Chart of the day — JP Morgan

/by Peter BrandtCharts I am watching for this coming week

/by Peter BrandtS&Ps – possible wedge top?

/by Peter BrandtMeasuring gap in S&Ps targets 1910

/by Peter BrandtThe technical case for another advance in the Nasdaq index

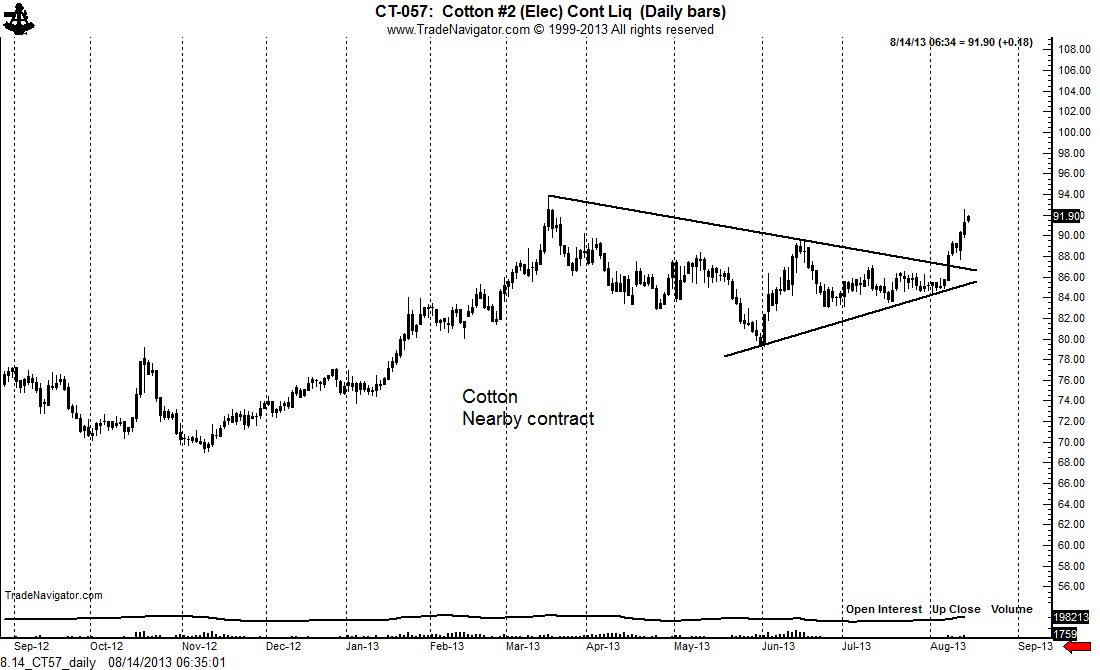

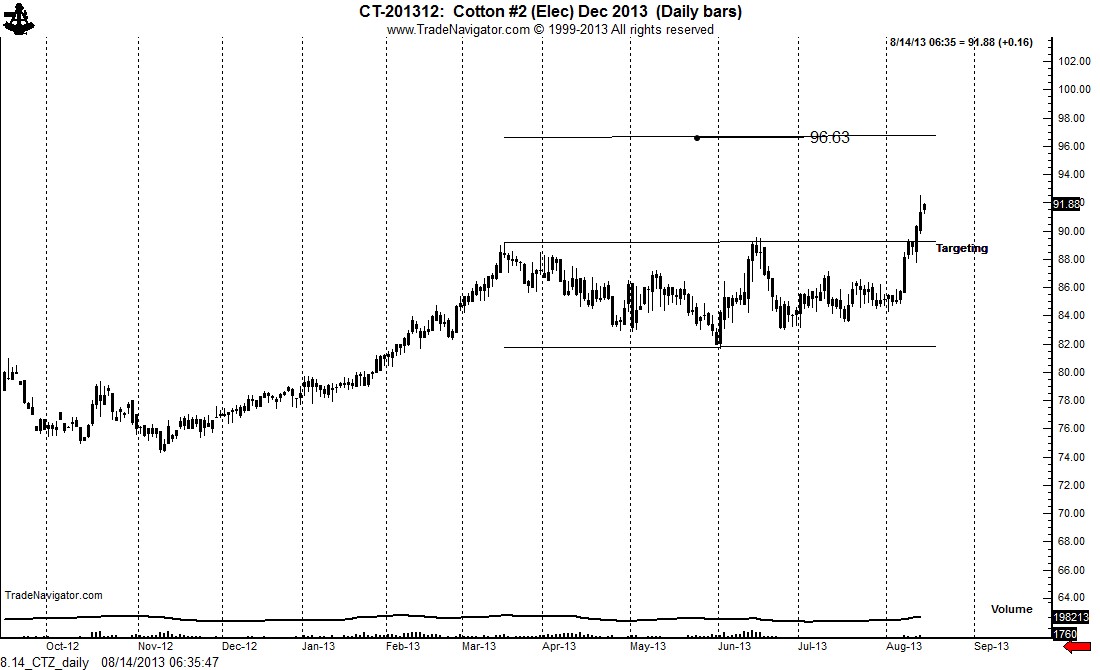

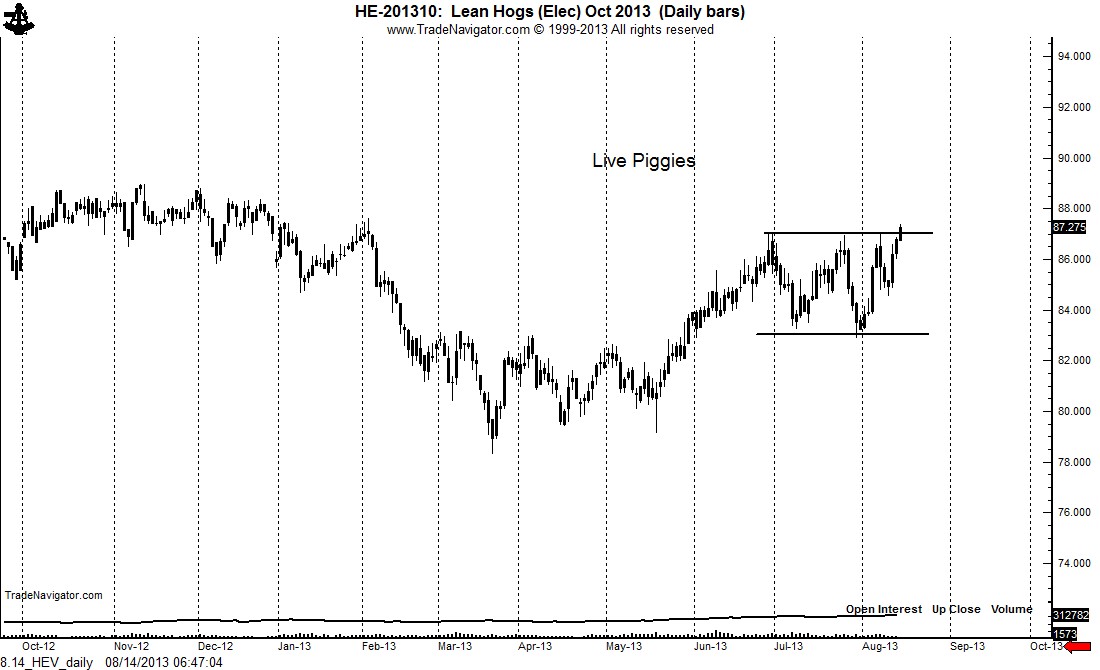

/by Peter BrandtCharts of the day – August 14, 2013 (Hogs, Cotton)

/by Peter Brandt

The nearby continuation chart in Cotton completed a 4+ month continuation triangle on August 7. The December contract completed a continuaition congestion on August 12, confirmed on August 13. Many traders fear buying a market that has already broken out — instead, they often get chopped up within a trading range attempting to get positioned before the breakout, then they miss the move when it happpens. Any period of weakness in a strong advancing trend is a buying opportunity.

The October Live Hog chart is attempting today to complete a 7-week rectangle. A strong close today would complete this pattern and serve as a buy signal. However, the failure of the market to breakout convincingly would be a cause for concern for long position holders.

$HE_F, $CT_F

###

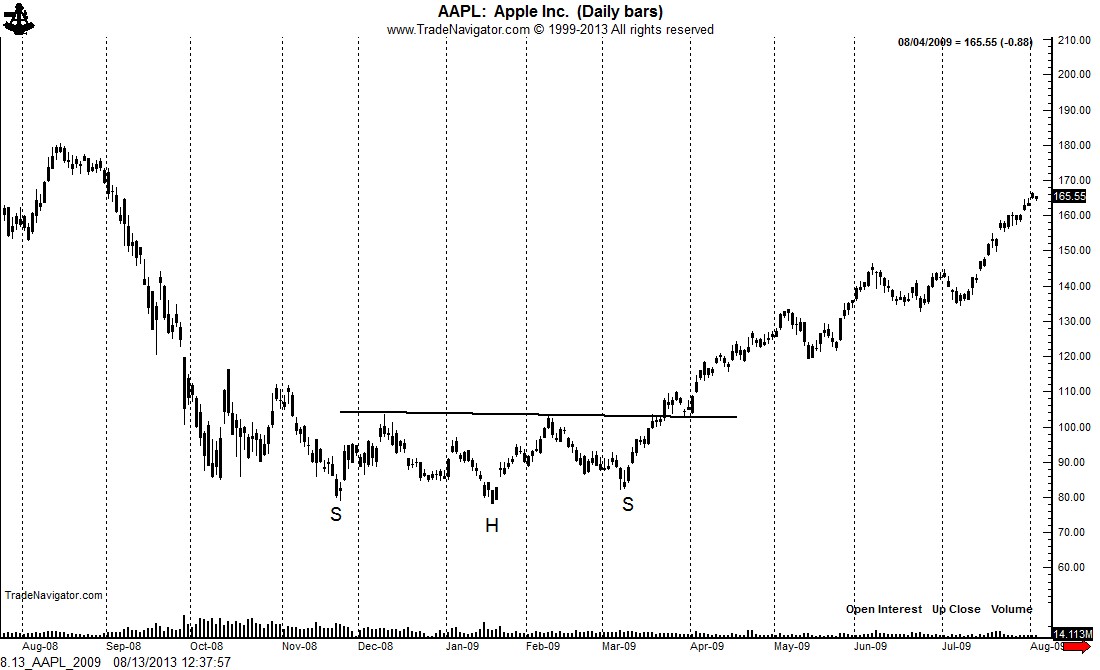

Apple and a history of head and shoulder patterns

/by Peter Brandt

The H&S pattern has served an important role in the turning points of $AAPL in recent years

The H&S pattern — when properly identified — is the most reliable of all classical chart patterns. Unfortunately novice market analysts are way to quick to mislabel market action as a H&S configuration.

The H&S pattern has served as the key turning point in $AAPL since the March 2009 low. The first chart below shows the classic H&S bottom completed in March 2009. This pattern launched a $600 rally.

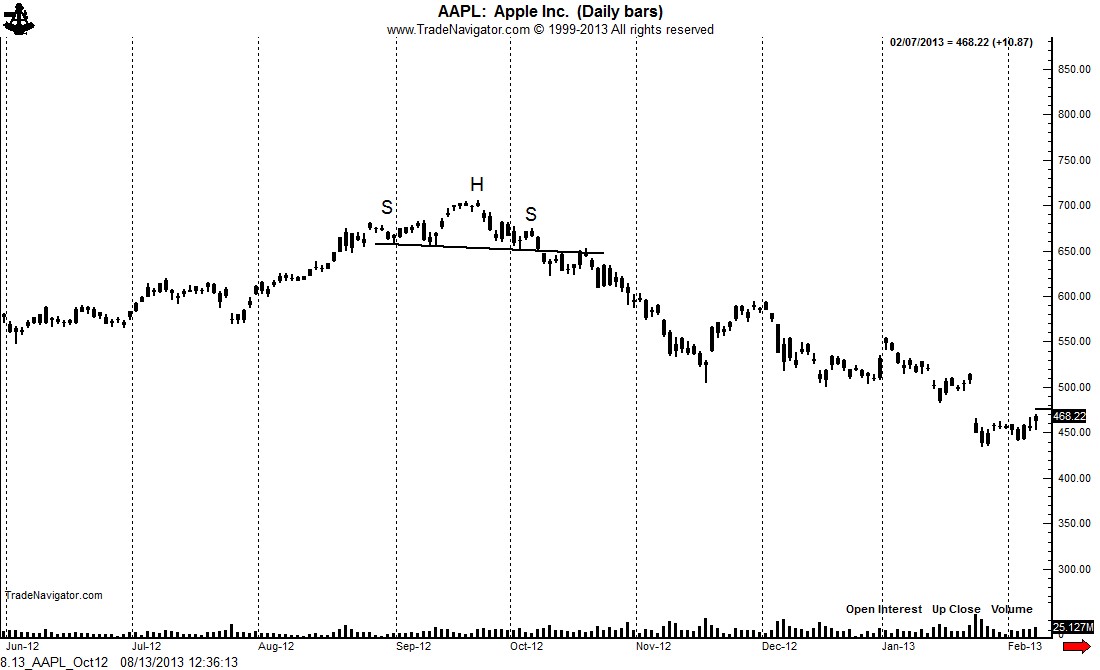

The late 2012 top took the form of a small H&S top. It is not unusual for H&S tops to be brief, whereas H&S bottom patterns tend to be much longer in duration.

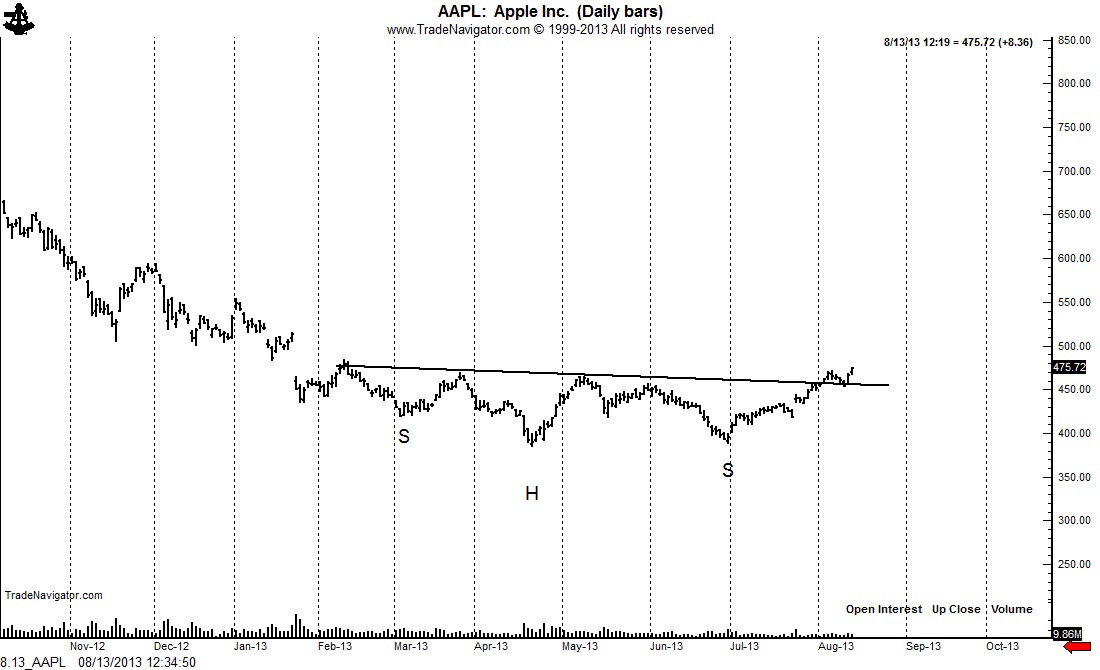

The rally in AAPL today confirmed a 6-month H&S bottom. It appears as though the long-term bull trend in AAPL has re-emerged. The intial target of this pattern is $545. A close below $425 would negate this interpretation.

$AAPL

###