The Public Blog site

Battle Lines are Drawn in World Stock Markets

/by Peter BrandtUpdate on the major top in U.S. stocks

/by Peter BrandtAnnouncing the “How to Trade for a Living” Bootcamp

/by Peter BrandtSoybeans — Get ready for a price explosion!

/by Peter BrandtCharts I am watching the week of July 25, 2011

/by Peter BrandtTaiwan – Ready to Rock and Roll!

/by Peter BrandtCharts I am looking at for the week of July 18, 2011

/by Peter BrandtDue to a death in the family, this may be my only post of the week.

Following are the charts that have my interest coming into a new week.

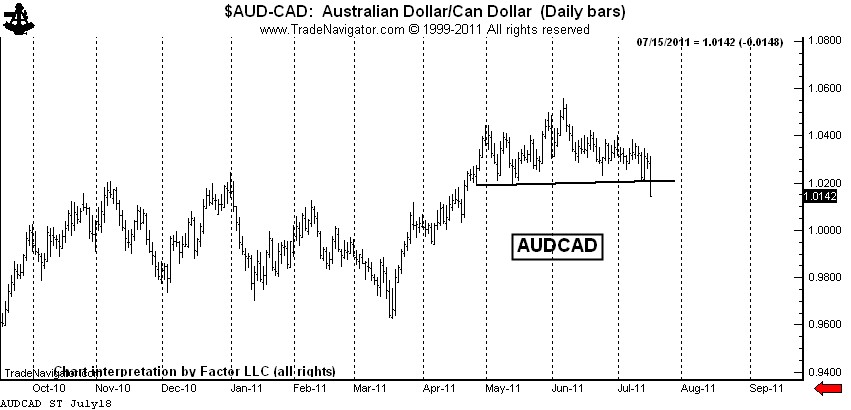

$AUDCAD — This forex pair completed a rounding top last week. I am short, but not as short as I would like to be. I will have orders in place to extend my leverage if the market can retest the top.

Silver: $SI_F, $SLV — The rally late last week completed a possible symmetrical triangle bottom. The bulls appear to be back in control in Silver. I do not have a position in Silver futures, but am long $SLV with a stop below last Wednesday’s low.

Was my forecast for $20 Silver wrong? Right now that is the way it seems. Trading is a marathon, not a sprint. I have some very bad news for all the Silver bulls who are such fond fans of my blog — I was NOT short last week. Sad, but true! I will let you know when I go short. By the way, I always trade with a stop and seldom risk more than 100 basis points per trading event (one percent of capital).

There is another intrepretation of the Silver chart that is not as immediately bullish. I have a great dislike for chart patterns with diagonal boundaries. The symmetrical triangle is my worst enemy. I much prefer a horizontal chart boundary. Silver has not yet completed a bottom if we use horizontal boundaries to define the trading range over the past 10-weeks, as seen below.

Gold: $GC_F, $GLD — The Gold market completed a text-book continuation symmetrical triangle this past week. I am long Gold futures and Gold ETFs. Gold, unlike Silver, may one day be monetized.

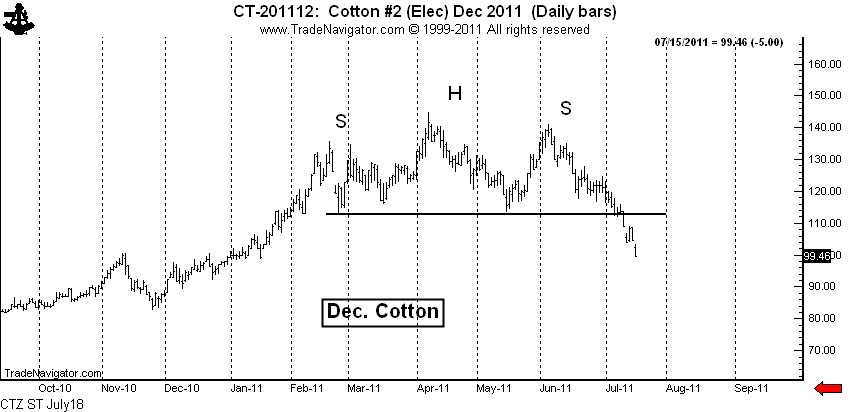

Cotton: $CT_F — I feel like an idiot. I shorted Cotton really well based on the H&S top. I felt like a genius when I covered on Friday, only to have the market go limit down. I really thought the market would cover the opening gap. I got cute — and I doubt the market will let me back in. Big profits are important. I let one get away in Cotton. I should have been adding, not covering.

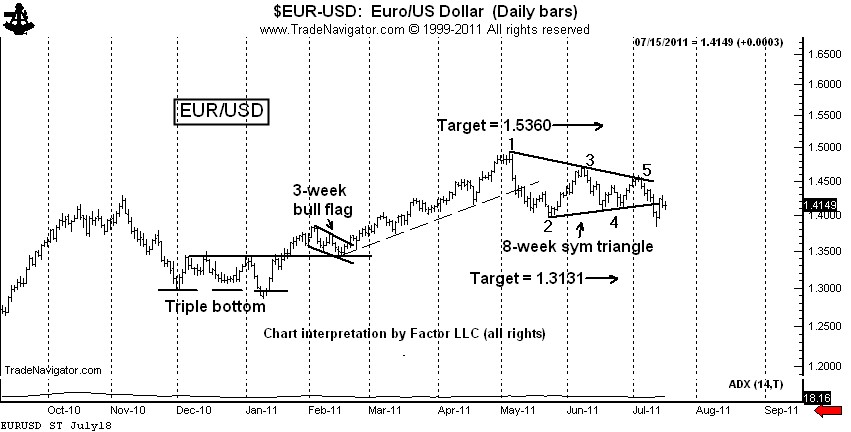

$EURUSD, $G6E_F, $UUP, $FXE — The decline on Wednesday completed a classic 6-point symmetrical triangle top. This completed triangle has been violated intraday, but not on a closing basis. I am short, using Thurday’s high as protection. I really thought I tagged a good one on Wednesday. The forex markets are vicious.

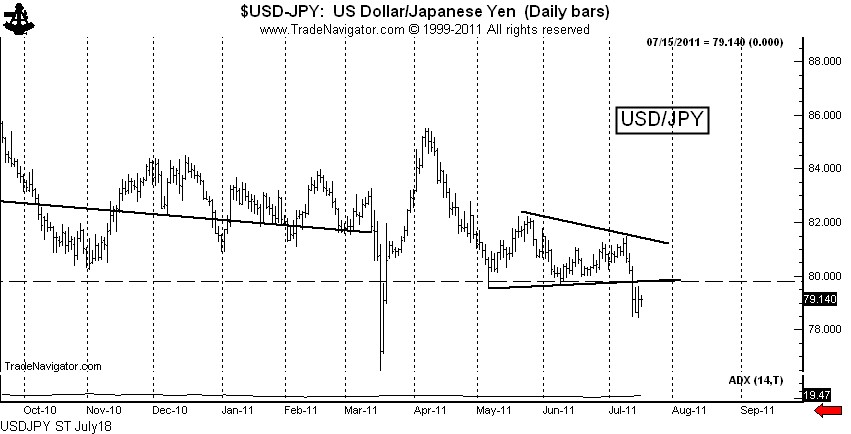

$USDJPY, $G6J_F, $FXY — The decline last week completed a triangle, but that is not the real story. Friday’s close is the lowest week-ending close in history, breaching the 1995 low (not shown). We may see Bank of Japan intervene next week, or it may be that the BofJ is capitulating until a lower price level is reached (such as 75.00). I am short $USDJPY and fully expect to have the BofJ run me out of the trade.

S&P 500: $SP_F, $ES_F, $SPY — This is my “pie-in-the-sky” chart. The daily graph displays a possible H&S top. If this analysis is correct (big IF), the right shoulder high is in place. This chart needs to be on everyone’s watch list. I am flat, tempted to go short under last week’s low. The CFTC Committment of Traders data released late last week was bearish.

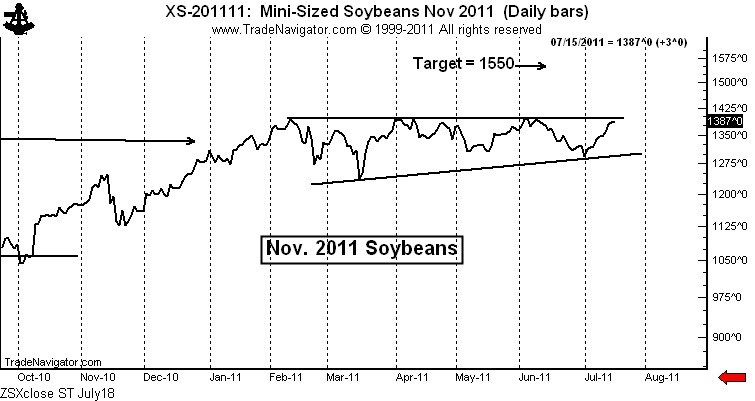

Soybeans: $ZS_F — This is an extremely intriguing chart. I fully expect that this chart pattern will be completed by an upside breakout — whether the breakout has follow through is a different story. I am lightly long Soybean futures with a stop below the July 12 low. I will add if the market breaks out intraday. I will add more if the market breaks out on a closing basis.

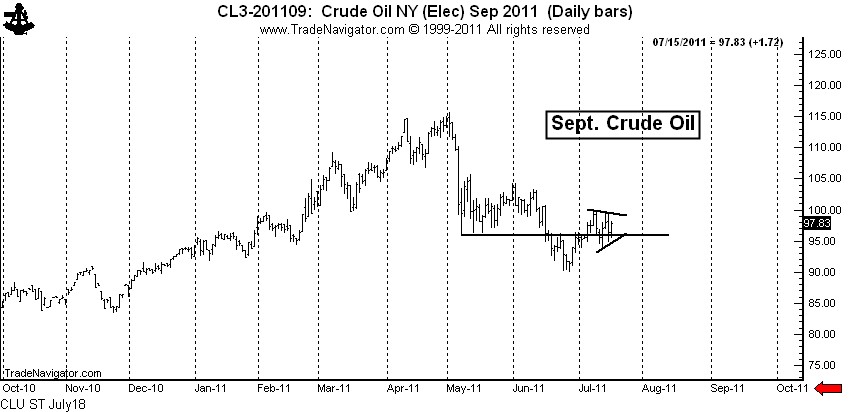

All the above charts are fairly long-term in duration. As a token to you shorter-term chartists, I leave you with Crude Oil. I am not in this market and probably will not become involved due to travel, but an interesting story can be told for getting long.

Crude Oil: $CL_F, $USO — If Crude Oil was in a “for-real” bear trend, then the May low should have turned back any and all rallies. Yet, the market has now climbed back above the May low. This is a sign that the May to June decline was a correction, not the start of a new bear trend.

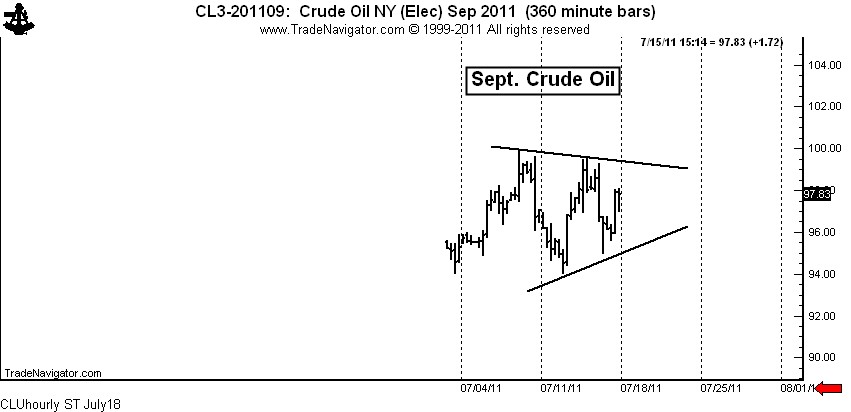

On a shorter-term basis, the market is forming a 7+ day symmetrical triangle. A completion of this small pattern would probably lead to a test of the June 1 high at 104+. See the hourly chart below.

Let me throw in a couple of final charts. For the first time in a very long time I have some encouraging words for the millions of you who think Natural Gas prices are too cheap.

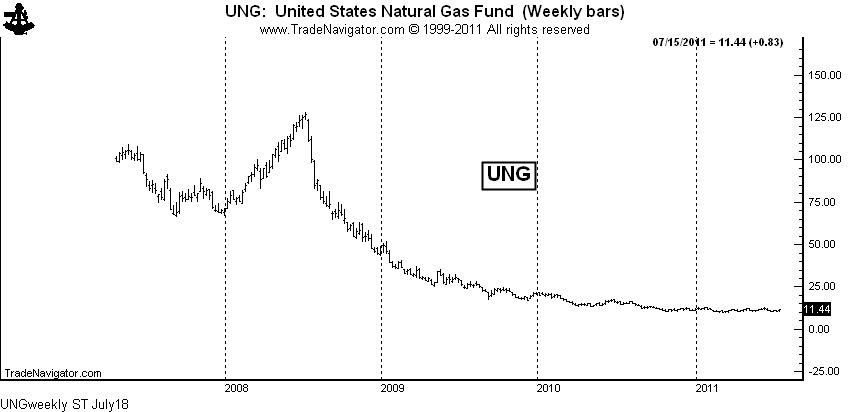

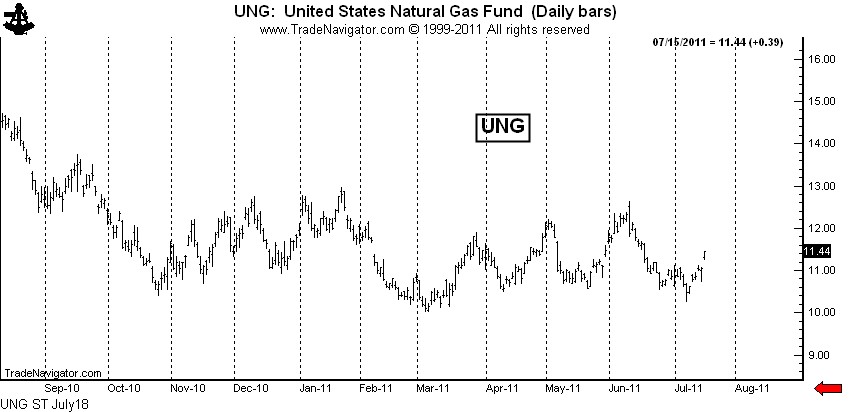

Natural Gas: $NG_F, $UNG, $UNL, $GAZ — Being long Nat. Gas ETFs has been a losing game due to the huge carrying charges that disappear each month. The weekly chart of UNG shows the result of this time decay.

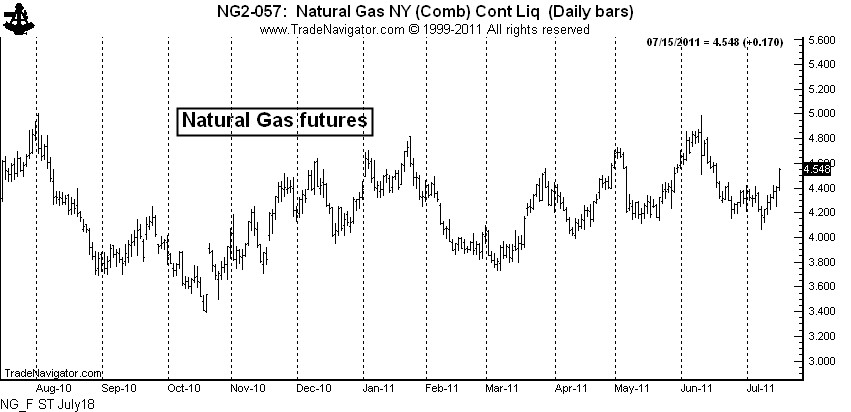

This time decay may continue to take place, but I can say with as much certainty as possible that the physical market has bottomed. The chart of Natural Gas futures shows that the market has lifted well off the 2010 low and is forming high lows and higher highs.

There is also some signs that UNG has bottomed — the March low may hold, despite the massive supply on hand and the negative publicity on fracking.

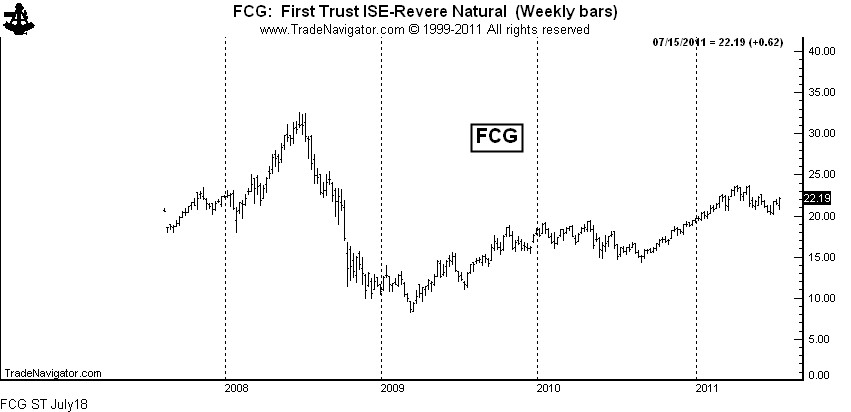

While there may come a time to be long the ETFs for the physical commodity, I would prefer to own the ETF for the producers and other companies deriving income from the production and processing of the product. A chart of FCG ends this post.

Markets: $AUDCAD, $SI_F, $SLV, $GC_F, $GLD, $IAU, $CT_F, $EURUSD, $FXE, $UUP, $ZS_F, $SP_F, $SPY, $CL_F, $USO, $USDJPY, $G6J_F, $UNG, $UNL, $GAZ, $FCG

###

Strong Opinions, Weakly Held!

/by Peter BrandtOn June 28, I posted a chart that overlaid Silver prices today with Silver prices in 1980 (see here). I saw the two periods as an example of analog price behavior. My conclusion was that — based on price behavior of the 1980s — Silver was headed to $20. At the time of the post I felt strongly about the market prediction.

Then on July 4 I added a post titled, “A potentially bullish development in Silver.” Based on the newly released CFTC Commitment of Traders data, I saw a new development in the Silver market.

Of course I got hit with some snide comments — “How could I be a $20 bear one day and start changing my mind just a week later?”

One of my favorite web posts of all time was by a trader I greatly admire, Barry Ritholtz, author of the blog The Big Picture. Barry is an astute market participant and observer. The post, from July 24, 2006, was titled “Strong Opinions, Weakly Held.” This blog, and the management philosophies it discussed, perfectly describe why I could hold strongly to a bear bias in Silver one week, and start to think differently just a week later.

Barry ended the post with the following sentence: “The bottom line is that strong opinions, weakly held is a mindset more investors need to familiarize themselves with.” I could not agree more.

Barry’s blog post was founded in the academic work of Professor Robert Sutton who teaches Management Science and Engineering at Stanford. Sutton’s work sought to distinquish between what was “smart” and what was “wisdom.”

As Ritholtz stated, “Being a successful investor often requires you to hold numerous conflicting concepts simultaneously — something many the average phyche has difficulty with. One must think through the best possible analysis for your positions, expend the time and effort to thoroughly test them. You need to be able to strongly argue your position — bullish, bearish or cash — but at the same time, be ready to admitt error and change views.”

When I express an opinion about a particular chart, it is most often a strongly held opinon. Keep in mind that for me a strong opinion does not necessarily equate to a trading position. Trading positions are brought about by a strong opinion PLUS a specific technical set up PLUS a favorable reward to risk relationship.

Strong Opinions, Weakly Held! What a great concept for a trader.

$$Study

###

StockTwits Midday Q&A with Peter Brandt

/by Peter BrandtRecent Posts:

Primer: Interest Rates & The Fed (+FREE .PDF)December 3, 2025 - 8:30 pm

Primer: Interest Rates & The Fed (+FREE .PDF)December 3, 2025 - 8:30 pm Loss Aversion: A Mental Trap Every Trader Needs to KnowNovember 19, 2025 - 6:52 pm

Loss Aversion: A Mental Trap Every Trader Needs to KnowNovember 19, 2025 - 6:52 pm Three Day Trailing Stop (Video)October 24, 2025 - 5:25 pm

Three Day Trailing Stop (Video)October 24, 2025 - 5:25 pm One Year Later: GE, Classical Charting, and Avoiding Dead MoneyJuly 22, 2025 - 1:01 pm

One Year Later: GE, Classical Charting, and Avoiding Dead MoneyJuly 22, 2025 - 1:01 pm