Tag Archive for: $SLV $SI_F

Factor Update, March 20, 2016

/by Peter BrandtGeneral Market Commentary

Not all market environments are equal. Similarly, the same market environment can treat different trading styles in very different ways – some favorably, others miserably. The current markets, in my opinion, are neutral/hostile to classical charting principles. Current markets are volatile; false and premature breakouts have increased in 2016 to date; and, there is a lack of substantial patterns under construction. I have experienced this type of trading environment before – many times. There are profits to be had in some markets, but there are also an oversupply of land mines. For me, this type of trading environment has not correlated well with a robust three-month forward ROR. Of course I will continue to take signals that are promising knowing that sooner or later markets favorable to classical charting will return. Warning: I generally ignore one-day price action, preferring area patterns. Yet, nearly every market discussed in this Update experienced a narrow real-range bar on Friday that occurred at or just below the close of Thursday’s wide range day. This development suggests the possibility of a shake out next week. According, I enter next week in a very defensive frame of mind.Market Review

Read More

Read MoreFactor Update, March 20, 2016

/by Peter BrandtGeneral Market Commentary

Not all market environments are equal. Similarly, the same market environment can treat different trading styles in very different ways – some favorably, others miserably. The current markets, in my opinion, are neutral/hostile to classical charting principles. Current markets are volatile; false and premature breakouts have increased in 2016 to date; and, there is a lack of substantial patterns under construction. I have experienced this type of trading environment before – many times. There are profits to be had in some markets, but there are also an oversupply of land mines. For me, this type of trading environment has not correlated well with a robust three-month forward ROR. Of course I will continue to take signals that are promising knowing that sooner or later markets favorable to classical charting will return. Warning: I generally ignore one-day price action, preferring area patterns. Yet, nearly every market discussed in this Update experienced a narrow real-range bar on Friday that occurred at or just below the close of Thursday’s wide range day. This development suggests the possibility of a shake out next week. According, I enter next week in a very defensive frame of mind.Market Review

Read MoreIs the tarnish on Silver about to be removed?

/by Peter Brandt

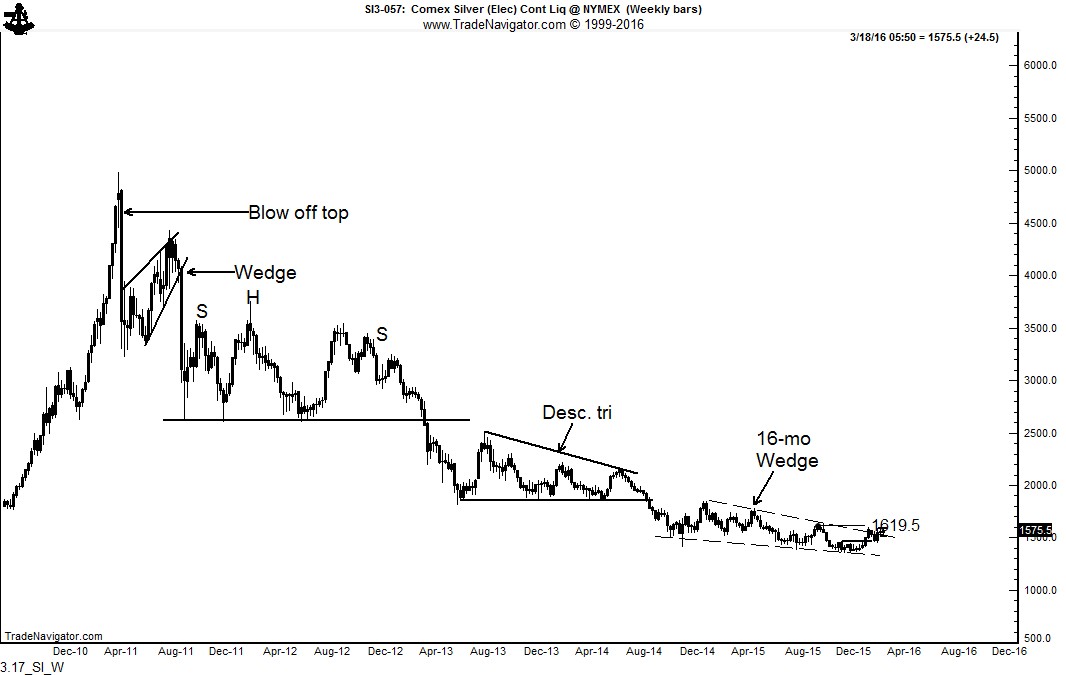

Five-year bear trend in Silver may be coming to an end

For the past five years Factor has remained negative on the Silver charts, calling for the bottom in Dec 2014. The weekly graph has now formed a 16-month falling wedge. This pattern can serve as a primary bottom based on classical charting principles.

April 2011, Factor correctly called the top in here (How do you spell bubble — SILVER) and here (8 years of Silver Supply changes hands at top).

![]()

The daily chart exhibits several features. First, note the 12-week rounding bottom at the low boundary of the weekly chart wedge. The chart is now forming a possible 6-week cup and handle pattern (in form only). Note that the handle portion has formed an independent rectangle. The completion of this cup and handle pattern would also clearly resolve the weekly chart falling wedge. The completion of the wedge would establish an initial price target of 1840.

WARNING — Silver is notorious as a volatile market that whips traders around without warning. A $1 swing can occur at any moment. I far prefer to trade Gold.

$SI_F, $SLV