For Premium Members Only

Factor Alert – NZD/JPY

/by Peter BrandtThis is a forex cross I have been watching for the past four months.

The cross has remained in a broad trading range of 45.00 (means 45 Yen per NZD) to 96.00, as shown on the monthly graph.

Read MoreFactor Update – April 3rd

/by Peter BrandtThis content is for members only

Factor Alert – March 30th

/by Peter BrandtFactor Alert - March 30th

Note: Report publish to current members (Feb 29th).

There are a few charts of interest developing this week.

New Zealand Dollar. This chart appears to be completing a common bottom on the weekly and daily graphs. A decisive close above the Oct 2015 high would complete this base area and establish a target of .7470, although resistance should be expected at the Feb 2015 low of .7147. This is a possible Factor Move.

Read MoreFactor Report – March 27th

/by Peter BrandtFactor Update, March 27, 2016

Note: Due to our Easter Holiday schedule this is an abbreviated Factor Update with limited coverage of the markets under review by Factor LLC.

Market ReviewFactor Moves are currently ongoing in: |

|

| · Japanese Yen | · Crude Oil |

| A Factor Move was completed or terminated in Gold, Silver and USD/NOK. A Factor Move is developing in USD/SEK and AUD/NZD. This issue of the Factor also comments on the Soybean complex, Sugar, Gold, AVGO and global stock indexes. Also included in this Update is commentary on the process by which we throw in the towel on a trading position. | |

Factor Update, March 20, 2016

/by Peter BrandtGeneral Market Commentary

Not all market environments are equal. Similarly, the same market environment can treat different trading styles in very different ways – some favorably, others miserably. The current markets, in my opinion, are neutral/hostile to classical charting principles. Current markets are volatile; false and premature breakouts have increased in 2016 to date; and, there is a lack of substantial patterns under construction. I have experienced this type of trading environment before – many times. There are profits to be had in some markets, but there are also an oversupply of land mines. For me, this type of trading environment has not correlated well with a robust three-month forward ROR. Of course I will continue to take signals that are promising knowing that sooner or later markets favorable to classical charting will return. Warning: I generally ignore one-day price action, preferring area patterns. Yet, nearly every market discussed in this Update experienced a narrow real-range bar on Friday that occurred at or just below the close of Thursday’s wide range day. This development suggests the possibility of a shake out next week. According, I enter next week in a very defensive frame of mind.Market Review

Read MoreHodge-Podge

/by Peter BrandtThe last Factor Update commented on a possible bottom in Soybeans based on a H&S bottom on the continuation graph (most active contract roll).

A close above 900 would, in my opinion, complete this bottom. It is unfortunate that the charts of the individual contract months do now show the precision of the continuation graph. This chart illustrates the reasons I far prefer a flat or horizontal neckline. Even though the neckline as drawn may be violates, the left and right should highs remain as serious resistance points. Thus, even though the H&S pattern might be completed with a neckline breakout, the market remains in a trading range.

Read MoreFactor Report – March 13th

/by Peter BrandtMarket Review

Factor Moves are currently ongoing in:- Gold

- Japanese Yen

- USD/NOK

- Copper

- AUD/NZD

Factor Moves in Progress

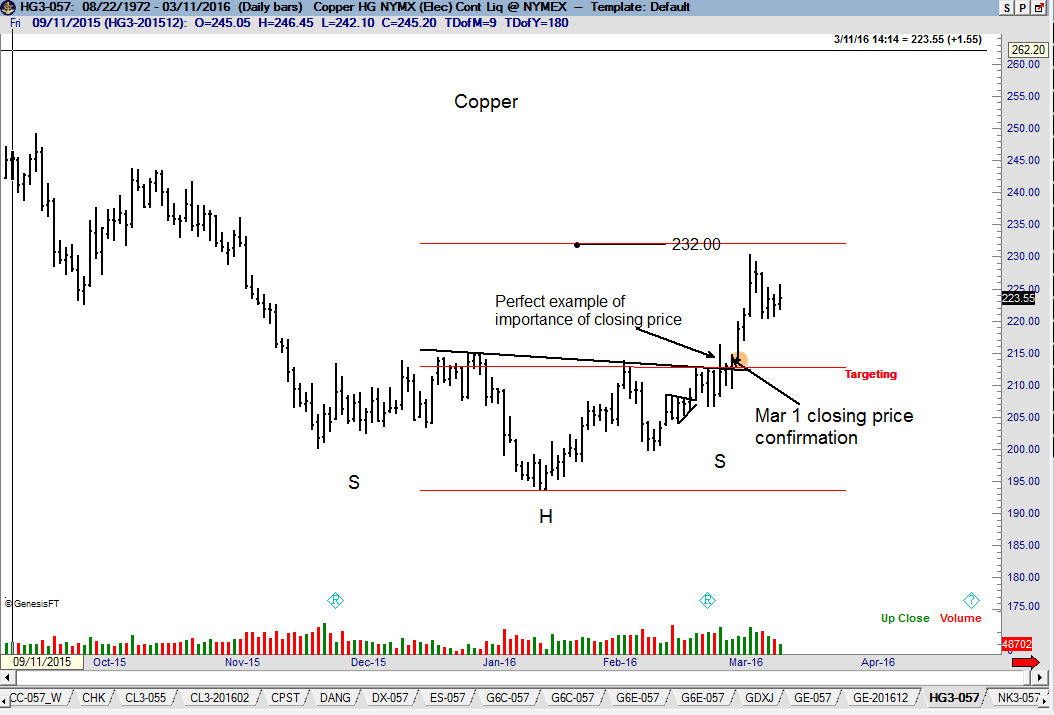

Copper (daily chart)

After falling from a high of 465 in Feb 2011, it appears that Copper bottomed at 193.55 on Jan 18. The advance on Mar 1 confirmed a H&S bottom. I have upped the initial price target to 231.90. An eventual test of the Oct 2015 high at 244 is likely. Factor is long one layer. Read More

Read MoreFactor Trading – March 6th Report

/by Peter BrandtMarket Review

Factor Moves are currently ongoing in:- Gold

- Japanese Yen

- USD/NOK

- Copper

- GBP/CAD