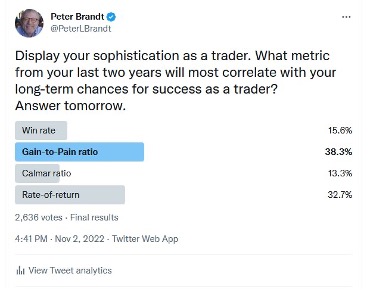

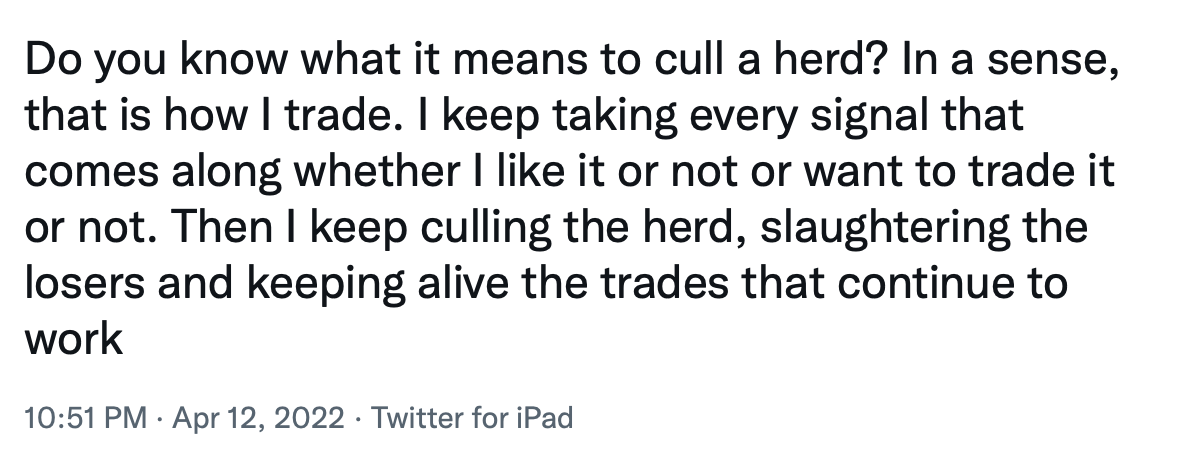

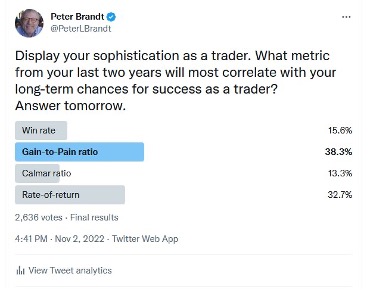

On November 2, I posted the following Twitter poll.

In hindsight, I should have included the Sharpe Ratio as one of the answers. As an aside, perhaps I will do another poll someday comparing the Sharpe Ratio to Rate-of-Return, the Gain-to-Pain (GPR) ratio, and the Profit Factor (PF).

I was very pleasantly surprised that the GPR ratio was the top vote-getter because this was the correct answer.

Win-rate (the percent of trades that are winners) was likely the vote of trading newbies. Win-rate is a totally meaningless metric with very little correlation to long-term success (which I define as performance over a five-year period).

I have known traders who are consistently profitable with a 30%-win rate and also individuals who self-destructed with a 70%-win rate. Of much more importance is the average size of wins in relationship to the average size of losses.

Rate-of-return (ROR) received the second greatest number of votes. Again, ROR is a mostly meaningless metric because it does not take into account the asset volatility required to achieve the ROR. Of what benefit is a 50% ROR if, in the process drawdowns of 50% or more are experienced.

So, between ROR and win rate, 46% of the poll participants wasted their vote.

Gain-to-pain ratio (GPR) is the sum of all monthly returns divided by the absolute value of the sum of all monthly losses. In other words, this metric measures the ratio of cumulative net gain to the cumulative loss to achieve that gain. To be a good guide, GPR should be measured over at least three years. A GPR of 1.0 is acceptable, 2.0 is outstanding, 3.0 is excellent and 4.0 is world class. It is a difficult challenge to maintain higher GPRs over more extended time periods. Dating back to 1981, my career GPR was calculated by Jack Schwager (author of the Market Wizards series) at 2.8.

The Calmar ratio is calculated by dividing the average annual ROR over at least three years by the worst drawdown (DD) during the same period. As such, like the GPR, Calmar is a risk-adjusted expression of performance.

The poll did not include two other performance metrics I want to mention – Profit Factor and the Sharpe Ratio.

The Sharpe Ratio seems to be the most relied upon measure of performance in the investment world. I find this strange because I consider the Sharpe Ratio to be mostly useless. The Sharpe Ratio rewards annuity-like performance outcomes with little performance volatility. But more to the point, the Sharpe Ratio penalizes upside performance volatility which is EXACTLY the type of volatility needed for outstanding profitability.

Profit Factor (PF) is actually my favorite performance metric. PF is measured using the performance of each individual trade (as a percent return on total trading capital) rather than a reference to a time period (such as is the case with GPR).

Profit Factor is calculated by dividing the cumulative ROR sum of positive trades over a set period divided by the absolute value of the cumulative ROR sum of losing trades. Because more data points are involved with PR than with GPR, lesser time frames can be revealing. A PF above 0 indicates profitable trading. A PF above 1.0 is acceptably profitable trading, above 2.0 is good, above 3.0 is outstanding, above 4.0 is excellent and above 5.0 is world-class. The Factor LLC’s Prop Account’s PF since 2014 has been 5.4.

I strongly believe that anyone serious about trading needs to maintain certain metrics. Trading is my business – it has been my livelihood for almost 50 years. Business is serious business – and serious business needs to take performance seriously. What would you think if a company in whose stock you own had no idea what is profit margin, gross sales, net profits and return on shareholder equity were for its most recent year? Yet most trades do not have a clue on some of the most important performance metrics, and this is sad.

Performance metrics are obviously back-looking in nature. But importantly, various performance measures can reveal much about the strengths and weaknesses of a trading program, thus allowing for possible improvements.