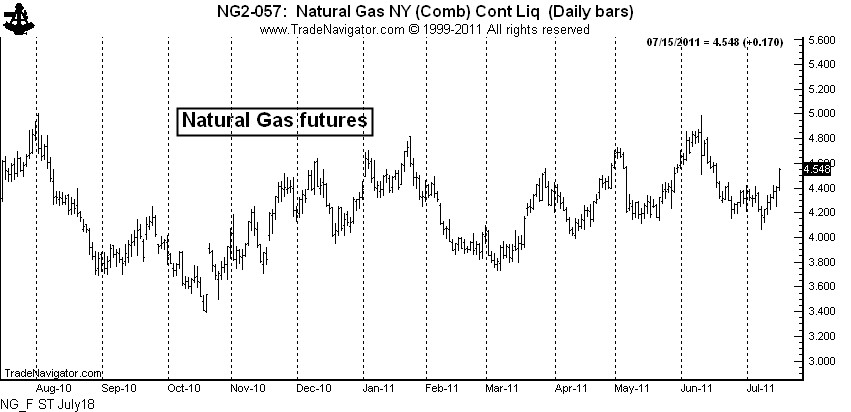

Let me throw in a couple of final charts. For the first time in a very long time I have some encouraging words for the millions of you who think Natural Gas prices are too cheap.

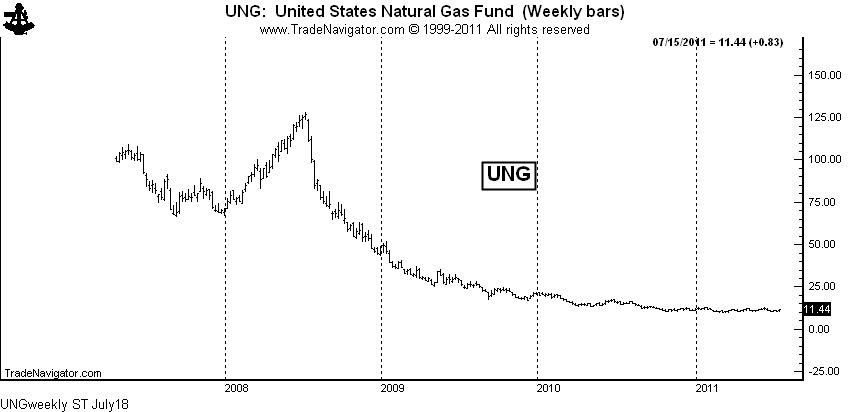

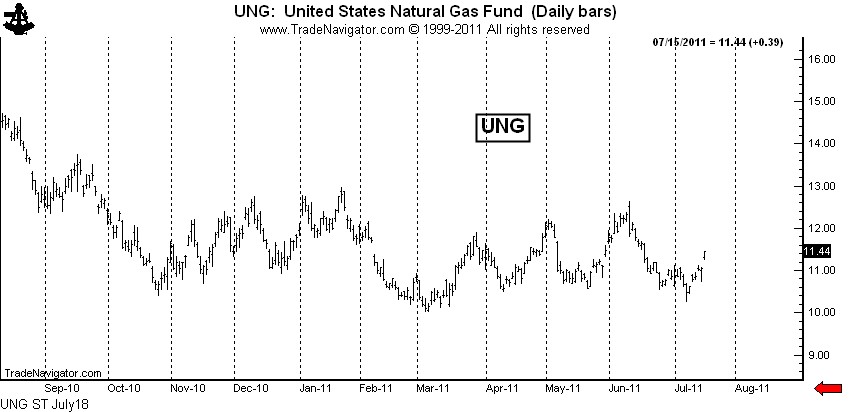

Natural Gas: $NG_F, $UNG, $UNL, $GAZ — Being long Nat. Gas ETFs has been a losing game due to the huge carrying charges that disappear each month. The weekly chart of UNG shows the result of this time decay.

This time decay may continue to take place, but I can say with as much certainty as possible that the physical market has bottomed. The chart of Natural Gas futures shows that the market has lifted well off the 2010 low and is forming high lows and higher highs.

There is also some signs that UNG has bottomed — the March low may hold, despite the massive supply on hand and the negative publicity on fracking.

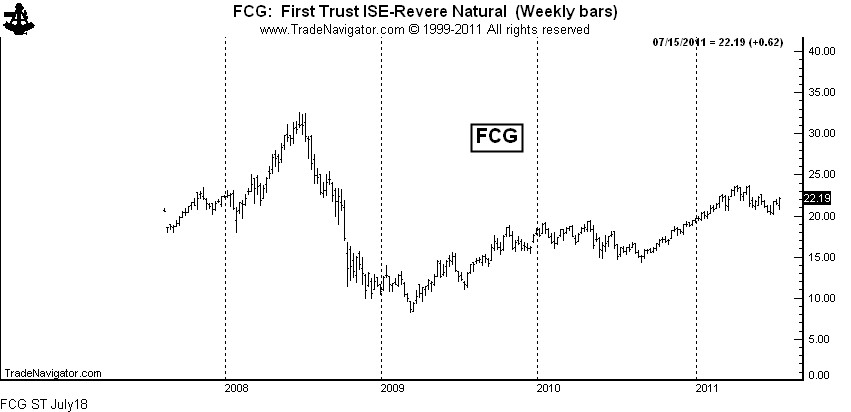

While there may come a time to be long the ETFs for the physical commodity, I would prefer to own the ETF for the producers and other companies deriving income from the production and processing of the product. A chart of FCG ends this post.

Markets: $AUDCAD, $SI_F, $SLV, $GC_F, $GLD, $IAU, $CT_F, $EURUSD, $FXE, $UUP, $ZS_F, $SP_F, $SPY, $CL_F, $USO, $USDJPY, $G6J_F, $UNG, $UNL, $GAZ, $FCG

###

Flags flying at half-mast – a sign of death!

/by Peter BrandtRisk On – Numerous charts show signs of a pending decline

In the markets, as in real life, flags flying at half mast symbolize death. A number of half-mast flags and pennants in the raw material markets indicate that the steep decline in early May was just Act 1 in a two-act play. The flags are symbolic of the intermission between the Act 1 (the first decline) and Act 2 (the next phase of the bear trend).

Bear flags or pennants are present in the following markets:

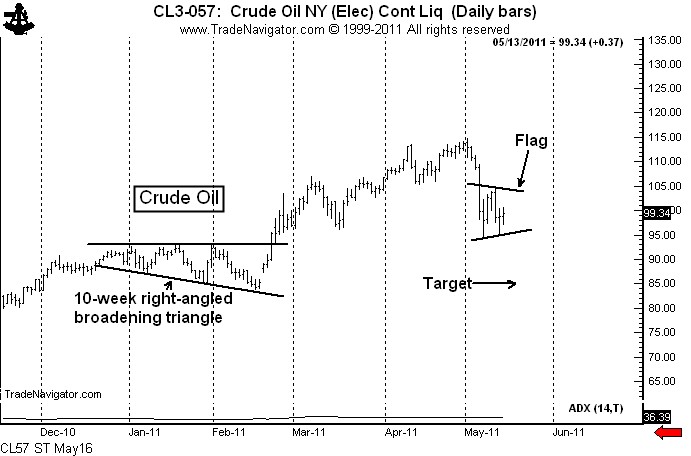

- Crude Oil

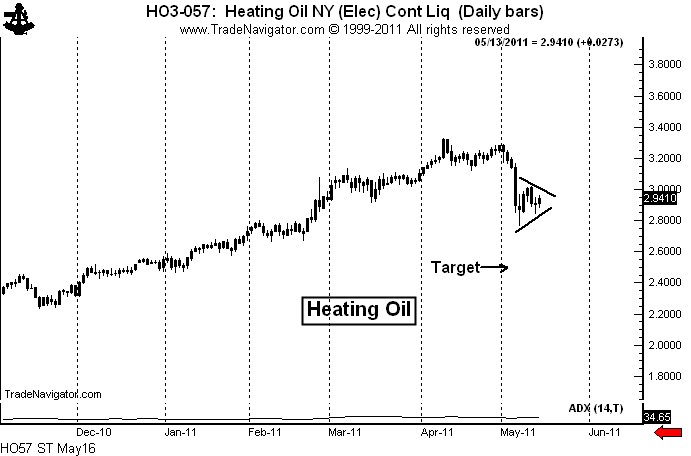

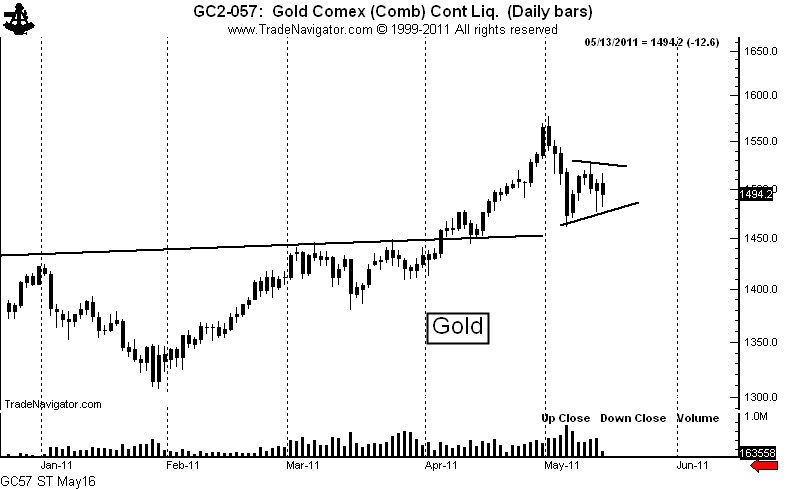

- Heating Oil

- Gold

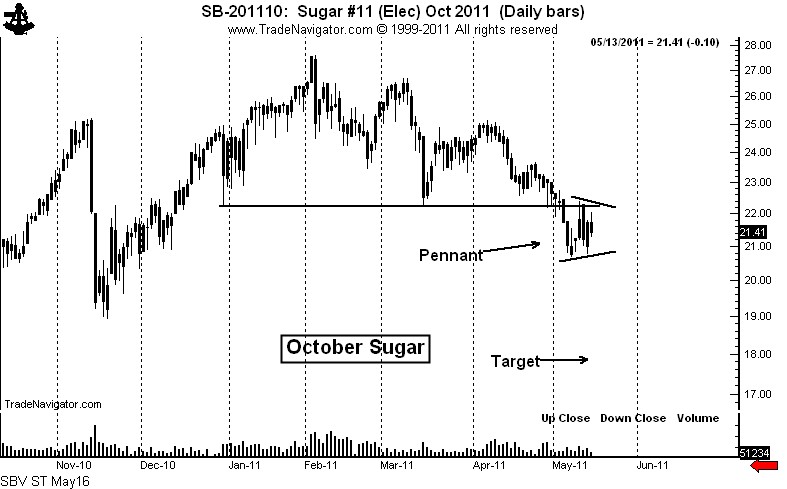

- Sugar

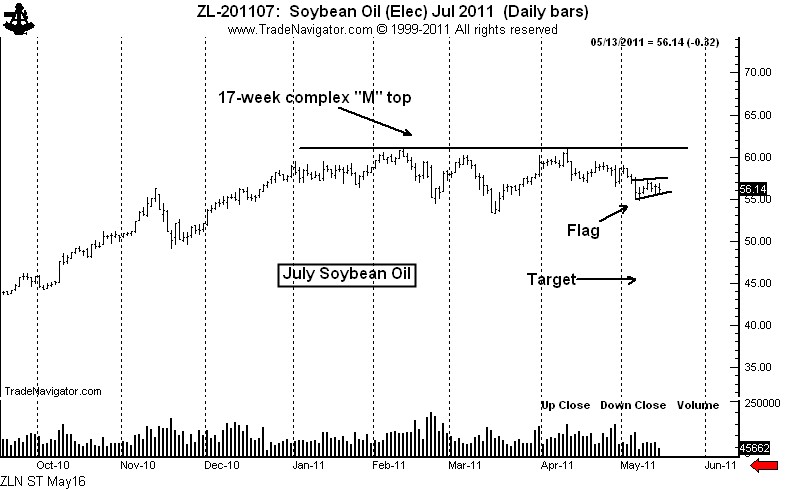

- Soybean Oil

Crude Oil and Heating Oil display classic pennants. Rallies toward the May 11 high (while not necessary) would be an excellent shorting opportunity. The target of the pennant is Crude Oil is 84.80.

The target in Heating Oil is 2.5060.

The Gold displays chart construction similar to the energy products with two exceptions. First, there is potentially enormous support under the Gold market in the form of a previously completed 4-month continuation inverted H&S pattern. However, old support sometimes has a way of disappearing. Second, the huge volume on May 5 could indicate accumulation buying by strong hands. However, if the energy pennants lead to a strong decline it will be difficult for Gold to hold up in a Risk On/Risk Off market environment.

Sugar also displays a classic bear pennant. This market is in a well-established bear trend and has been since early February. Notice that the pennant in the October contract is forming just below the neckline of a 5-month H&S top. The target in October Sugar is 17.83.

If my analysis is correct in Soybean Oil, the current pause in the form of a flag should be the last support before a sustained markdown in price. Once this flag gives way, prices should trend to 45.60. (Caveat: The pattern in Bean Oil could prove to be an extremely bullish continuation H&S pattern. Traders need to be flexible on this one.)

Additionally, a number of other markets present technically bearish potential. These markets include:

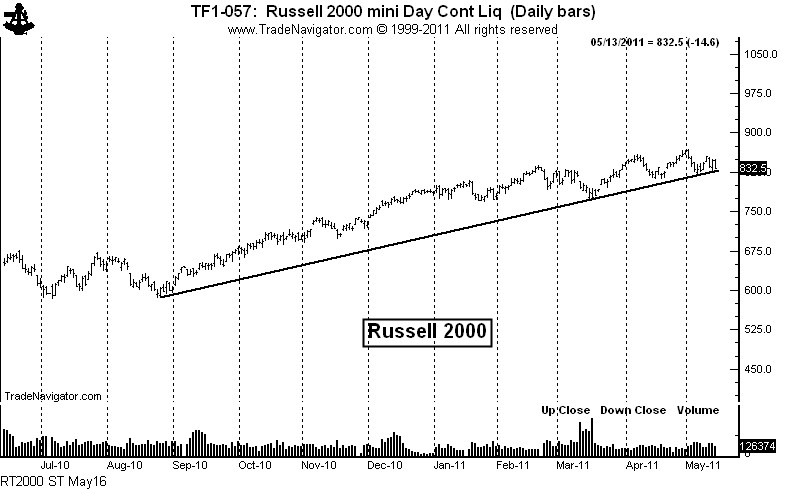

- Russell 2000

- S&P 500

- Silver

- Corn

- Soybean Meal

The Russell 2000 is hovering right at the major 8+ month trendline. A violation of this trendline would indicate that the bull trend since March 2009 is seriously aging. The initial target would be 770 as part of the transition from bull market to bear market.

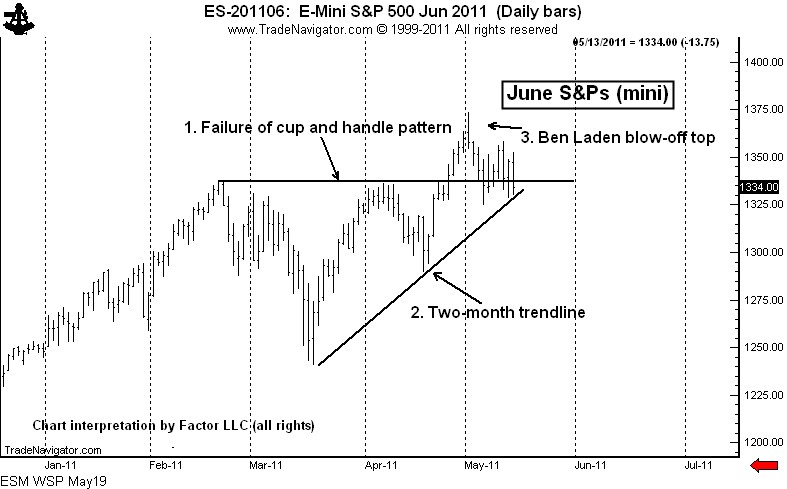

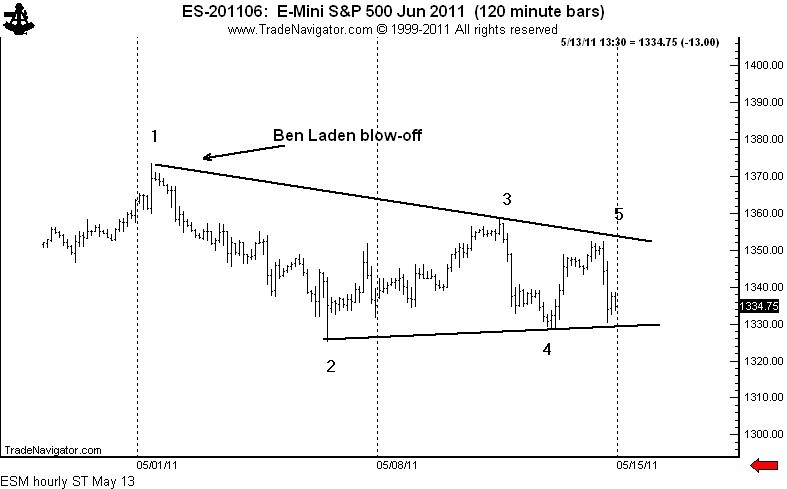

A confluence of technical developments can add to the legitimacy of a breakout. There are four factors that could trigger a sell signal in the S&Ps simultaneously by a decline below the May 6 low. First, the 2-month cup and handle bottom would fail; second, the 2-month trendline would be violated; third, the May 2 Ben Laden blow-off would be confirmed;

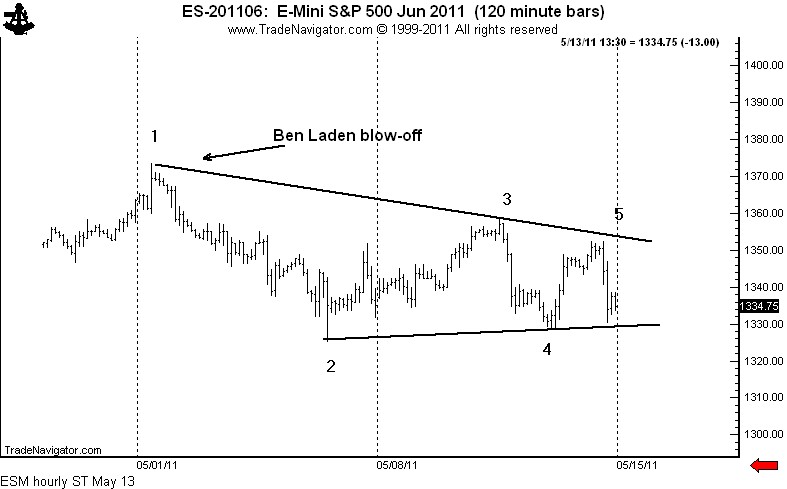

and, finally, the hourly chart symmetrical triangle would be completed.

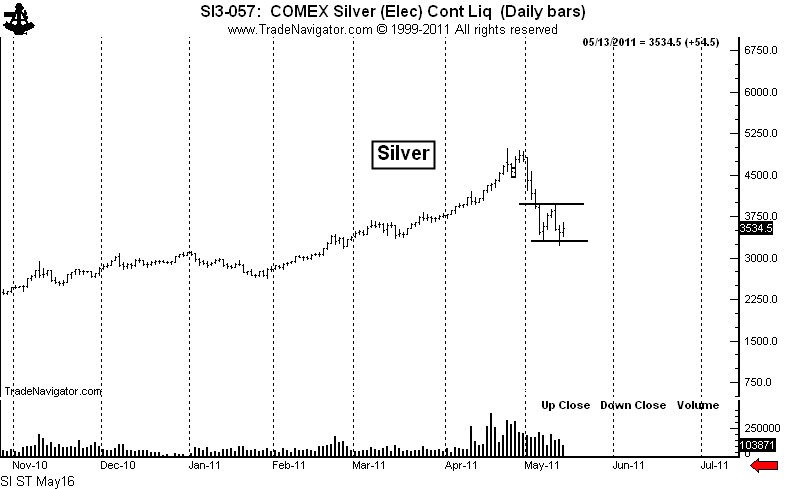

I touched the third rail in late April when I announced that Silver was in the bubble phase. I was tarred and feathered on May 1 when I pronounced the previous week’s volume (7.5 years of global supply) was a strong sign that Silver had topped. The market has found support in the low 30s and a bounce into the low 40s is possible as Silver develops its own half-mast bear pattern.

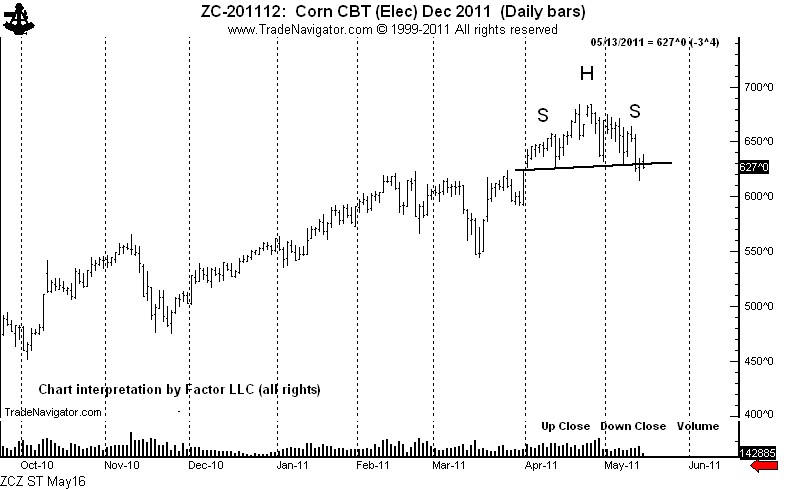

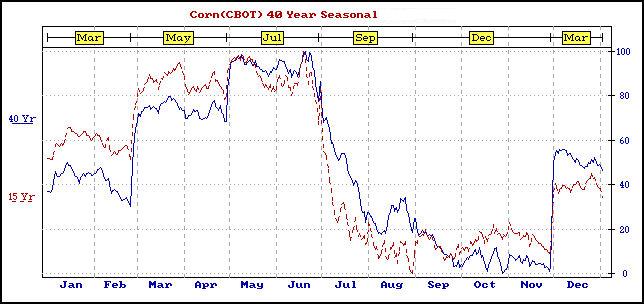

New crop December Corn has traced out a H&S top. It would not be unusual for Corn to top now.

The seasonal chart shown indicates a strong tendency for new crop Corn to top in May or June.

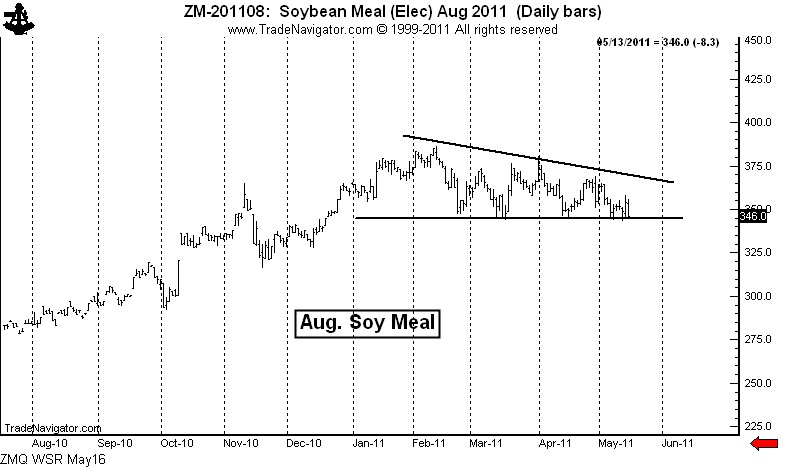

Finally, the daily chart of August Soybean Meal displays a very clear possible descending triangle. A close below the recent lows would complete this pattern and establish a target of 300.

Adding all things up, the period just ahead could be a tough life for raw materials (and stocks).

###

It’s 1…2…3 strikes you’re out!

/by Peter BrandtThe S&Ps have a possible top

When it comes to classical charting, it is always best when a multiplicity of developments occur. Such is the case in the S&P right now. There are three (if not four) chart developments that could support an important change in trend.

FIrst, the late April breakout from the 9-week cup and handle pattern has not resulted in follow through. The top of this pattern was tested hard on May 5. A move below the May 5 low would be a failure of this pattern. Possible strike 1.

Second, the daily chart displays a trendline from the March low. While I am not a big fan of trendlines, when a trendline violation occurs simultaneously with other developments it grabs my attention. Possible strike 2.

Third, the intraday chart displays a clearly defined 5-point symmetrical triangle top. Possible strike 3.

Importantly, a decline below the May 5 low would complete all three developments. There is one other important technical factor worthy of note. The Ben Laden top now appears to be a clear blow-off. The market has been unable to trend back into the range of this reversal day.

I will short this market if the May 5 low is penetrated. The target would be 1243. I remain long the Nasdaq from April 20– and am very close to being stopped out of that trade.

###