Bitcoin — a once in a lifetime trade, never to be equaled

There has never been and may never be another market like Bitcoin $BTC

2024 is my 50th year anniversary of the first futures market trade of my life — it was for contracts of bags of pre-1964 Silver quarters and dimes. https://www.nytimes.com/1971/04/02/archives/futures-in-silver-coins-traded.html

I have traded a best-guess 35,000-plus futures contracts in my life covering everything from Corn to Gold, treasuries to Copper, Sugar to Palm Oil, Lumber to Cattle, stock indexes to shelled eggs, Iron Ore to Idaho Potatoes.

I can say with no pause that there has never been a market like Bitcoin. Sure, some of you ask, but what Alt-coins and memes? Well, these proliferations owe their existence to Bitcoin.

What makes Bitcoin so unique? There are two things I point to:

- The nature of the asset itself – non-hackable (at least so far), limited quantity, globally accepted, trackable, almost instantly transactional

- The price behavior of the asset

This blog post focuses on the second point above — the price discovery history of Bitcoin. Here are the unique features not attributable to any other asset I can identify.

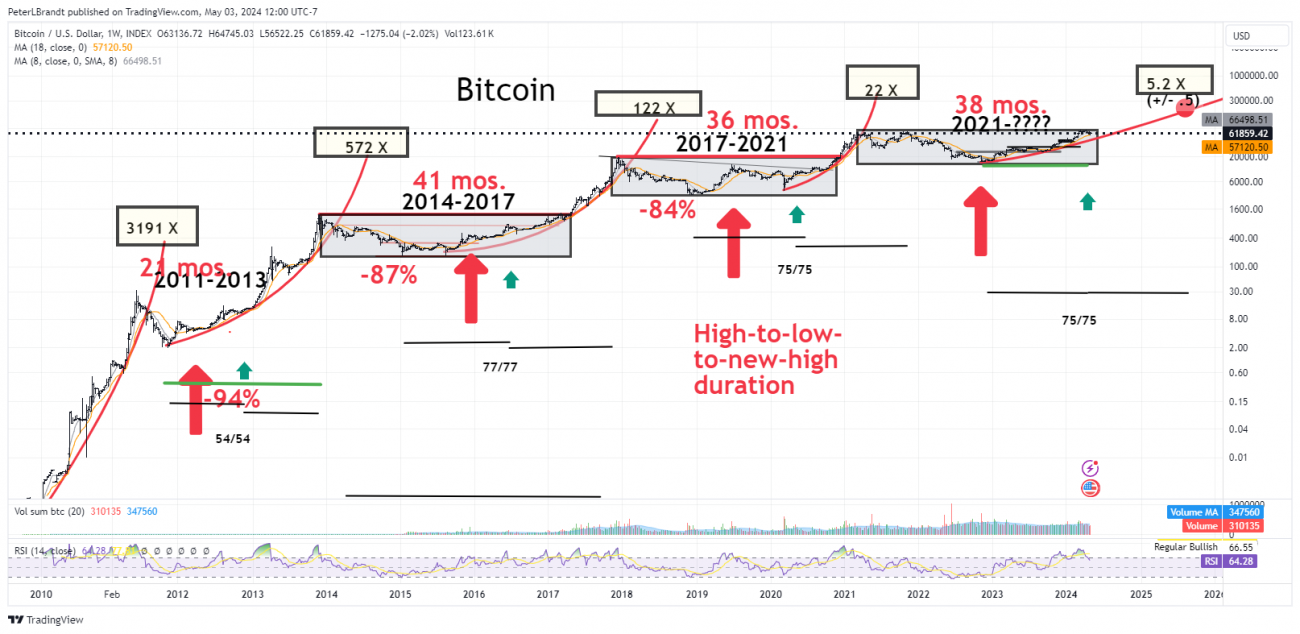

Repeated multiple X price advances. Just to name them:

-

- 2009 to 2011, 3,191 X advance

- 2011 to 2013, 572 X advance

- 2015 to 2017, 122 X advance

- 2018 to 2021, 22 X advance

- 2022 to ????, 4.7 X advance to date

Even though Bitcoin’s advances have been subject to exponential decay, the advance still put Bitcoin in a class by itself.

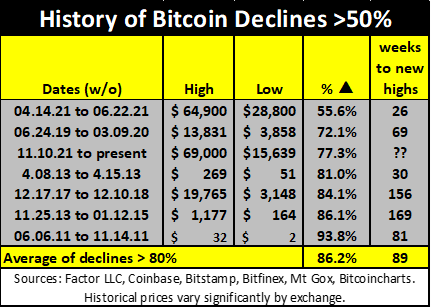

The other price behavior feature is the magnitude of the bear market crashes between the multiple X advances. There have been at least seven declines in Bitcoin larger than 50% and six grater than 75%. Thus, Bitcoin has a unique feature of making some people a huge bundle and wiping out another cohort.

The chart below is a graphic representation of the above. Not only have the major advances in BTC been according of parabolic nature, but of parabolic on log scale. I can find no other stock, commodity or publicly traded asset that can make the same claim.

What’s next for Bitcoin? Who knows. I am in my late 70s and of poor health, so I am unlikely to witness the end of the Bitcoin story. But I have no doubt but that excitement and surprises are to come. I remember that the stock market of the 1980s was the era of hostile takeovers of corporations. Bitcoin represents an attempted hostile takeover of the world’s currency system. What an exciting story to follow and take part in. I feel privledged that I’ve been able in some small part to have taken part in this grand experiment.

End