Forex Ideas

Forex Ideas

Below are some interesting Forex ideas I’ve been tracking.

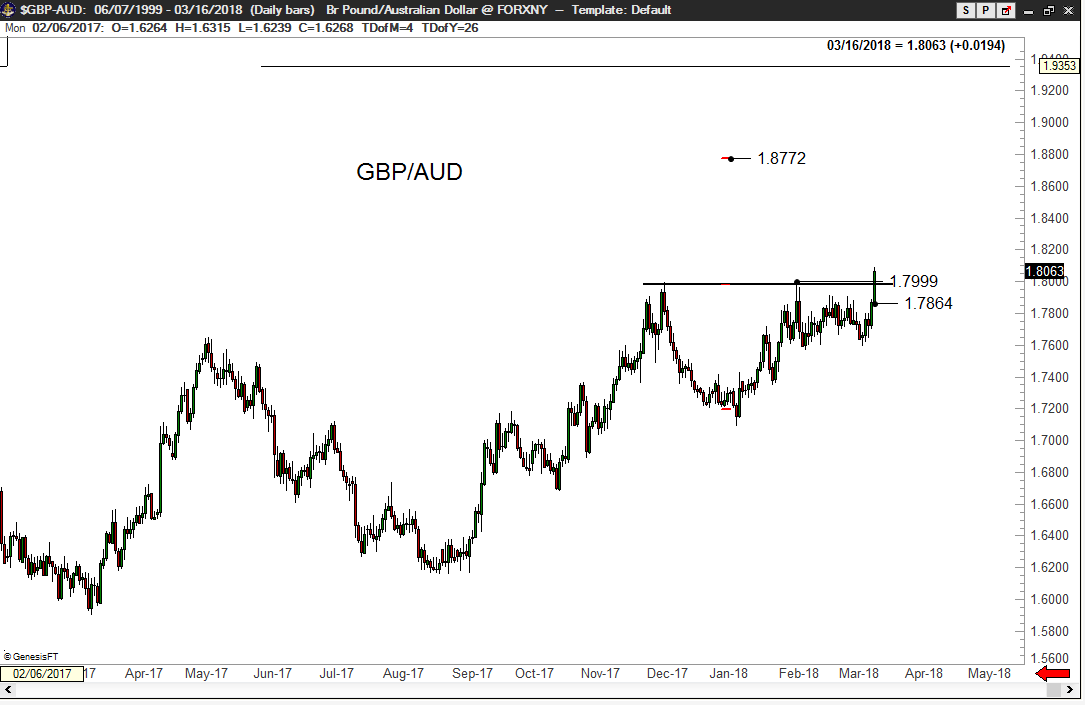

GBP/AUD — the advance on Friday completed a 14-week Cup and Handle buy signal in this forex cross. I am interested in buying a slight retest of this pattern if given the opportunity, but I will not chase the advance. I would limit my risk on this trade to 40 basis points.

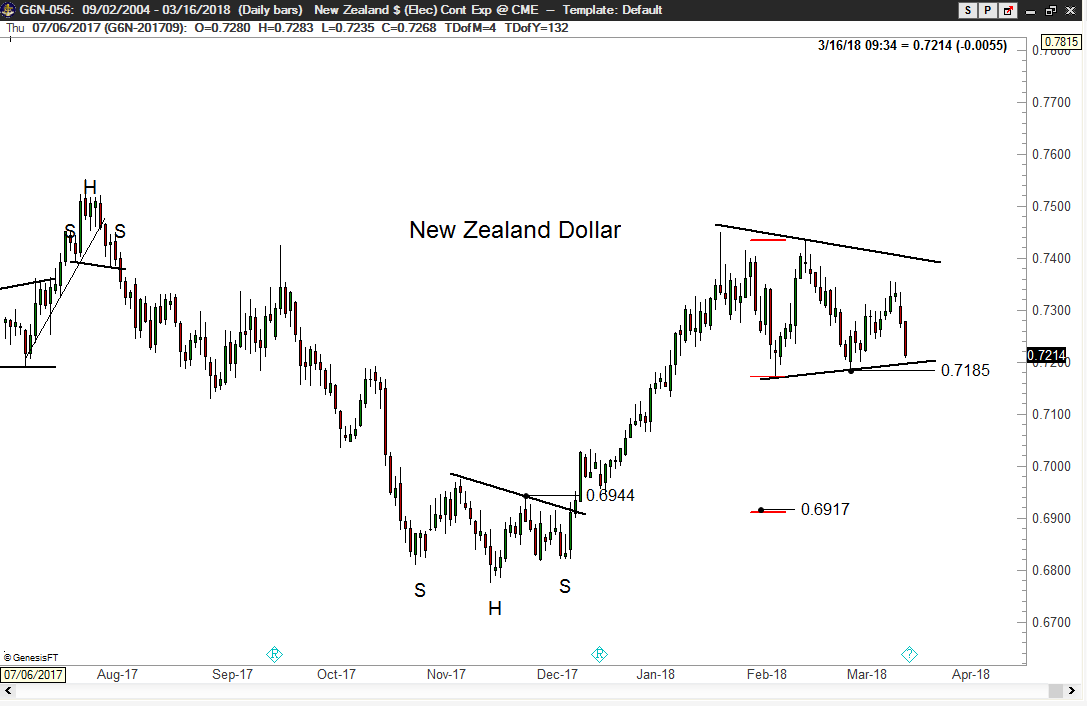

New Zealand Dollar futures

The daily chart is forming a textbook symmetrical triangle top pattern. I typically do not like trading the symmetrical triangle pattern, but in this case the lower boundary is horizontal enough that I am interested in the short side.

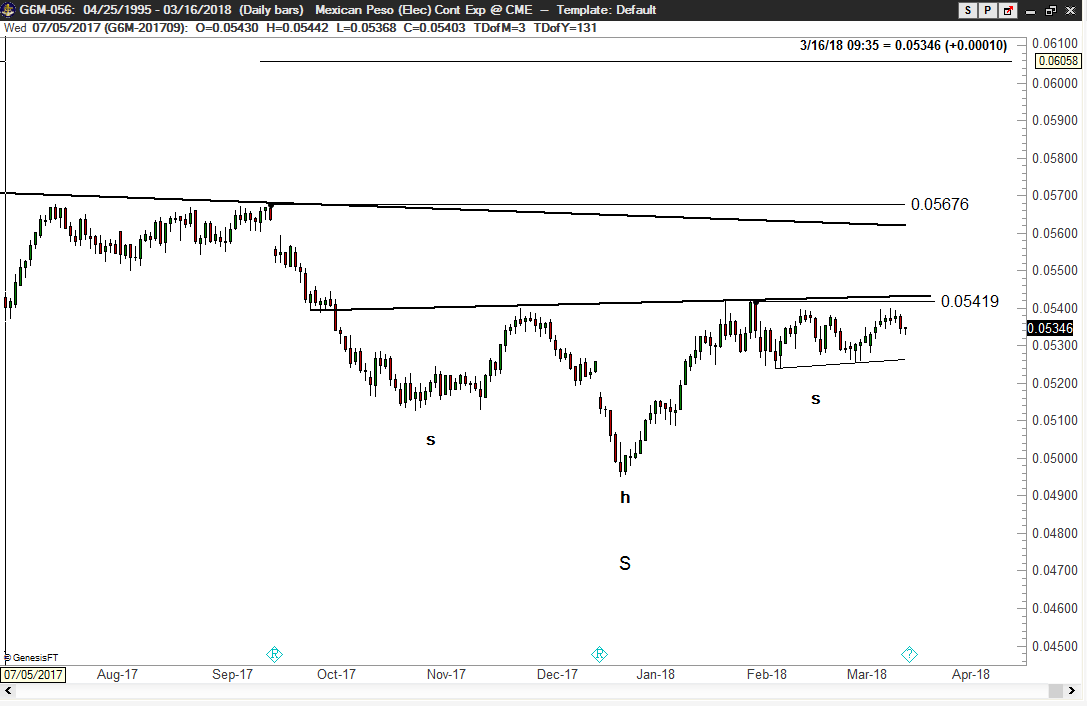

Mexican Peso futures

The monthly graph displays a possible 2+ year H&S bottom – the right shoulder is forming an independent inverted H&S as seen on the weekly and daily graphs. Factor is flat. I will buy a breakout of the daily chart H&S and then explore extending long leverage should the weekly H&S bottom be completed.

Factor Membership

.

Peter Brandt is a 40+ year veteran of trading. Through his Factor Service, members receive:

.

View your Factor Member options here. You could consider your membership in the Factor Service as just one more trade. If the Factor Service is not of value to you, well, it is just one more trade that did not work. Through the Factor Service I endeavor to alert novice and aspiring traders to the many pitfalls you will face – and to offer advice on overcoming those pitfalls. My goal is to shoot straight on what trading is all about. For more information watch my 30 minute webinar where we cover the Factor service in depth.

I hope you will consider joining the Factor community.

.