Does the current CFTC COT Report forecast a decline in Gold prices?

/by Peter BrandtCFTC COT (Commitment of Traders) Report Forecast a Gold Decline?

In recent past, I have cited the CFTC COT (Commitment of Traders) report's record open interest by large specs and record short open interest by commercials as a possible negative for Gold prices. Never one to trust myself, I decided to dig deeper to find out if my claim held water.Do the CFTC COT data forecast a decline in Gold prices?

/by Peter BrandtAlways Consider Risk Management

/by Peter BrandtRisk Management

Recent events only highlight the importance of Risk Management. Late Thursday evening, and early Friday morning, I spoke by phone to many of the old-timers (some with near 50-year trading careers) in whom I have the highest level of respect. There was a universal consensus – we have never witnessed markets like those experienced over such a brief period of time. Even though I had almost no exposure, I stayed up into the late hours on Thursday evening watching in awe a broad level of volatility exceeding anything I can remember. There was, no doubt, some serious blood-letting. In the weeks ahead we will read and hear about some horror stories. More than one trading firm will announce bankruptcy. We will not hear about the hundreds of individual speculators whose accounts were destroyed.

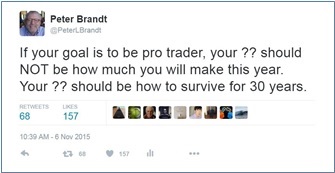

I want to revisit some of the themes I emphasize over and over and over again. Often times I feel that my harping on issues of Risk Management does not fully register with Factor members – especially newer traders who have not developed an adequate respect for market volatility.

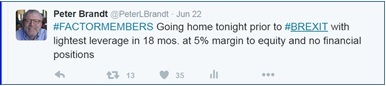

As a general rule, I pay little attention to news events and the release of government reports. My view of Brexit was quite the opposite. I had no desire to carry any positions in the financial markets into Brexit with the hunch that things could get wild. I could not have imagined exactly how wild things would get. In recent Factor communications I expressed the view that holding a trade into Brexit was gambling, not calculated speculation.

Several of my Factor members (see Premium option here) have asked me to clarify the difference between gambling and calculated market speculation. Hopefully you all now know the difference. In case the difference still evades you, try this on for size.

- In calculated market speculation, a trader has some certainty that risk can be predetermined and

- In gambling, a trader has no ability to predetermine and contain

Allow me to review a few important principles.

- Money management is job #1 for a trader.

- Keeping your pile of chips intact is the only thing that really matters at the end of the day. (Risk Management)

- If you think you know what a given market is going to do, you are only fooling yourself.

- Trading a market with expanded volatility but reduced liquidity is a demonstration of arrogant insanity.

- Being flat is a position.

- An obsession to always be in the market will lead to disaster – it is only a question of when.

- Being short volatility (short gamma) is akin to picking up pennies in front of a steam roller.

- Of what value is market analysis and trade selection once a trader has lost his or her trading capital.

The volatile outcome of Brexit should remain burned into all traders’ memory as a reminder of how much damage can be done very quickly. Having an excellent way to analyze markets … refining trade identification techniques … using leading edge trading technology … etc., etc., etc. … none of these things hold a candle to capital preservation in terms of importance. In the final analysis, the only thing that matters is surviving to trade another day.

Factor Membership is now available. You could consider your membership in the Factor Service as just one more trade. If the Factor Service is not of value to you, well, it is just one more trade that did not work. Through the Factor Service I endeavor to alert novice and aspiring traders to the many pitfalls you will face – and to offer advice on overcoming those pitfalls. My goal is to shoot straight on what trading is all about. For more information watch my 30 minute webinar where we cover the Factor service in depth.

I hope you will consider joining the Factor community.

##

Risk Management Quick Tips

/by Peter BrandtMember Webinar Recording

/by Peter BrandtBrexit Exit Polling by Hedge Funds

/by Peter BrandtBrexit Polling

Understanding global macro economics in 75 minutes

/by Peter BrandtNatural Gas Rising

/by Peter BrandtNatural Gas Rising

The dominant chart construction in Natural Gas is the completed 7- month H&S bottom on the daily graph (Oct contract). Note the appearance of a possible 6-day flag on the Oct chart. Factor is long Natural Gas and members were alerted of this buy with our premium reports section.

The chart of the soon-to-be nearby Aug graph displays a pennant, not a flag (see below). The difference is that a flag is a diagonal correction while a pennant is a horizontal correction. A pennant is more constructive than a flag. That the nearby Aug Natural Gas contract displays a pennant while the Oct contract displays a flag is a constructive indication – in my opinion, for whatever that is worth.

Factor Membership is now available. You could consider your membership in the Factor Service as just one more trade. If the Factor Service is not of value to you, well, it is just one more trade that did not work. Through the Factor Service I endeavor to alert novice and aspiring traders to the many pitfalls you will face – and to offer advice on overcoming those pitfalls. My goal is to shoot straight on what trading is all about. For more information, visit the home page here. Or watch my 30 minute webinar where we cover the Factor service in depth.

I hope you will consider joining the Factor community.

##

Recent Posts:

Primer: Interest Rates & The Fed (+FREE .PDF)December 3, 2025 - 8:30 pm

Primer: Interest Rates & The Fed (+FREE .PDF)December 3, 2025 - 8:30 pm Loss Aversion: A Mental Trap Every Trader Needs to KnowNovember 19, 2025 - 6:52 pm

Loss Aversion: A Mental Trap Every Trader Needs to KnowNovember 19, 2025 - 6:52 pm Three Day Trailing Stop (Video)October 24, 2025 - 5:25 pm

Three Day Trailing Stop (Video)October 24, 2025 - 5:25 pm One Year Later: GE, Classical Charting, and Avoiding Dead MoneyJuly 22, 2025 - 1:01 pm

One Year Later: GE, Classical Charting, and Avoiding Dead MoneyJuly 22, 2025 - 1:01 pm