Tag Archive for: EURUSD

Factor Update – June 5, 2016

/by Peter BrandtFactor Alert – Forex and other markets

/by Peter BrandtLong Term Euro Charts Point to Trouble Ahead

/by Peter Brandt

Long Term Euro Charts

For a considerable period of time I have held a very negative opinion on the Euro. The Euro currency has a complicated history. The Maastricht Treaty of 1992 obligated certain Euro nations to adopt a common currency – although it was not until Jan 2002 that currencies such as the D-Mark were officially replaced by the Euro currency mechanism. It is possible to create a proxy EUR that dates back to 1992. In fact, IMM and proxy price data exist back to the early 1970s. Several technical developments on the EUR graphs are worthy of note.

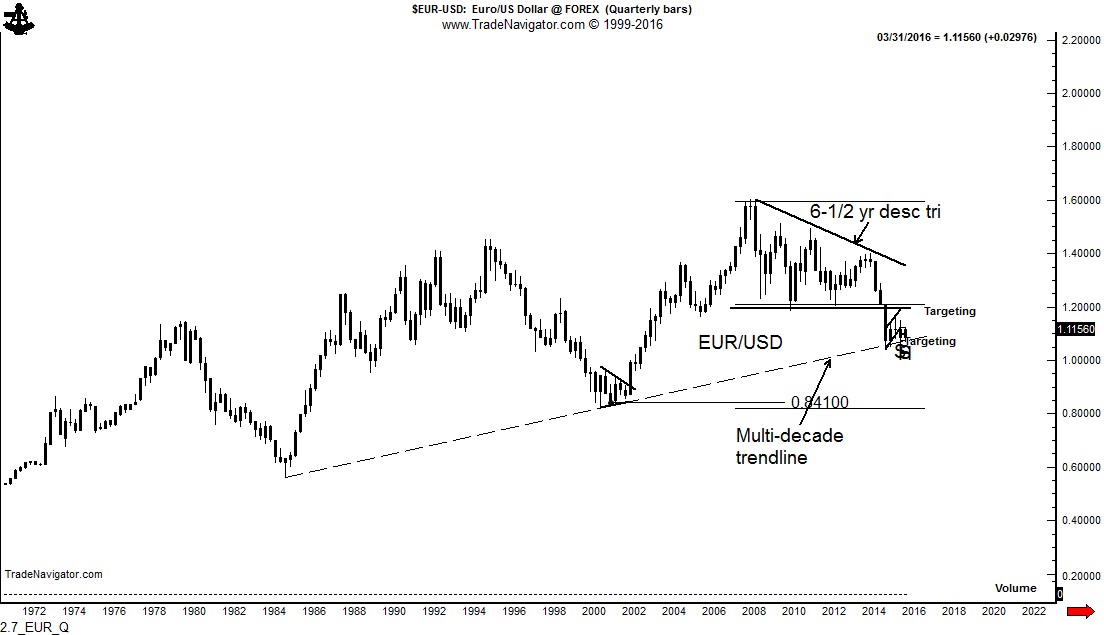

A 6-1/2 year descending triangle on the quarterly graph was completed by the decline in Jan 2015. This pattern has an unmet target of 84 cents, the area of the 2001 low. The monthly graph also displays a dominant multi- decade trend-line connecting back to the 1985 low. The decline in the first quarter of 2015 found support at this trend-line. It is interesting to note that the price range in the first quarter 2015 has contained the market ever since. The weekly graph displays a possible 27-month congestion. It is my contention that this congestion will eventually be resolved to the downside – and that the simultaneous violation of the lower boundary of this congestion zone and the multi-decade trend-line will tie into a crisis in the Euro currency mechanism.

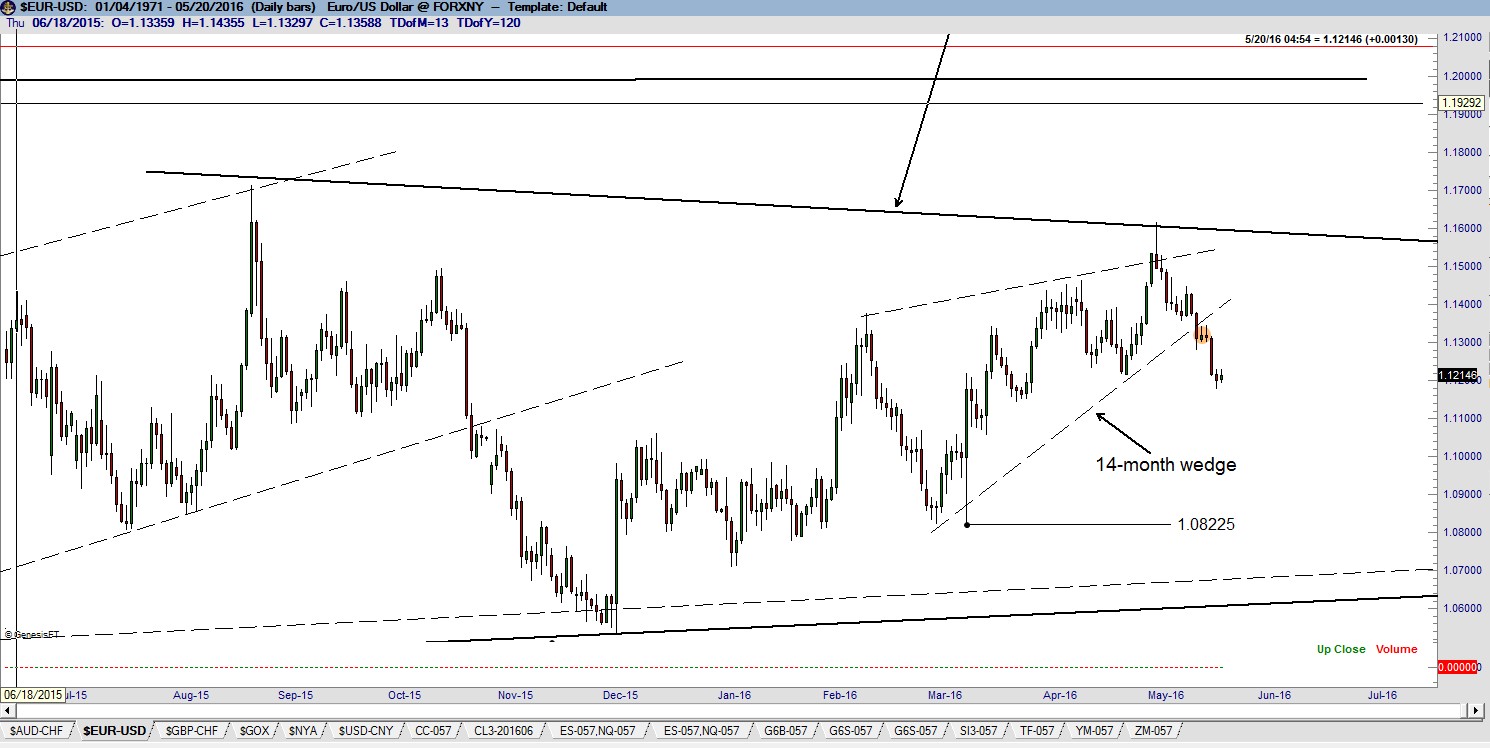

The daily graph displays a completed 14-week rising wedge with a target of 1.0822.

Factor Membership is now available, including a quarterly option. You could consider your membership in the Factor Service as just one more trade. If the Factor Service is not of value to you, well, it is just one more trade that did not work. Through the Factor Service I endeavor to alert novice and aspiring traders to the many pitfalls you will face – and to offer advice on overcoming those pitfalls. My goal is to shoot straight on what trading is all about. For more information, visit the home page here.

I hope you will consider joining the Factor community.

##

Factor Update – May 22, 2016

/by Peter BrandtJapanese Yen is attempting to break out of a major H&S pattern.

/by Peter BrandtA chart analysis of the forex markets

This post looks at the present forex markets through the lens of classical charting principles, as originally forumated in the early 1930s by Richard W. Schabacker, editor at the time of Fortune Magazine. Factor LLC is recognized as one of the world’s preeminent authorities on classical charting principles as applied to the futures and forex markets.

There are a number of forex crosses that indicate substantial trading opportunities for traders willing to hold positions for weeks or even months. Before examining the current forex markets, a basic understanding of classical charting principles is approriate.- Charts simply show where a market has been, what it is doing now, and what the path of least resistance might be. Classical charting is simply an attempt to define market behavior in geometric terms. The real edge provided by classical charting comes from the marriage of risk management with well-defined geometric patterns.

- There is no magic in price charting. Charts do NOT predict the future. Unlike some Elliott Wave adherents who attempt to label every zig and zag, I believe that the vast overwhelming majority of markets the vast overwhelming proportion of time cannot be understood through the lenses of classical chart principles (or any other method of technical analysis, including Elliott Wave Theory).

- Well-defined chart patterns naturally provide opposite possible outcomes. A rectangle can complete in either direction. A rising wedge can become a running wedge. A symmetrical triangle can fake a trader out in more ways than imaginable. A H&S pattern can become a H&S failure. And on and on it goes.

- Charts are subject to morphology. I do my best to always find a geometric explanation for price action. As a chart morphs it can be subject to different geometric construction. As a general rule, intraday charts morph more often than daily charts, daily charts morph more often than weekly charts. But, more often than not a market cannot be explained easily by geometry. It is then time to find another market. This is why I might be focused on Robusta Coffee one day and some foreign stock index another day. I want to focus on markets I can define geometrically.

- Reliable chart trading is cyclical. There are periods during the year (an average of two periods lasting two or so months each) when an unusual number of markets form well defined patterns AND the markets respond to those patterns in predictable fashion. Using language of farming, this is time to make hay. During the other periods we rely on aggressive risk management to limit our losses and keep out pile of chips somewhat intact.

- It is a thing of beauty when classical chart configurations work. It is a thing of frustration when they do not work. It is a thing of confusion when the majority of markets defy definition from a classical charting perspective.

A review of selective forex markets

Eurocurrency (EUR/USD) The long-term trend (as featured by the 45-year trendline) in EUR is under threat, as shown by the quarterly graph. The dominant chart construction is the 6-1/2 year descending triangle completed in Jan 2015. This pattern has a target of $.84. Such a decline would likely be accompanied by a massive change in the European Currency Mechanism (ERM). Read More

Read More