Factor Alert, June 6, 2018 — It’s harder to manage a profitable trade than a losing trade

Profitable trades are the hardest trades to manage

Trades that are somewhere between break-even and an eventual price target are the hardest trades for me to manage.

I have no trouble exiting a trade that turns quickly into a loss or challenges my entry level a few days after I enter the trade.

I also have no trouble taking profits at the target level I predetermine for a trade.

It is between these two extremes that managing a trade is difficult. There is an old trading adage:

"Cut losses short, let profits run"

Easy to say -- hard to do, especially the "let profits run" part of the adage. In practice letting profits run is one of the most challenging parts of trading. On one hand I want to give a trade ample opportunity to trend toward a profit target. On the other hand I do not enjoy letting a profitable trade return to the starting gate ("Round trippers" is my name for these trades). Finding the balance is the issue.

The Factor Tracking Account presently holds two quite profitable trades in U.S. stock market indexes.

Long Sept Nasdaq futures at 7048 with a revised target of 7774. I have raised my stop to 7087, but this price is 154 points (or $3,800 per contract) below Tuesday's close. That is a lot to give back, but I do not see any closer level that makes sense on the chart. With 550-plus points remaining to the target I am willing to give the trade some room.

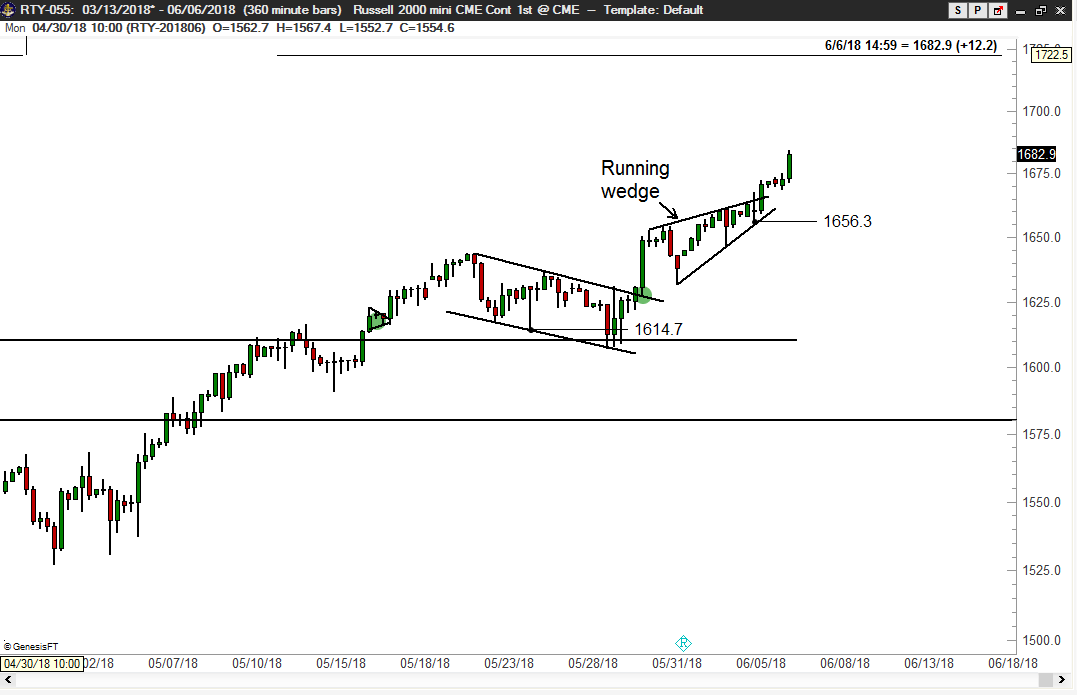

Long Jun Russell at 1628 with a conservative target of 1748. A further target of 1809 also exists. I will need to roll this trade to the Sep contract soon. My current stop at 1654.4 is based on the interpretation that the advance on Tuesday completed a small running wedge on the 6-hour graph.

Because I am long both the Russell and Nasdaq for the Factor Tracking Account (and my personal prop account) I will attempt to be more aggressive with the Russell and give the Nasdaq a bit more wiggle room. Given the extended target in the Nasdaq I would fully expect some corrections along the way, and perhaps even the development of a small flag or pennant. Should a flag or pennant develop I will have the ability to advance my protective stop in the Nasdaq accordingly.

I continue to point to the breadth of the U.S. equity market as a reason to believe the upper targets will be met. The cumulative A/D line for the NY Composite Index continues to charge into new ATH territory. Expanded breadth is a sign of a very healthy market.

I believe that the U.S. equity market is in the final blow-off stage of the bull trend that began at the 2008/2009 low. The climactic end to a major bull market can be explosive, so hang on folks for what could be a wild ride.

plb

###