Clues from the Treasury Markets

Interest rate markets

U.S. interest rates have experienced a generational low. The long-term trend is toward higher rates (lower prices).

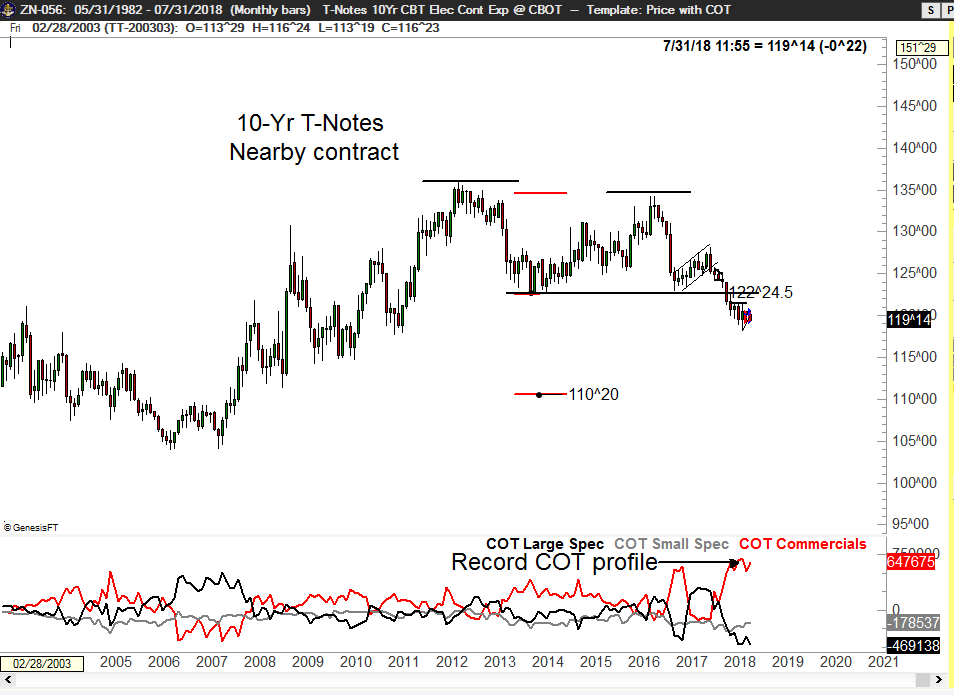

Treasury Markets – T-Notes

The COT profile is at all-time record extremes in terms of Commercial long and Spec short positions. The daily chart displays a 6-month bottom. While I am a long-term bear on Treasury prices (bull on yields), the COT profile and daily chart suggest a sharp rally could be in the works. I will monitor this market for a buying opportunity.

A rally by the nearby contract to 122^24 would retest the double top on the monthly graph.

Treasury Markets – T-Bonds

A rally on the monthly futures graph to 148^00 would be a retest of the overhead H&S pattern. The daily chart displays a possible inverted H&S bottom. This chart would suggest an advance to 152^00 – and that would go a long way to negate the H&S top on the weekly graph. The monthly T-Bond yield chart (next page) shows that the multi-decade channel remains intact.

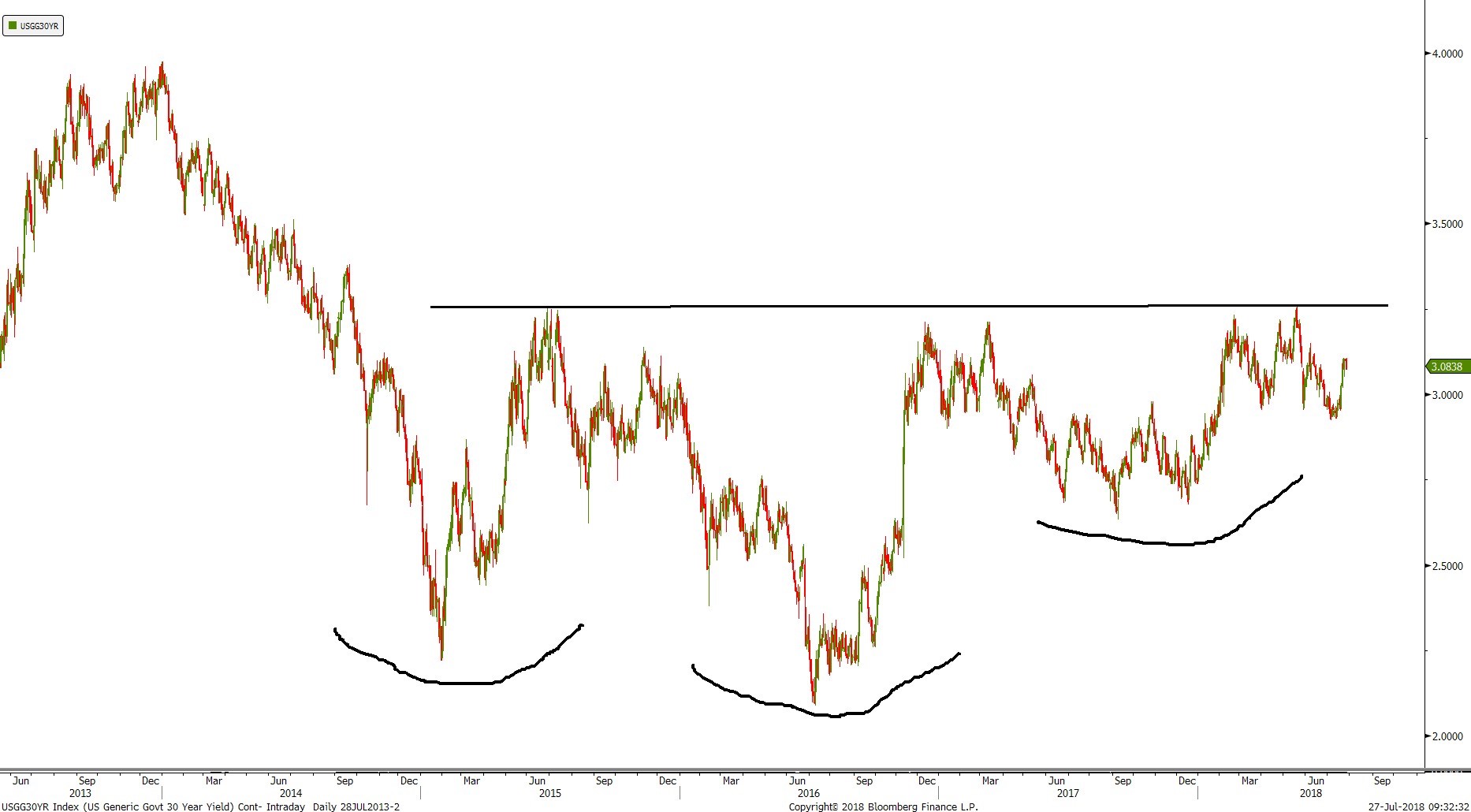

The weekly yield chart displays a massive H&S bottom pattern. Resistance in the 3.25% zone has repelled the advances. A 30-year Bond daily print of 3.32% would signal the start of a strong trend toward higher yields (lower futures prices).

Treasury Markets – Bond Yield Charts

.

Factor Membership

.

Peter Brandt is a 40+ year veteran of trading. Through his Factor Service, members receive:

.

View your Factor Member options here. You could consider your membership in the Factor Service as just one more trade. If the Factor Service is not of value to you, well, it is just one more trade that did not work. Through the Factor Service I endeavor to alert novice and aspiring traders to the many pitfalls you will face – and to offer advice on overcoming those pitfalls. My goal is to shoot straight on what trading is all about. For more information watch my 30 minute webinar where we cover the Factor service in depth.

I hope you will consider joining the Factor community.

.