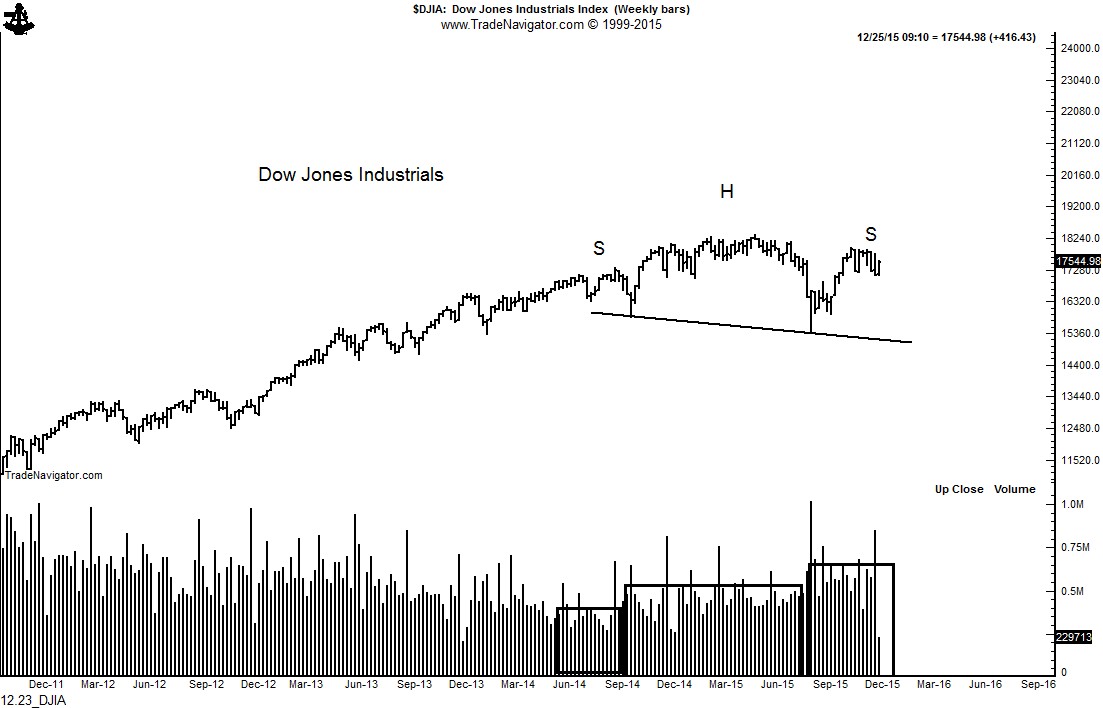

Is the present decline in the S&Ps a déjà vu of 2011?

Examining the chart structures of 2011/2012 with the present period

Classical charting principles at the core represent analog analyses -- that certain price patterns tend to repeat over time with slightly different variations.

An interesting analog situation has developed in the S&Ps. Some technical analysts have declared that the current market construction is analogous to 2011/2012 and will be similarly resolved by a continuation of the dominant bull trend. I completely disagree.

Let’s examine the construction components of each period. The top chart is the S&Ps during the 2011/2112 period. The bottom chart is the current market.

- Both periods had a textbook H&S top and, coincidentally, each top was completed in the month of August -- both marked as Stage 1

- Both periods quickly met the target of their respective H&S top patterns only to develop a period of extreme volatility -- both marked as Stage 2

- Both periods then rallied sharply back into the price zone of the initial H&S top pattern only to develop an other range of volatility -- both marked as Stage 3