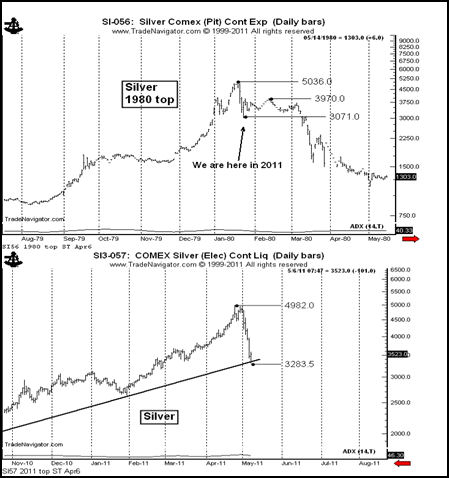

Silver — history repeating itself

Three reasons why Silver might be close to a temporary bottom (within a larger bear market).

- There will be support at the trendline from August and January lows. Today could end up as a reversal day.

- Small investor may be washed out — this is needed for a rally to occur. SLV had record volume Thursday at 294 million shares. More volume than SPY. This volume represented small investors liquidating, not accumulating. The buyers were people who took profits last week. Sorry, small investors, this is the way the raw material markets work.

- The top in 1980 would indicate a rally from here. The rally should not exceed $39 to $42. Do not be confused — Silver is now in a bear market.

Leave a Reply

Want to join the discussion?Feel free to contribute!