U.S Stocks Look Promising

Russell 2000

U.S Stocks look promising, with the Russell 2000 appears to be leading the upward parade. The Factor is long this market as of last Wednesday. The daily chart of the Russell 2000 ETF (IWM) is shown below after a breakout this past week that was promising.

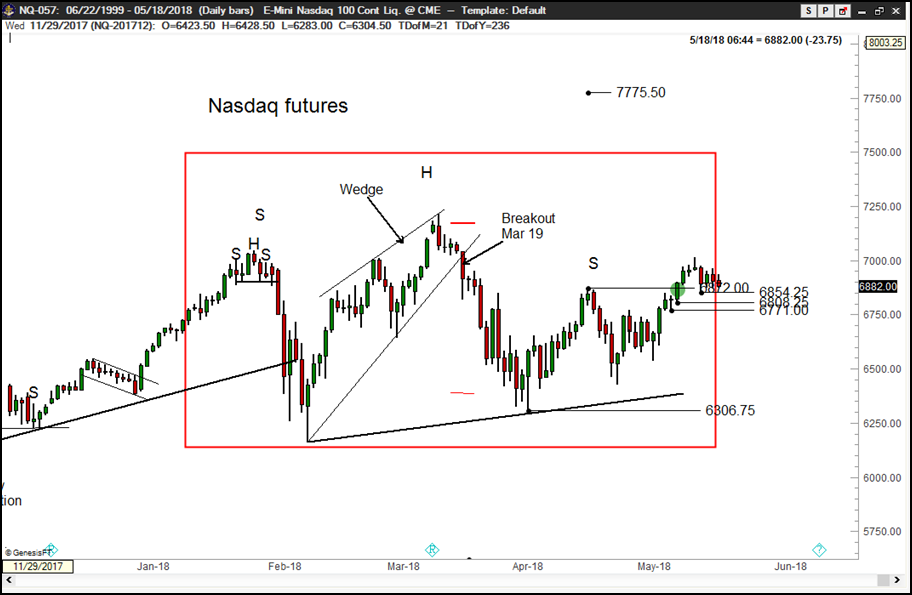

NASDAQ

A 4+ month H&S failure pattern has been completed. The upside target – if the interpretation is correct – is 7775. Factor is long the ETF (QQQ) using this past week’s low for protection.

S&Ps

The daily chart of S&P futures displays a giant 16-week symmetrical triangle. The S&P chart is much weaker than the charts of the Russell or NASDAQ. For this reason the S&Ps represent the best candidate for a short trade. The price bars on Tuesday, Wednesday and

Thursday formed a potential bearish Hikkake pattern.

[See https://en.wikipedia.org/wiki/Hikkake_pattern. Long-time friend and Factor member Dan Chesler is recognized as the father of the Hikkake pattern.] I will pay close attention to the S&Ps early next week. I will consider a short trade if a measured risk point can be identified.

Factor Membership

.

Peter Brandt is a 40+ year veteran of trading. Through his Factor Service, members receive:

.

View your Factor Member options here. You could consider your membership in the Factor Service as just one more trade. If the Factor Service is not of value to you, well, it is just one more trade that did not work. Through the Factor Service I endeavor to alert novice and aspiring traders to the many pitfalls you will face – and to offer advice on overcoming those pitfalls. My goal is to shoot straight on what trading is all about. For more information watch my 30 minute webinar where we cover the Factor service in depth.

I hope you will consider joining the Factor community.

.