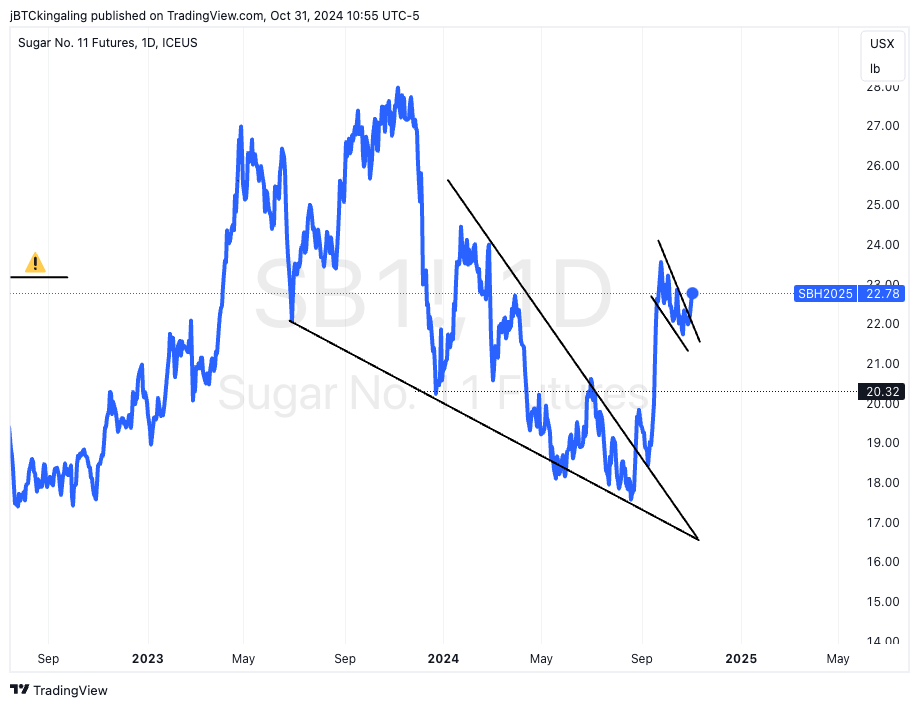

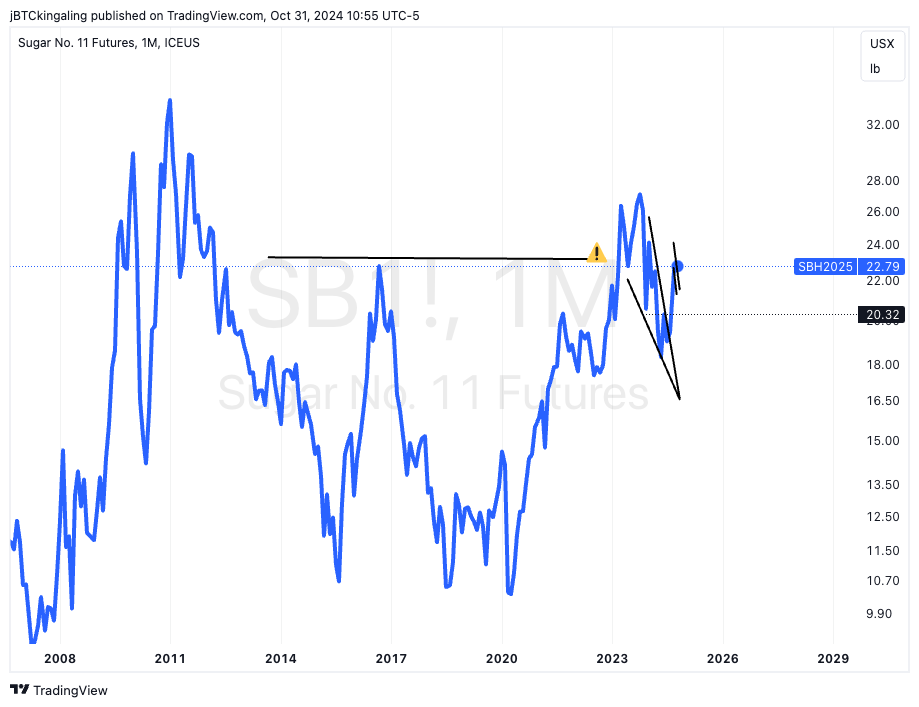

Sweet, Sweet, Sugar

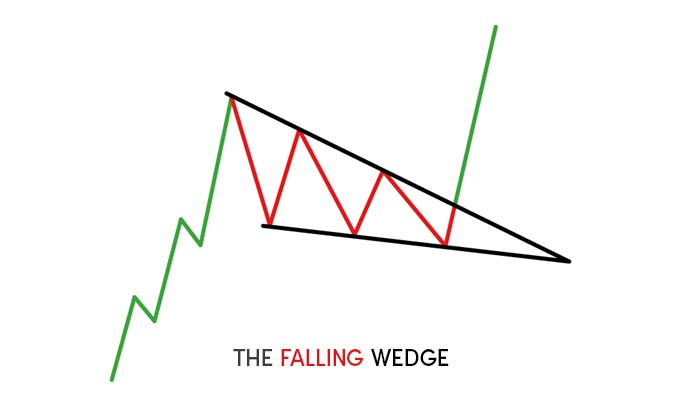

In the battle between bulls (buyers) and bears (sellers), both the falling wedge and bull flag are continuation patterns signaling a continuation of upward trends.

Falling Wedge: This pattern usually forms after a strong rally, but bulls are temporarily pushed back by bears, creating a waning series of lower highs and lower lows within a narrowing downward channel. Most falling wedges are formed between 3 weeks to a few months, so I am breaking that rule here. When price rises above the upper trendline, it signals that bulls are regrouped and ready to resume the uptrend. The target of a breakout of a falling wedge pattern is the previous high of the wedge. In this case, the high is28.00 cents/lb of Sugar #11.

Falling Wedge: This pattern usually forms after a strong rally, but bulls are temporarily pushed back by bears, creating a waning series of lower highs and lower lows within a narrowing downward channel. Most falling wedges are formed between 3 weeks to a few months, so I am breaking that rule here. When price rises above the upper trendline, it signals that bulls are regrouped and ready to resume the uptrend. The target of a breakout of a falling wedge pattern is the previous high of the wedge. In this case, the high is28.00 cents/lb of Sugar #11.

bullish falling wedge continuation pattern

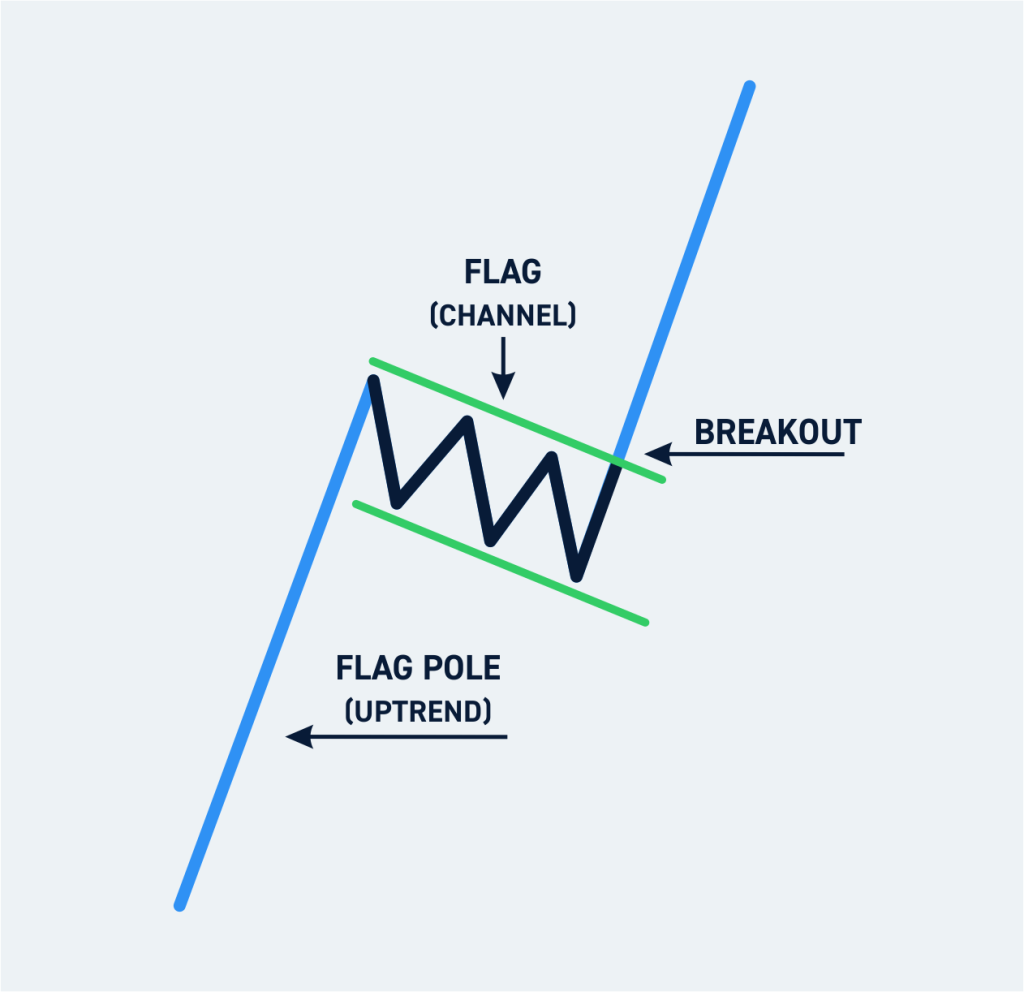

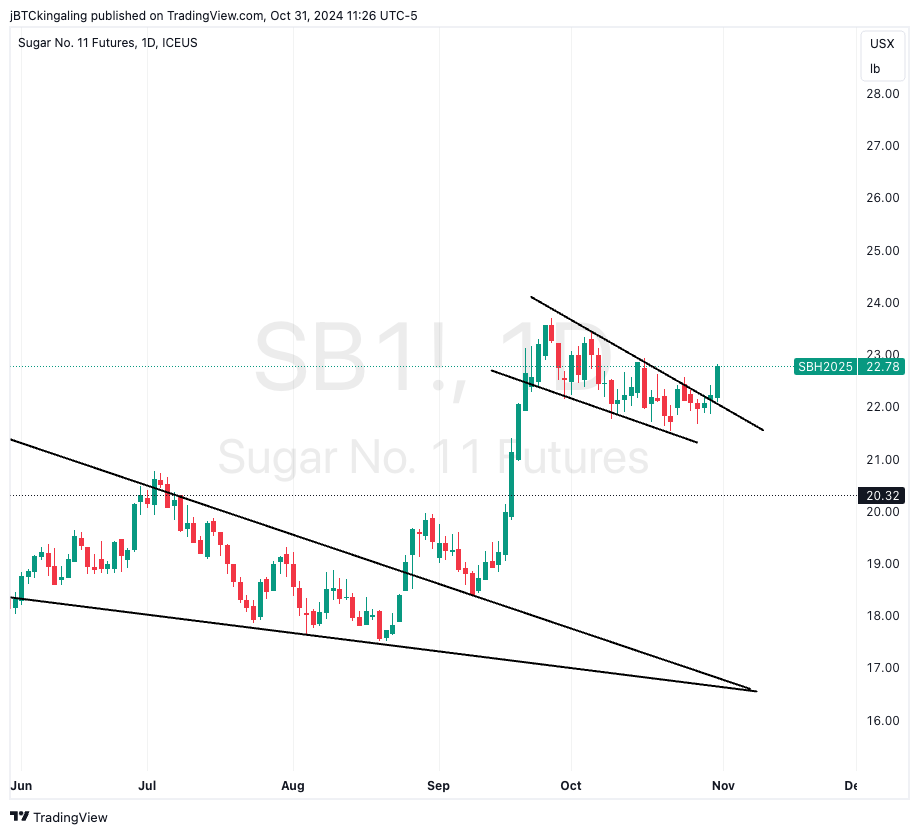

- Bull Flag: Also often found after a strong upward move (the “flagpole”), bulls consolidate in a tight, downward or sideways channel, creating a price chart resembling a “flag.” This brief pause shows bulls consolidating gains, not surrendering. A breakout above the flag confirms bulls’ renewed strength, ready to push higher and continue the prior uptrend. The target for a flag pattern is found by applying the distance of the “flagpole” to the breakout point. So, for a flag, the formula is:

Target Price = Breakout Price + Flagpole Height

bull flag pattern

It is worth mentioning that the flag is a launching pattern for the bigger falling wedge. This means that the setup creates an asymmetric risk/reward opportunity by establishing a position where potential upside significantly outweighs downside risk. Here’s how it works:

- Defined Risk: In these patterns, traders can place a stop-loss just below the consolidation area (the flag or wedge), capping the downside risk to a small, controlled amount if the pattern fails. For instance, if a bull flag fails and price dips below the flag’s lower boundary, it signals that the breakout setup is invalid, allowing traders to exit quickly. Call it a 1 penny stop down to 21.00.

- High Reward Potential: The breakout from these launching patterns often leads to a rapid price move that can target the length of the initial rally or more. This gives traders a clear profit target that is often several times the stop-loss amount, creating a high reward-to-risk ratio. For example, the wedge projects a move to 28.00, or 6 cents.

That is a 6:1 setup — almost double what I normally search for.

Bull flag on a “flagpole”

There’s a time and place for greed, and win or loss — this is one of the best type of bets to make in my trading system.

I would risk up to 1.00% of my trading capital on this trade. A little can go a long ways.

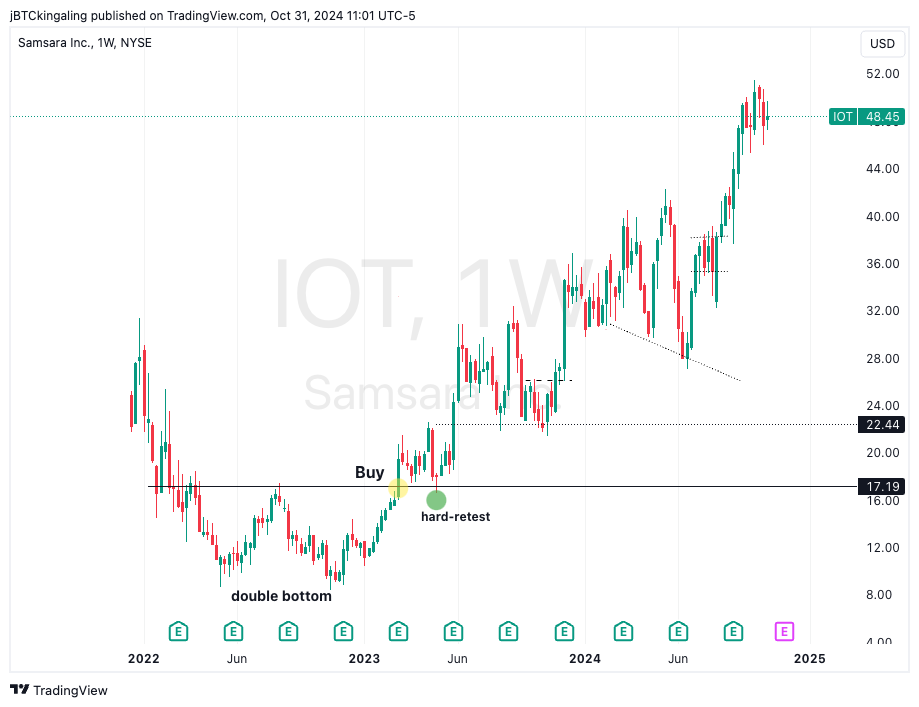

Speaking of launching patterns…

… IF the flag is a flag, and if the wedge is a wedge,

can the result complete a double bottom?

Double Bottoms are rare, and often mislabeled, but when they work, they are powerful signals.

Samsara ($IOT) one of the Chart Wizards favorite picks of 2023/24 shown below completed a double bottom in April 2023.

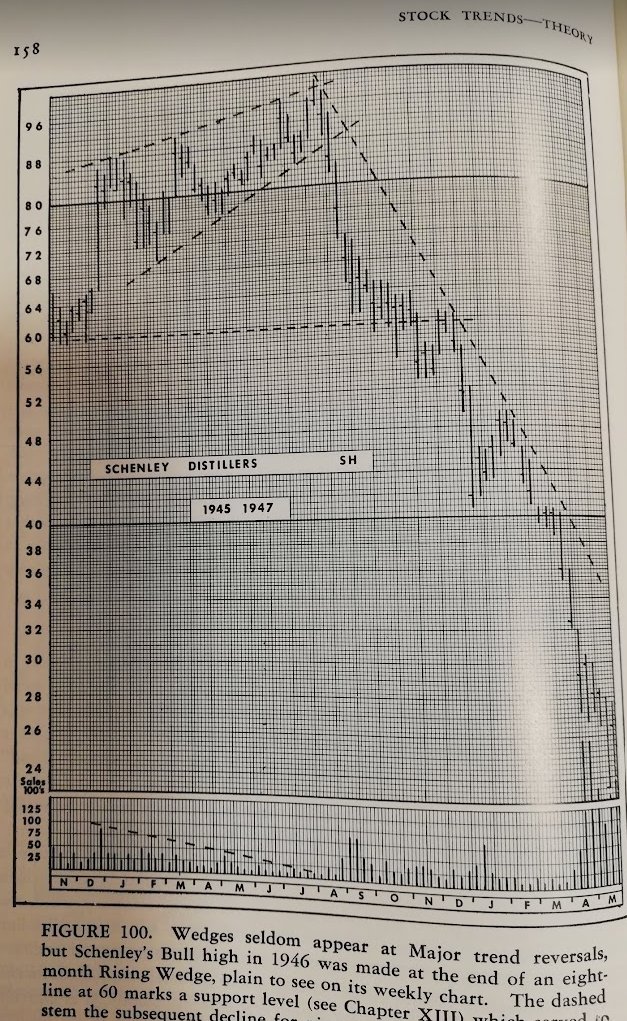

Wedge, flags, (continuation patterns) and double bottoms (a reversal pattern) are defined in detail in Edwards and Magee’s classic work, Technical Analysis of Stock Trends. I’ve annotated the entire textbook for Peter Brandt’s readers — here.

Click HERE and improve your trading for $149/yr.

- 1-2 monthly reports covering macro, commodities, stocks, and crypto

- Real-time signals and alerts on X and for ChartWizardsNFT members in Discord

- Actionable, tactical trading tips with accountability and transparency

- Lock in your membership before prices go up!!!!

**THIS DOES NOT INCLUDE A MEMBERSHIP TO FACTOR. I AM THE AUTHOR OF CHART WIZARDS REPORTS.**

Chart Wizards Reports: https://www.peterlbrandt.com/chart-wizards-reports/

Thanks for reading,

Jonathon King

#jk