Real Vision Interview: What Are the Secrets, Lessons & Wizardry of Great Traders? – Peter Brandt interviews Jack Schwager

/by Peter BrandtThoughts on a Weekend Afternoon, November 21, 2021 (issued November 19)

/by Peter BrandtThoughts on a Weekend Afternoon, November 14, 2021 (posted Nov 13)

/by Peter BrandtSpecial Alert — U.S. Dollar Index, November 10, 2021

/by Peter BrandtThoughts on a Weekend Afternoon, November 7, 2021

/by Peter BrandtThe Monthly | Blog Edition | October 2021

/by Peter BrandtA glimpse inside the Factor Member Portal

From the just-completed month

October Numbers

- Private Member Tweets: 127

- Posts on the Member site: 9

- Videos/interviews: 1

Snippets from Thoughts on a Weekend Afternoon

Peter’s thoughts on the finished week and the week ahead | Issued most weekends

An introduction on Risk Management (Oct 17th Report)

“Also fortunate, I suffered paper cuts and avoided any gashes. It is the gashes that can take a trader out of the game. I closed 10 tranches this past week at an average loss of 18 basis points or a total loss of 181 BPs (1.8% of total capital). Interestingly, minus 18 is my average tranche loss dating back to the start of the Factor Service in 2014.

An interesting irony exists. My observation is that most novice/aspiring traders hate taking small losses out of worry that the markets in which they are stopped will turn around and go their way. Yet, an unwillingness to accept many small losses actually leads to some really big losses – and it is the big losses that badly end a trading venture.

Taking my pick between taking many small losses only to be flat when some anticipated moves occur on one hand and taking a few inevitable huge losses on one hand and my choice is easy – I will take the small losses even if it means missing some big moves because I was stopped out prematurely.

Factor members, your policy on taking losses – BIG or small – is the most important decision you must make regarding your trading operations. “

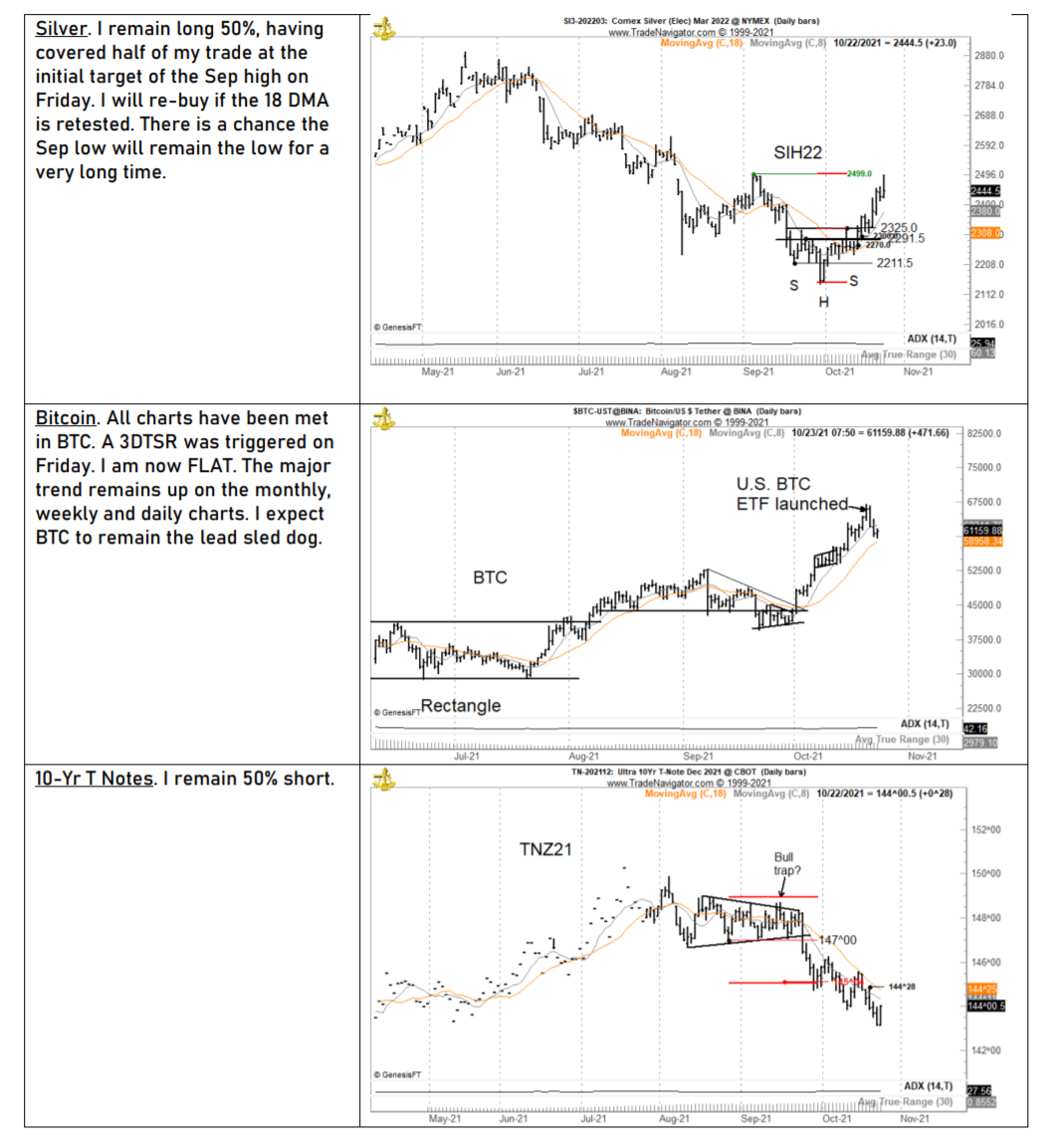

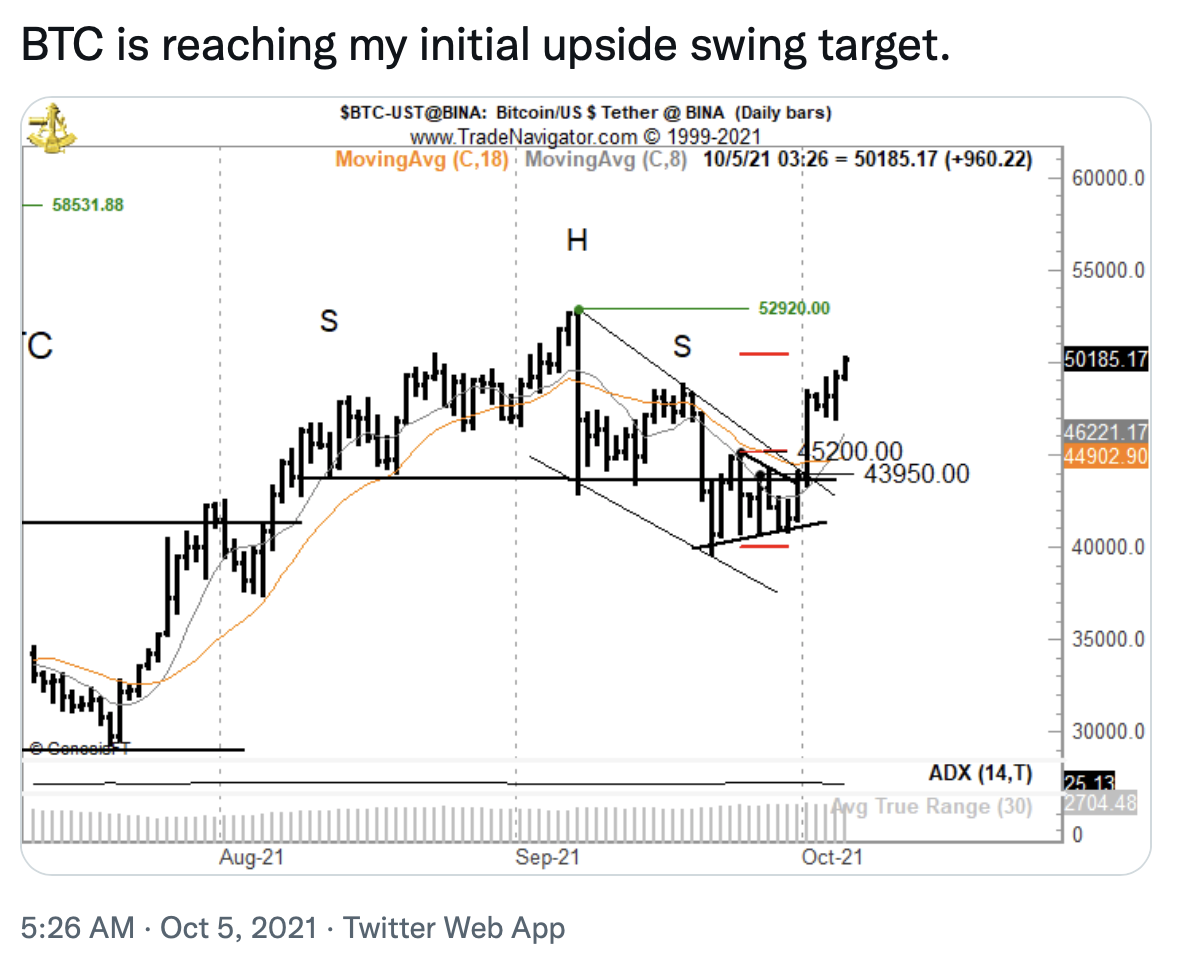

Some Chart/Trade Ideas shared with Members (Oct 24th Report)

Factor Member Private Twitter

Top Five Tweets

Recommended Reading

Contains an affiliate link to our Amazon Store

Become a Factor Member

Members receive:

- Trading Commodity Futures with Classical Chart Patterns: A free PDF copy of Peter’s classic out-of-print book

- The Weekend: Thoughts on a Sunday (Weekend) Afternoon

- The Monthly: Issued monthly, will provide an overview of the completed month and highlighted member content

- Private Twitter Page: Real-time alerts on interesting charts and observations, member dialog, the process of trading, the human aspect of trading, and risk/trade management (streamed on the member site as well)

- Webinars: Periodic member-only webinars where Peter speaks about current conditions and fields member questions

- Knowledge Center: Fast and easy access to current and archived content from Peter’s extensive library of trading content

- Automatic notifications: Email and social media notifications are sent out when new content is published

- Factor Report Educational Papers: Periodic educational and instructional documents

View your Factor Member options here. You could consider your membership in the Factor Service as just one more trade. If the Factor Service is not of value to you, well, it is just one more trade that did not work. My goal is to shoot straight on what trading is all about.

I hope you will consider joining the Factor community.