Silver: Going According to the Script – DOWN!

The markets whip me around often enough that I will take credit when I make a correct call…and my next call for Silver is DOWN.

Every once in a while a trader gets “in-step” with a market. And when that happens, a trader needs to ride that horse until the first time the horse bucks the trader off. At that point the trader needs to dust him or herself off and find a new horse.

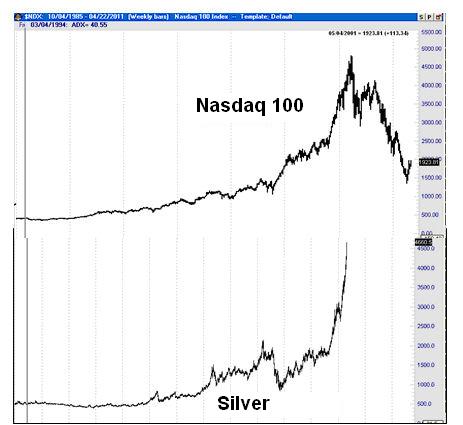

On April 24, I posted the blog, “How do you spell bubble?…SILVER!” A chart included in the posting is shown below. In the posting I stated that the market was within weeks or even days of a major top. In fact, the high had already been made on April 25. On April 28 the market tested the high and the subsequent decline was historic.

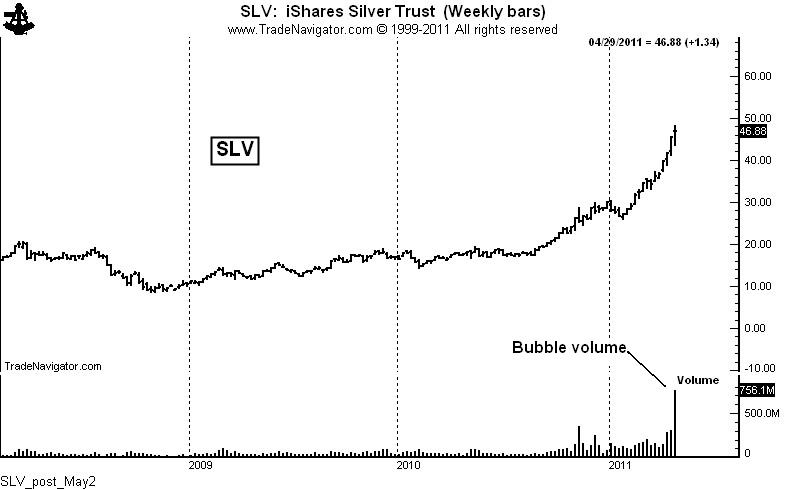

On May 1, I posted the blog, “8 years of global Silver supply changed hands last week.” My conclusion was that a major distribution of ownership had occurred from the strong hands to the week hands. The chart I included in the post is shown below. The next day, May 2, Silver droped $5.65 per ounce at its low.

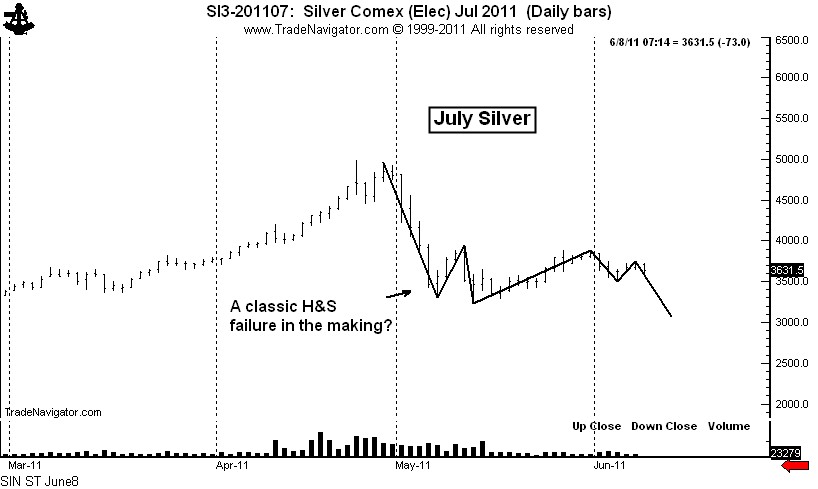

On May 10, I posted the blog, “Silver – What’s next short-term?” The chart from the post is shown below. My conclusion was that Silver would drop to new lows for the decline, then rally into the low 40s, then drop sharply.

I was correct on projecting new lows for the decline, but I think I was wrong on forcasting the rally into the low 40s. Earlier this week I posed the possibility of a 4-week H&S bottom with an extended right shoulder. While this is still a possibility, my preferred interpretation is that a H&S failure will occur. Extended right shoulders should generally cast doubt upon a H&S interpretation.

A H&S bottom failure occurs when:

- The pattern is briefly completed, but the advance immediately terminates and the trend preceeding the H&S bottom returns, or,

- A right shoulder rally falters short of the neckline and prices fall below the existing right shoulder low, completing the H&S failure pattern. [Note: I consider the H&S failure to be a pattern unto itself.]

The current chart of July Silver is shown, highlighting an idealized H&S failure.

I want to conclude with two points. First, neither the H&S bottom nor the H&S bottom failure have been completed. This market remains anyone’s guess. Charts are constantly evolving with one pattern morphing into the next, into the next, into the next, and on and on it goes. The real value (arguably, the only value) of charts is they provide traders with trigger points containing favorable risk/reward relationships.

Second, I am flat but would go long if the H&S bottom is completed or short if the H&S bottom failure is completed. Either event would be a tradeable signal for me. My bias is that the H&S failure will occur. The H&S failure formation would have a pattern target of 28.52 and a swing target of 21.58.

If the market continues to drift sideways in a choppy manner and then completes the H&S bottom, the chances are great that the H&S bottom completion will be a giant bull trap.

###

Leave a Reply

Want to join the discussion?Feel free to contribute!