Tag Archive for: Dow

Thoughts on a Sunday Afternoon, May 2, 2021

/by Peter BrandtStocks Keep On

/by Peter BrandtS&P 500 (CME)

The S&P Index is attempting to penetrate the neckline of a 22-month continuation inverted H&S pattern. Note that a 15-week ascending triangle has been completed on the daily chart of the Dec contract. Perhaps this triangle will serve as the launching pad to complete the larger H&S configuration. Factor is long. Read More

Read MoreEquities Show Promise

/by Peter Brandt(This is an excerpt from the past weekend premium member report published last Friday morning the 6th)

Global Equity Markets

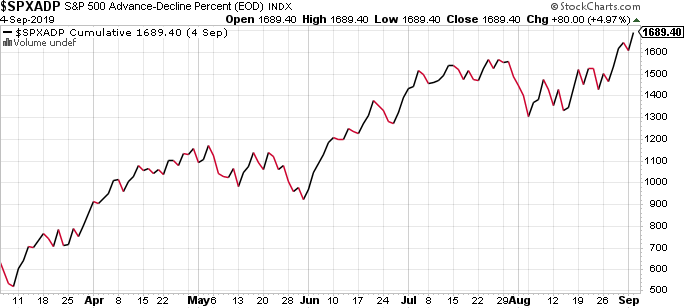

The S&P cumulative A/D line has posted a new high. The major indexes (DJIA, S&P 500 and NASDAQ) should be next to post ATHs.

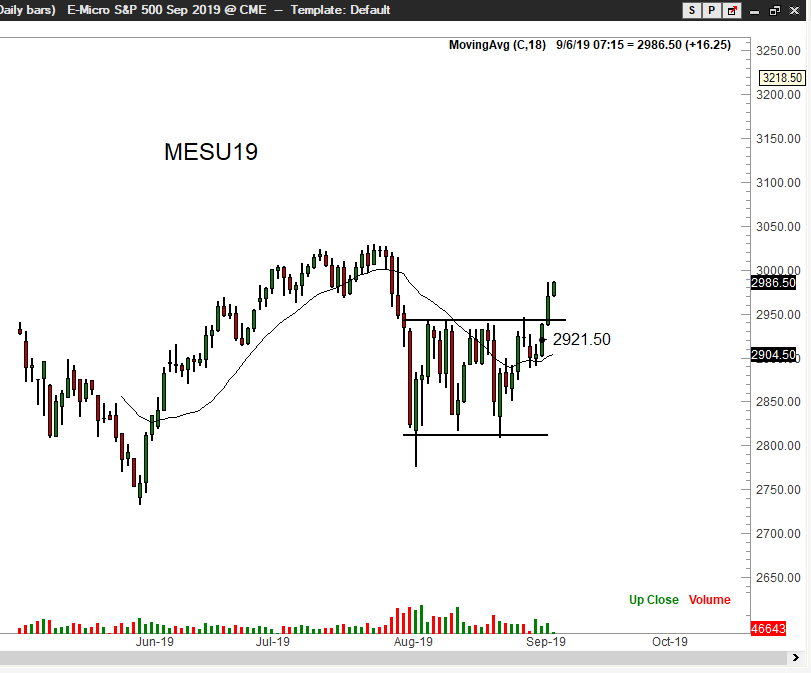

S&P 500 (CME)

I bought the completion of a rectangle on Thursday – and did so with hesitation knowing how frustrated I have been buying strength (over and over and over again) during 2019. The possible inverted H&S pattern has an up-slanted neckline.

China A50 (SGX)

The monthly chart exhibits a possible 4-year ascending triangle. The daily chart is attempting to complete a continuation symmetrical triangle. Factor is long – note the small 2-week pennant on the daily graph (boxed). I have an interest in pyramiding this trade. A close above 13995 is needed to confirm the daily chart triangle.

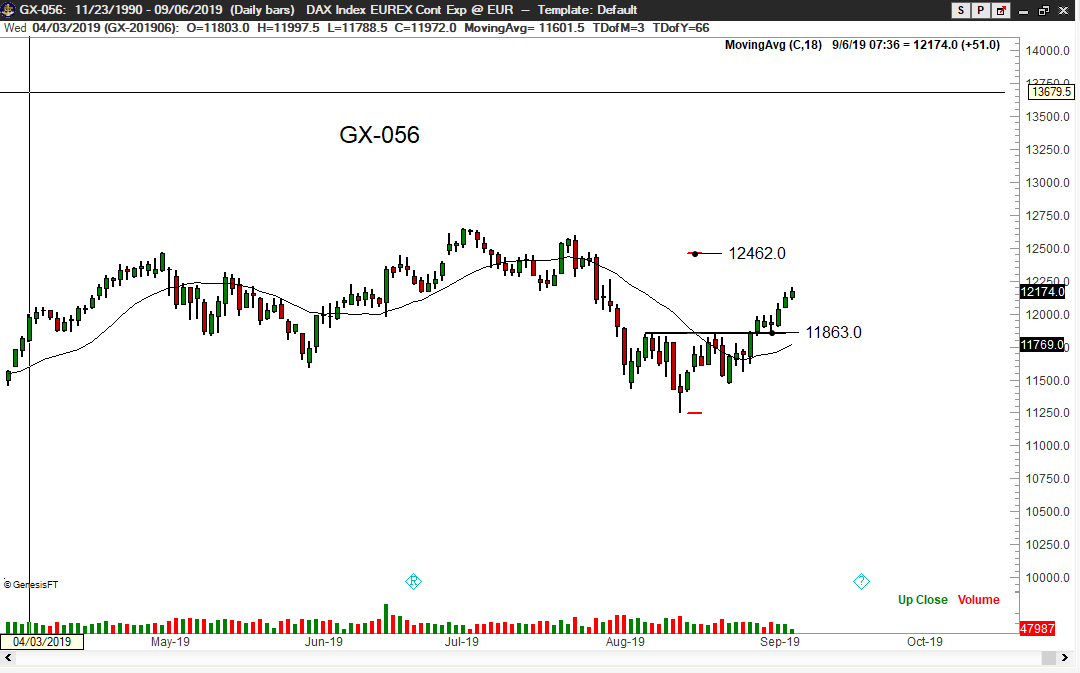

DAX (Eurex)

The advance on Aug 30 completed a small, but well-defined, inverted H&S bottom. Factor is long. The Sep 3 low is my pivot for protection. I will look to jam stops if the market approaches the 12462 target.

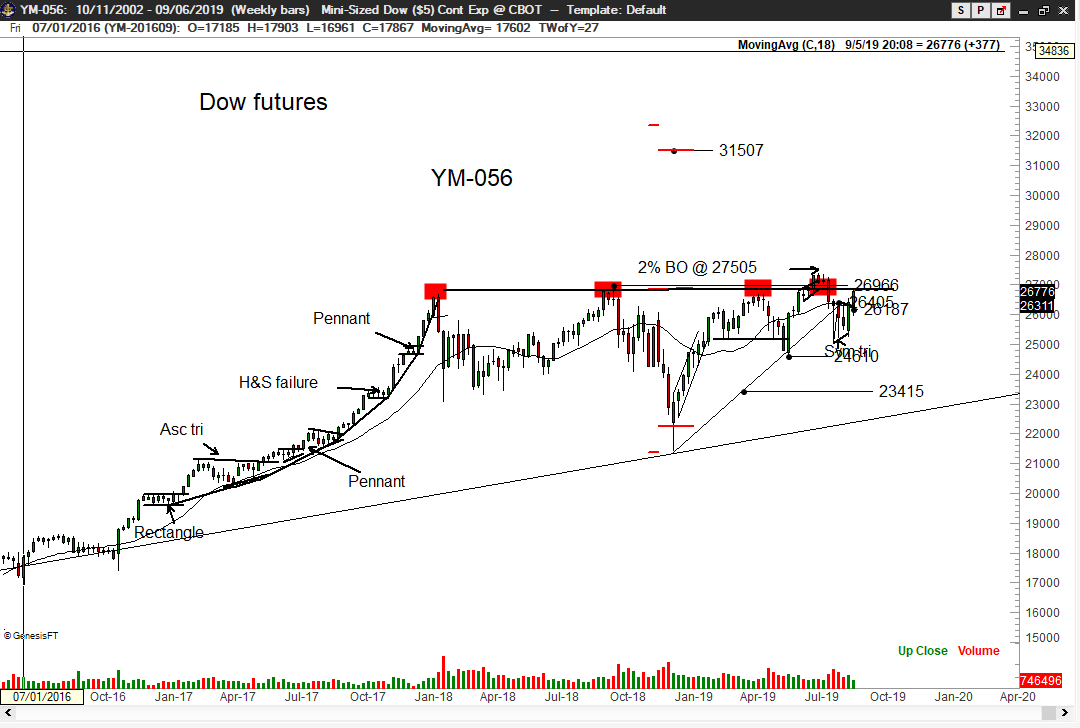

DJIA (CBOT)

I view the weekly chart as a 17-month inverted H&S with a premature breakout in Jul.

TSM (NYSE)

Two weekly charts are shown to display the massive 17-month inverted continuation H&S pattern. The total- return chart is on the right. The prices on this chart include previous dividend payments. The chart on the left is ex-dividend (prices have been reduced by previous dividends). Factor is flat. I will buy a breakout.

Factor Membership

.

Peter Brandt is a 40+ year veteran of trading. Through his Factor Service, members receive:

.

View your Factor Member options here. You could consider your membership in the Factor Service as just one more trade. If the Factor Service is not of value to you, well, it is just one more trade that did not work.

Through the Factor Service I endeavor to alert novice and aspiring traders to the many pitfalls you will face – and to offer advice on overcoming those pitfalls. My goal is to shoot straight on what trading is all about. For more information watch my 30 minute webinar where we cover the Factor service in depth.

I hope you will consider joining the Factor community.

SaveSave

Factor Abbreviated Update, April 26, 2019

/by Peter BrandtFactor Update, February 16, 2019

/by Peter BrandtFactor Update, December 21, 2018

/by Peter BrandtFactor Alert, August 4, 2018 — Get ready for a wild week in U.S. equities

/by Peter BrandtFactor Alert, March 22, 2018 — Misc markets

/by Peter BrandtWorld Stock Markets – Perma-bears Beware

/by Peter Brandt Read More

Read More