The Public Blog site

Charts I am watching, week of July 22, 2012

/by Peter BrandtTreasury Bonds in final blow-off stage of 30-year bull market

/by Peter BrandtCharts I am watching, week of July 8, 2012

/by Peter BrandtTime-lapse video of Colorado Springs fire

/by Peter BrandtAcademic research on the H&S pattern

/by Peter BrandtNasdaq set up for a major buy signal

/by Peter BrandtAt last, a bottom in Natural Gas

/by Peter BrandtGold rallies out of the doom zone

/by Peter BrandtThere is a difference between a good trade and good trading

/by Peter Brandt

Many novice pedestrian traders focus on the next position. Consistently success traders focus on the process and care little about the outcome of the next trade. The distinction is enormous.

I made a comment in a recent blog about a trade being a loser yet being a good trade. I received a number of inquiries about how this can be a reality. So, I thought I would discuss the matter.

Often what I post is the analysis of a chart with some comment on the implications of the chart construction in question. Many other traders disagree with either my method of analysis (i.e., classical chart principles) or the conclusion of my analysis.

Hey, I am ok with either type of disagreement. It is what makes a market. So, as long as there is no name calling or rudeness feel free to disagree whenever you feel the urge.

Yet, many readers don’t or cannot comprehend two factors:

- An opinion or analysis of a specific market may or may not equal a position

- In reality, my trading is based on process, risk management and the reality that I am wrong more often than I am right. While the analysis of a given chart may be interesting, that analysis fits within a much more comprehensive approach to trading than it is possible to discuss on an ongoing basis.

I select and manage trades basis on a set of rules, guidelines, best practices and principles that have evolved over three decades. These rules, guidelines, practices and principles dictate for me what trades I do, how much I risk, what leverage I assume and how to manage the trade.

A given trade may end up being wrong. A recent example was a short trade in Copper on Apr 10. I rode that trade down and up and down and up before taking a loss on Apr 26.

The question for me is simple: Was this a good trade based on my trading algorithm. The answer is an absolute “YES.” But was the analysis right and the trade profitable. The answers are an absolute “NO” and “NO.”

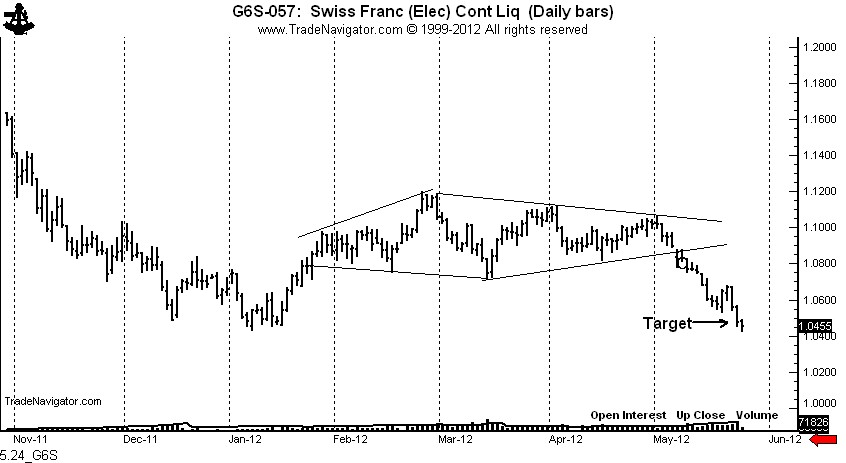

Then there is a recent trade in the Swiss Franc. A 3-1/2 month or 10-week triangle was completed on the May 8 close. The target was met on May 23.

While the practical (P&L) implications of the Swiss and Copper trades were very different, in my mind these trade were both perfectly aligned with my trading approach.

Thus, there is difference between a “good” trade and a profitable trade. As a trader, your goal should be good trades. Then you let the profits land where they may over a multi-trade series.

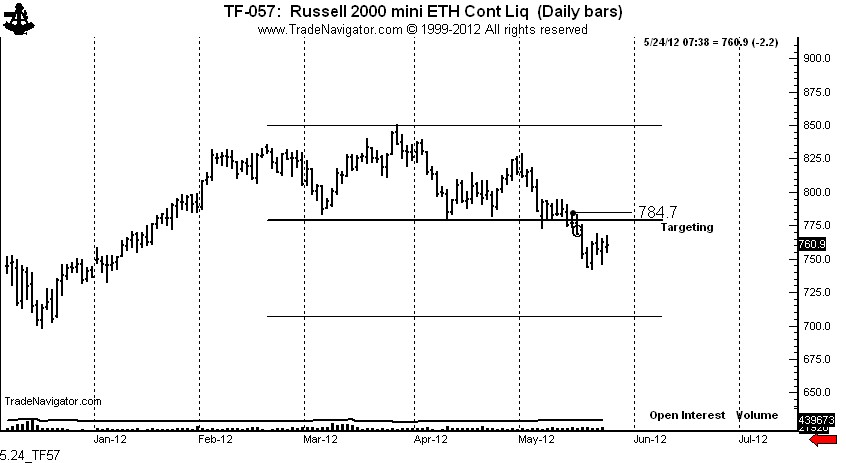

I am presently short the Russell 2000. Is it a good trade based on my trading approach? It is as good as it gets! Will it be a profitable trade? I have no idea. Do I care? Of course, I would much rather take a profit than a loss. Yet, loss or profit, the trade is a good trade.

In conclusion, while you may disagree with using chart patterns for the basis of trading or you may disagree with my opinion (and maybe my position) on a given market, please know that the results of any given trade is relatively unimportant.

A given trade is nothing more than a datum point in a series of data points that are governed by sequencing within random probability theory. And, unfortunately, that is a subject for a much later date.

###