Tag Archive for: QQQ

The History of Unfilled Gaps in the U.S. Stock Indexes

/by Peter BrandtCFTC COT Data — Commercials Huge Buyers of Stock Index Futures

/by Peter BrandtMy outlook for the U.S. stock market remains unchanged

/by Peter BrandtThe purpose of the markets is to redistribute wealth from the many to the few

/by Peter BrandtYes, yes, I know what you are going to say … about how the markets allow corporations to raise capital in order to expand … yadda, yadda, yadda!

But, while this is a function of the markets, it is not the purpose. The purpose is to make a very few people very wealthy at the expense of the many. If the markets fail to fulfill this purpose, then the markets will cease to exist.

The wealth distribution takes place over very extended periods of time (decades, even generations). But, we see this concept operating over shorter time periods. Like the present, for example.

I believe the U.S. stock market has topped. I believe that the bear market we are entering will make a few people very wealthy at the expense of the many. The process is like the tide, coming in one wave at a time.

Some of the questions I ask myself often about any given market include:

- How is this market going to best pick people’s pockets?

- How will the market go about accomplishing this pocket picking?

- How will the market impose the maximum penalty and pain on the maximum number of market participants (traders)?

- What price action needs to take place to make the greatest number of market participants the most complacent?

Sometimes I guess wrongly on these questions, sometimes rightly.

The decline (“collapse” is a better description) in August forced many people out of the stock market — in fact, everyone who bought stock in the first seven months of 2011 (based on the indexes) lost money. I am sure tremendous liquidation occurred at or near the August low. The volume tells us this. The decline also turned a lot of traders bearish at the worst possible time. Perhaps you are one of those unfortunate traders who got short the week of August 8. I would have never advised you to take such an action, even though I was and am bearish. Timing is as important as direction. A good trades needs both things to occur.

So, the market forced long liquidation and trapped shorts in the same breath. Now the market is “running in the shorts.” The market is also giving confidence to those people who either bought for the bounce or stayed long during the early August “correction.”

The market’s current rally may even cause some people who blew out at the botton to buy back in now. Ugh! Those who shorted in the hole will get blown out. In the next act, those who buy stock in the days ahead, believing the worst is behind us, will end up with the fish hook in their mouths.

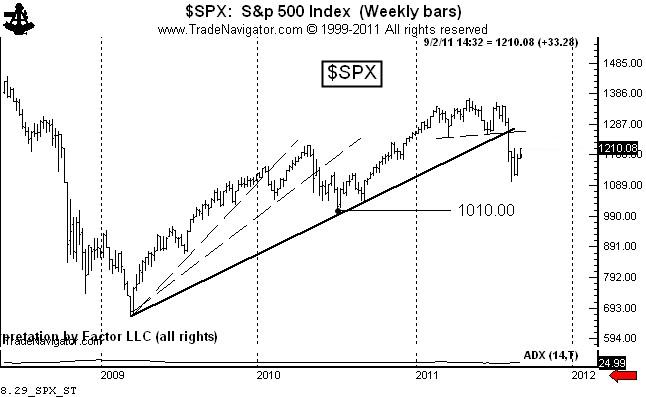

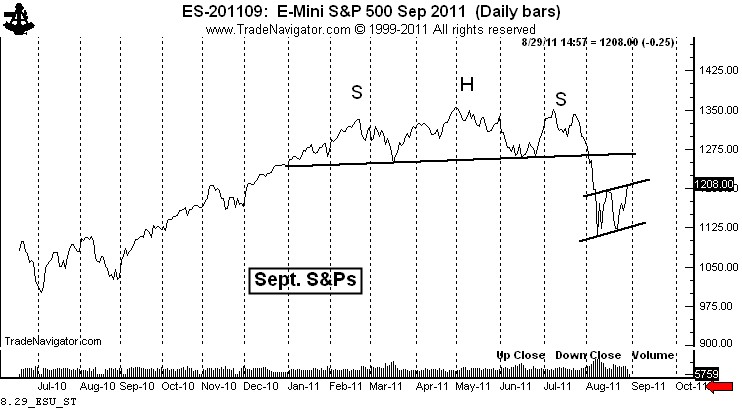

I remain short Sept. S&P futures. While I do not like losing unrealized profits, I will not take a loss on my trade. Take a look at the weekly and daily charts and ask yourself this question — which seems to be more powerful, the H&S top above the market or the dinky little double-type bottom under the market? In fact, the weekly graph does not even display a bottom.

The market is retesting the top. The retest is trying my nerves. But in the end I think the market is simply forming a bear flag. It will take a close above the August 2 high for me to change my tune. Could it happen? Of course, the market can do anything it wants to do.

I am looking for a spot to increase my short leverage. A hard retest of the top followed by a one-day reversal would be awesome. This may not happen, but if it does I will be ready. What ever happens, you can be assured of one thing — the markets are about redistributing wealth from the many to the few.

Markets: $ES_F, $SPY, $NQ_F, $QQQ

###