Charts of the day – August 14, 2013 (Hogs, Cotton)

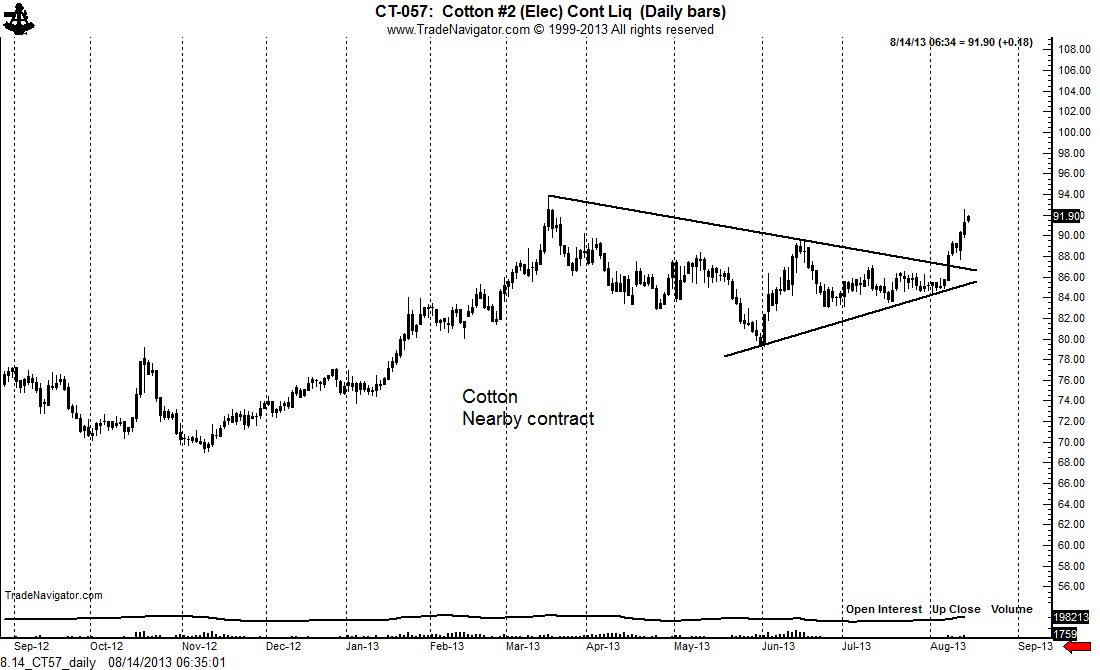

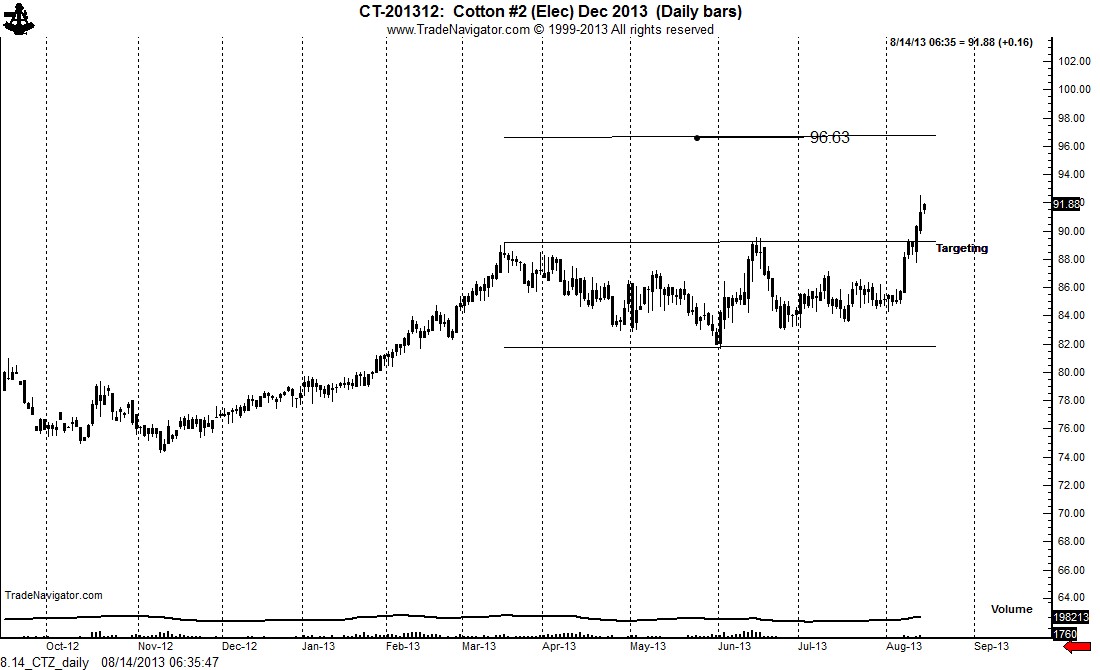

The nearby continuation chart in Cotton completed a 4+ month continuation triangle on August 7. The December contract completed a continuaition congestion on August 12, confirmed on August 13. Many traders fear buying a market that has already broken out — instead, they often get chopped up within a trading range attempting to get positioned before the breakout, then they miss the move when it happpens. Any period of weakness in a strong advancing trend is a buying opportunity.

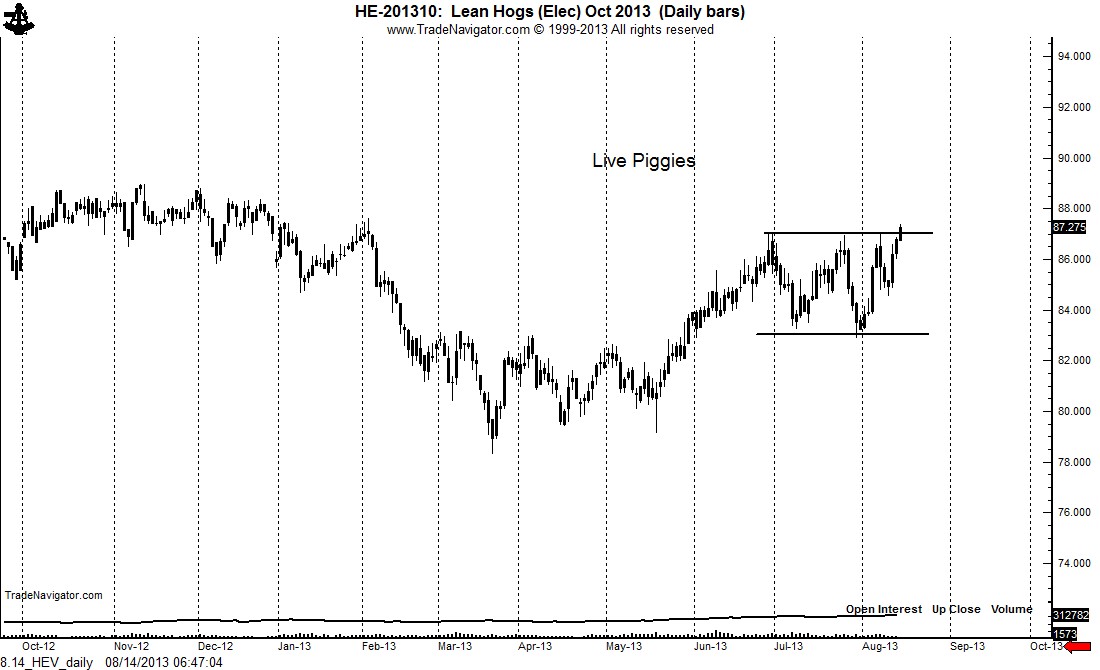

The October Live Hog chart is attempting today to complete a 7-week rectangle. A strong close today would complete this pattern and serve as a buy signal. However, the failure of the market to breakout convincingly would be a cause for concern for long position holders.

$HE_F, $CT_F

###

Leave a Reply

Want to join the discussion?Feel free to contribute!