A Collection of Member Q&A’s

Member Q&A's with 40+ years of insight

Question:Peter, could you condense as briefly as possible the approach you take to trading?

Read More

Question:Peter, could you condense as briefly as possible the approach you take to trading?

Read MoreAscending Triangle – Guest Post

Ascending Triangle - Video Tutorial

by Aksel Kibar Right angle triangles, with the hypotenuse slanting upwards from the origin of the pattern, are Ascending Triangle chart patterns and they are bullish.The below educational video describes how to identify a bullish ascending triangle, along with some of the characteristics of this pattern that could help you identify and take advantage of such patterns within your own personal trading.

Read MoreA Possible Turn in Direction

$US Dollar Index

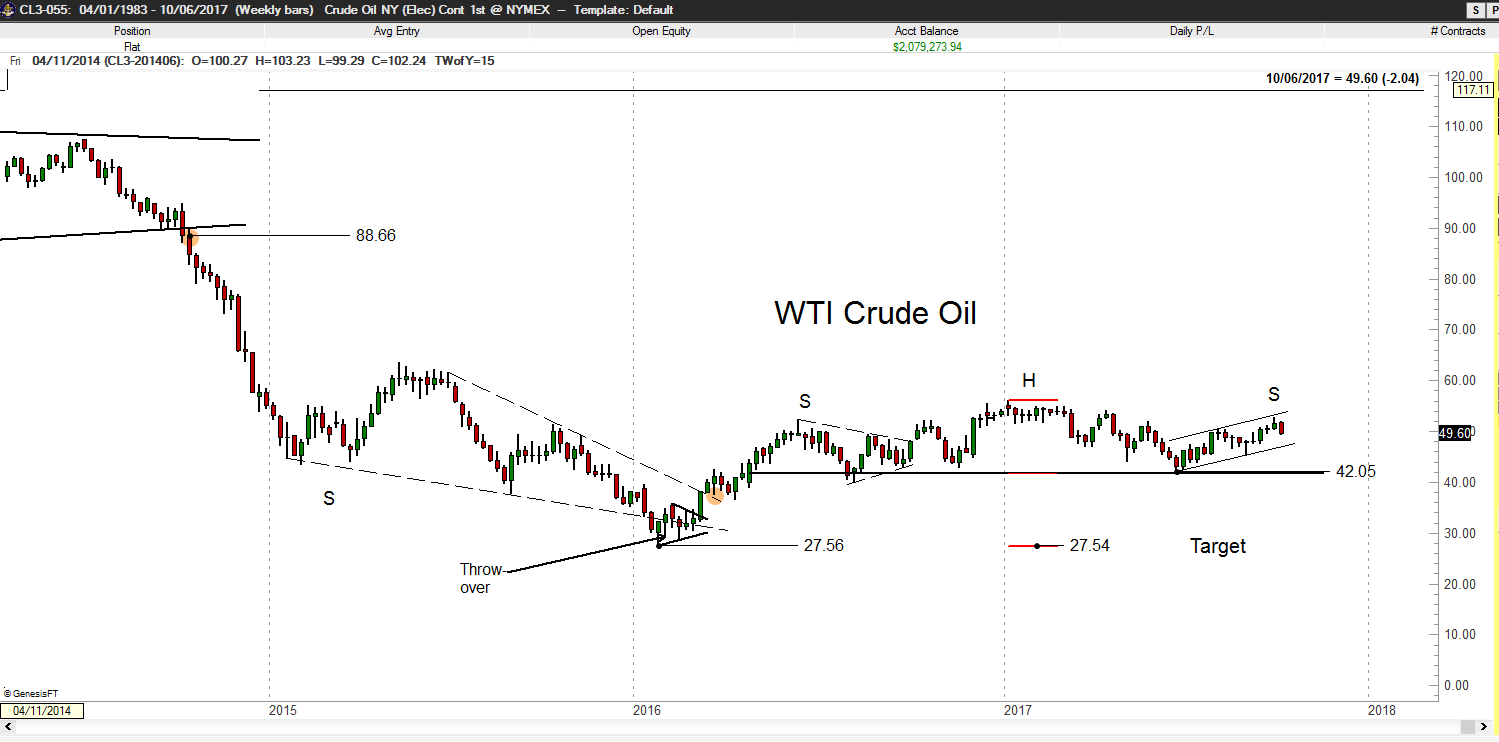

The Next Big Crude Oil Move

The 3 Most Important Ways to Track Trading Performance

Trading Performance

Human beings exist day-to-day in a world preoccupied by statistical measures, ranging from numerous personal health metrics (blood pressure, PSA counts, temperature, oxygen levels, heart rate, etc.) to standard weights & measures (gallons, pounds, meters, temperature, etc.) to determinants of economic well-being (GDP, unemployment rates, inflation rates, interest rates, balance-of-payments, etc.) to statistical definitions of every area of our lives. Modern society could not exist without measuring nearly every conceivable thing. Yet, many traders make no attempt to convert their Trading Performance into meaningful metrics. This is unfortunate because meaningful metrics are not simply interesting statistics – rather they can serve important functions:- Dictate and guide the development of trading strategy

- Monitor trading outcomes against intended benchmarks

- Diagnose potential problems

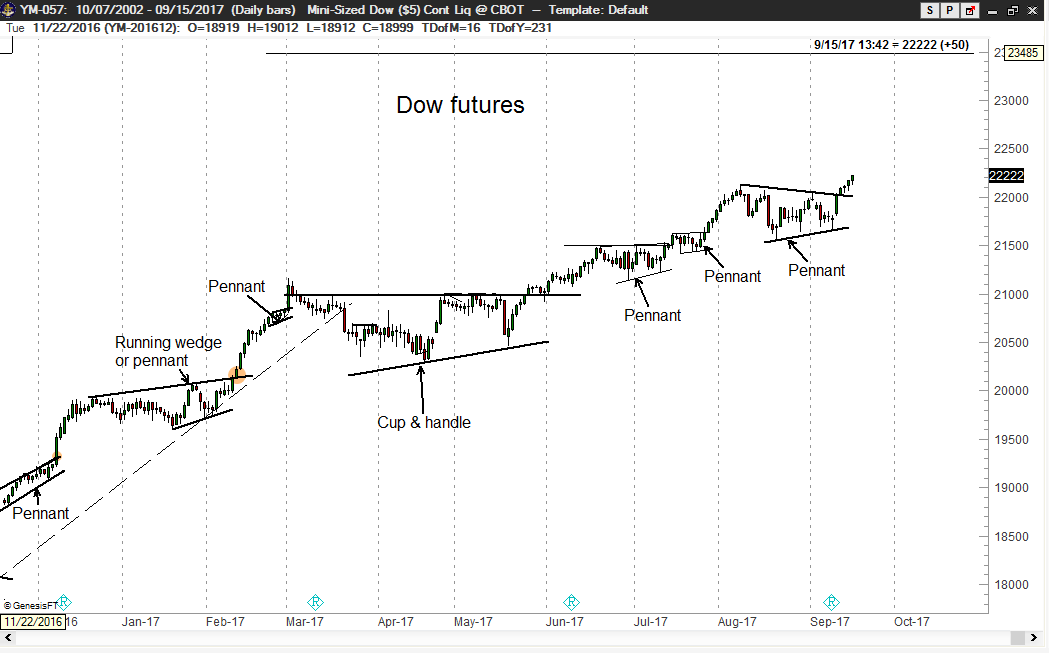

Factor LLC and Tech Chart Member September 2017 Webinar

Factor LLC and Tech Chart Member September 2017 Webinar

Member Webinar and Q&A with Peter L. Brandt and Aksel Kibar - Recorded live September 21, 2017 Opening discussion/presentation by Peter and Aksel- Favorite classical chart patterns

- Establishing timing of entry and targets

- Current markets

- Peter: Do you track prices of rice separately or is it included in the grains chart that you already are tracking? 46:02

- Aksel: How important is the volume when price break out from the chart pattern? Is it more reliable with higher volume in your opinion? 47:01

- Either: CS - (as an example) You pull up a chart on interactive brokers, big charts, metastock, etc., and you get different break out resistance lines — what is the “official" chart? 48:23

- Peter: Since I traded more in India, can you please tell what is the strongest sector that can be played for nifty move up to 11250? 50:54

- Aksel: What risk management / trade management rules of thumbs do you apply when trading? 51:41

- Both: From observing your trades/recommendations you seem to have a different time frame for your ideal trade setups (10-26 weeks vs 4-24 months) — would be curious to understand if this is a function of the different markets you trade or if you just have different experiences with the reliability of time frames or something else? 52:51

- Both: Neither of you use volume in your analysis, to confirm breakouts , etc., can you talk a little bit about why you don't use it, especially for stocks Aksel as volume is more readily available there compared to forex. 54:54

- Peter: Can the right shoulder in gold chart morph into an abbreviated one and thus making it breakout powerfully? What is the reason for you to have the H&S to be symmetrical in case of gold? 58:13

- Aksel: I have a general question concerning the neckline of HS-Formation. I noticed the neckline/boundary can be horizontal, and diagonal as well. Is that of any significance? 1:00:12

- Either: With regard to futures the successful patterns are 12-16 weeks long. In light of having to wait for the “right" patterns as a trader are you not significantly limiting yourself in building significant equity due to the few opportunities that emerges. 1:00:52

- Either: What do you see as the pros and cons of using CFDs for trading stocks? And is it an instrument your recommend using? 1:02:42

- Either: If a flag/pennant correction after a previous move, where you ideally enter and set the stop loss? 1:04:10

- Peter: You mentioned the tactical challenges in trading 1-2 year patterns — would you mind explain how you address these challenges tactically? 1:06:10

- Aksel: Do you agree with Peter that profits should be taken when target is met? 1:08:03

- Either: Do either of you have a real preference for bars over candles and why? 1:09:29

- Peter: Do you also watch bar-by-bar in order to identify patterns more accurately. Kind of "tape reading"? I understand you trade the break out, but are you more alert when e.g. bars are more narrow ranged at the moment you think breakout comes? 1:10:25

- Either: Where do you place initial and subsequent stops on BO? What do you consider too late a BO entry? 1:11:18

- Either: There are so many great trade set up ideas provided for in your chart analysis. Practically when managing capital, you are constrained by the number of trades that you can take. How do you manage the process of selecting the "best trades" and what criteria do you use to define those? 1:14:06

World Stock Markets – Perma-bears Beware

Read More

Read MoreFactor Member Questions

How much patience should a trader have with a losing trade?

How much patience should a trader have with a losing trade?

The question on losing trades, all traders must answer for themselves, and there really is no right answer. The answer for any given trader must depend upon his or her trading approach, markets traded, risk tolerance and other factors. For me, the answer to this question is quite simple and multi-layered.- My initial risk per trade seldom exceeds 70 basis points and is limited to 100 basis

- I aggressively advance protective stops within days (sometimes hours) after entering a trade.

- My goal is to bring a trade to as close to breakeven as possible, as quickly as possible!

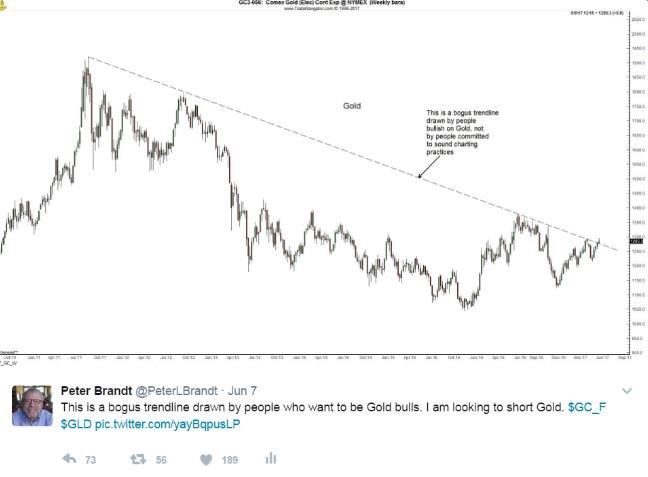

Gold Trendline – Bogus or Bullish?

Gold Trendline

This past week, I posted a Tweet stating an opinion that a Gold Trendline chart featured on financial social media by a number of “Gold bulls” was bogus. The issue is an apparent Gold Trendline connecting the Sep 2011, Oct 2012, Jul 2016, Aug 2016 and Apr 2017 highs. I received numerous inquiries on why I did not accept the trendline interpretation – and a number of critical comments.

Importantly, it was the validity of the present trendline I was challenging, not the analytical or trading abilities of others who believe that the Jun 6 penetration of the trendline represents a significant technical development. In fact, I have enormous respect for at least two other public voices (@jessefelder and @raoulpal) who point to this penetrated trendline as supportive of a bullish view of Gold. I do not hold my own opinion on chart developments to be superior to other very qualified market speculators.

I want to present two perspectives of the “Trendline” as a classical chart configuration – the first perspective through the lens of Robert Edwards and John Magee (“Technical Analysis of Stock Trends”) and the second perspective through my experience trading chart patterns for nearly 40 years.

First Perspective – Edwards and Magee on [Valid] Trendlines

Edwards’ and Magee’s narrative is in italics, followed by my comments.

“It is our purpose … to examine trends … to see how they [trendlines] can be used to reinforce or supplement the technical forecasts derived from our other chart formation[s]….”

Are there other recognizable chart configurations at play in Gold at the present time? Answer – NO!

On the Validity of Penetration –

“We can set up three tests or criteria … for determining decisive breakouts [from trendlines].”

The first is the extent of penetration. To be decisive, prices must not only push through the line but close beyond it by a margin equal to about 3% of the stock’s [or commodity’s] price.”

Has Gold closed above 1325 to 1330, a 3% penetration of the Gold Trendline? Answer – NO! Can the trendline be considered to be valid without a close above 1330? Answer – NO! (I could legitimately argue that the 3% rule is not as applicable to commodities or forex – that 1% to 2% might be more appropriate).

“The second is volume of trading. Activity should always be expected to rise notably on a genuine up-side breakout ….”

Did Gold’s trading volume expand as prices penetrated the Gold Trendline? Answer – NO! Volume actually contracted.

“The third test … applies particularly to breaks which are borderline as far as the margin of penetration is concerned. If prices simply edge up feebly to the underside of the trendline and tend to ‘roll over’ without being able to close clearly above it – then the situation is … critical and the slightest sign of renewed selling pressure may be taken as a signal that the up-trend has been decisively broken.”

Time will tell if this third test applies to Gold. If it does apply, then the next profitable play in Gold will be on the short side.

Bottom line is this – if the apparent Gold Trendline does not qualify as a trendline, then there is NO TRENDLINE. In my opinion – for what it is worth – a pattern (any pattern) is only a pattern if it performs according to the expectations set forth by classical charting principles. Otherwise all we have are some coincidental lines drawn on a graph page that have no real meaning.

Second Perspective – My experience as a chart trader

It has been my experience as a trader that certain chart configurations are more reliable than other chart configurations. My test of reliability is that a completed chart construction produces the expected price move outcome and does so in an orderly and sustained manner without deeply challenging the integrity of the completed chart construction.

I have found that patterns with horizontal (or nearly horizontal) boundaries are far more reliable (as much as two times more reliable) than diagonal chart construction. Examples of horizontal and diagonal chart construction are found on page 3.

The most unreliable diagonal chart construction is the trendline, followed closely by the symmetrical triangle. Do NOT read this to mean that diagonal patterns do not produce profitable trades. I have experienced some wonderful trades involving diagonal chart construction. In fact, over the years many of my most profitable trades have occurred when a horizontal area pattern was completed simultaneously with the penetration of a multi-contact point trendline. In this sense I find trendlines to be of particular importance.

But, the main problem with diagonal chart configurations is that they are subject to a concept I call “morphology.” For example, a completed falling wedge may advance briefly and then fall back to begin forming a longer-duration TBD pattern. As a trader I have little interest in chart construction that is likely to morph.

| Horizontal chart construction

· Head and shoulders – when the neckline is flat or slants away from the right shoulder · H&S failures · Rectangles · Right-angled (ascending and descending triangles) – when the breakout is through the horizontal boundary · Horns (or sloping patterns) · Compound fulcrums (borrowed from point and figure charting) · Rounding patterns |

Diagonal chart construction

· Head and shoulders – when the neckline slants into the right shoulder · Symmetrical triangles · Right-angled triangles – when the breakout is through the diagonal boundary · Wedges (falling wedge more unreliable than rising wedge) · Trendlines · Channels |

| One additional point about trendlines must be made. All other chart construction listed above carry an implication that price will experience a “measured move.” The violation of a trendline does not carry with it a price target – but simply indicates that the price behavior of the previous trend has altered. Thus, on its face the penetration of a trendline does not convert a bear market into a bull market or visa-versa. | |

Here is the reality – chart construction today is much more complex and subject to failure than was the case in 1933 (Schabacker) or 1948 (Edwards and Magee). This decline in the reliability of chart construction may be due to a number of factors including the impact of HFT and algo trading operations and the predominance of systematic trading programs, especially in the futures and forex markets. It is commonly understood that 90% of the large spec trading volume in futures is driven by computer algorithms.

Classical charting remains a very valid tool for market speculation, but chartists must be increasingly selective in trade identification. Here’s why – WIN RATE DOES MATTER! My experience is that 30% of trendline violations on longer-term charts (weeklies) produce a meaningful move while 70% of trendline violations completely fail or produce moves that fizzle out quickly.

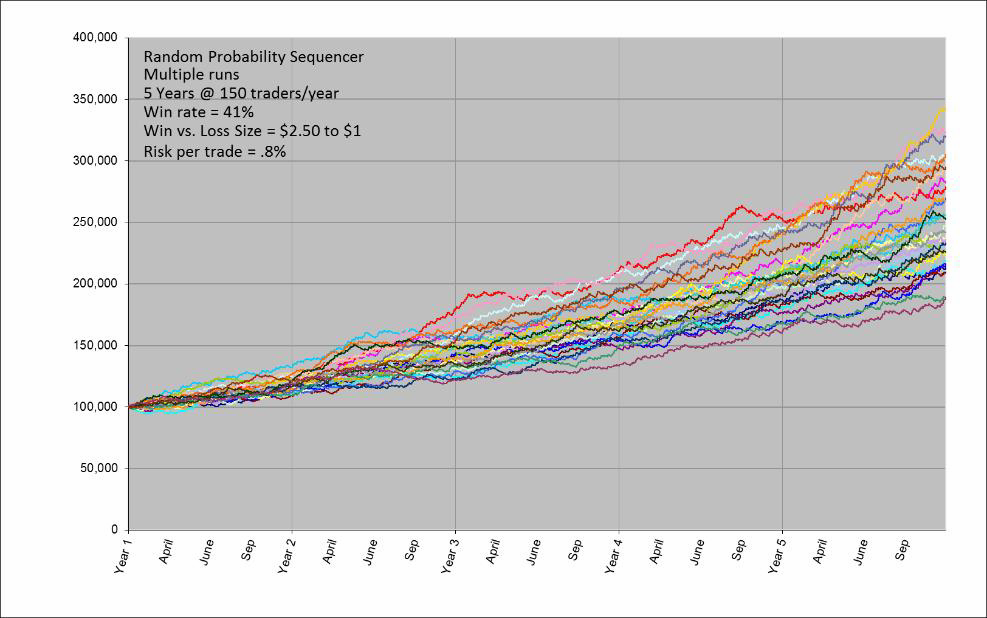

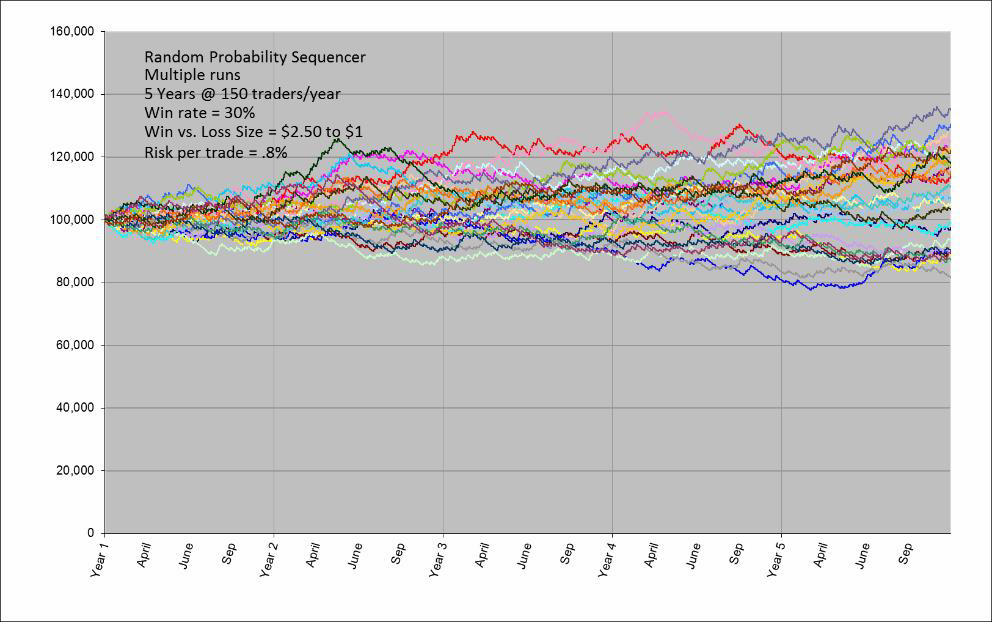

While risk management is far more important than trade selection, all other things being equal the performance metrics of being right 30% of the time are far different than the performance metrics with a 41% win rate (Factor’s historic baseline).

An exercise in sequencing

Shown (below) are 30 random sequences of 5-year outcomes (shown as NAV curves) based on Factor LLC’s historical benchmark trading metrics (at a win rate at 41%).

Shown (below) are 30 random sequences of 5-year outcomes (shown as NAV curves) based on Factor LLC’s historical benchmark trading metrics with one change – lowering the win rate to 30% which has been my experience with diagonal chart construction.

In summary, trading diagonal chart construction (in contrast to horizontal chart construction) produces significantly lower trading performance and most likely adds frustration to the lives of those traders who use diagonality in their signaling and opinion-forming processes.

A final word – if you as a trader have found a way to profitably trade diagonal chart construction, including trendlines, then I honor your achievement. It is not my desire to be the benchmark by which other traders are measured.

plb

###

Factor Membership

.

Peter Brandt is a 40+ year veteran of trading. Through his Factor Service, members receive:

.

View your Factor Member options here. You could consider your membership in the Factor Service as just one more trade. If the Factor Service is not of value to you, well, it is just one more trade that did not work. Through the Factor Service I endeavor to alert novice and aspiring traders to the many pitfalls you will face – and to offer advice on overcoming those pitfalls. My goal is to shoot straight on what trading is all about. For more information watch my 30 minute webinar where we cover the Factor service in depth.

I hope you will consider joining the Factor community.

.