Another update on the EURUSD January Effect

Composition of open interest is a story for the history books

Earlier this afternoon I posted a piece on the January Effect in EURUSD, posing whether today’s high (or the high in the next few days) will become the January Effect high or if the Jan 13 low will be the January Effect low (or if there will be no January Effect).

I did go home short $EURUSD at 1.3109 (spot). However, upon further study I am starting to believe that we have a January Effect low in place. I am employing a zero tolerance policy on my short position. If my position blinks wrong I am gone. With split stops, I am risking a net of 28 pips in the trade — the noise alone will get me. This is a hail Mary pass. I consider the risked amount as the cost of a ticket to a trading war.

There is an absolutely historic story to be told in this market regarding the composition of that open interest of futures contracts.

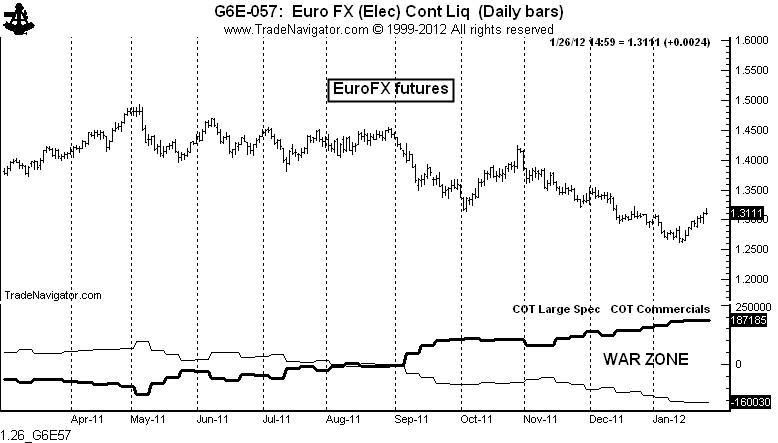

The graph below shows the EuroFX futures contract and the composition of open interest at the bottom (upper thick line is the commercials, lower thin line is the large spec). WOW!

Since early September (with the hype of the collapse of the EU) commercials have established a net long position of 187,185 contracts. That is equal to E23,4 billion Euros. Big number for the future market. The large spec has established a net short position of 160,030 contracts, equal to E20.0 billion Euros.

Folks, there is a war about to happen. This huge differential between the commercial and large spec will have to be unwound at some point. So, which group is going to blink first?

The obvious guess is that the commercial will win out in the end. But, it is not that easy. Since the May peak the commercial has gone from net short 124,000 contracts to net long 187,185 contracts, for a net purchase of E38.9 billion Euros. During that time the market has dropped from $1.480o to the present level of $1.3100. Anyway you count it the commercials have lost a ton of money and the large spec has an enormous open profit.

What we know are the COT data in futures. We do not know what is happening in the spot market — and spot forex is where the big dogs play. Does an imbalance exist in spot? If it does, is the imbalance in spot forex in the opposite direction, nulifying the futures profile. We don’t know.

What I think we can know is that there will be fire works. The liquidation of the current positons will be facinating to watch.

I am sure you can count as well as I can, but the commercials are out a TON of money in the EURUSD. There will be capitulation in this market — but I am not so certain the commercials will win, although I hate to bet against the them. I have seen markets in the past when the commercials have built up a massive position and have been wrong. I will try to look for some examples tomorrow if I have the time. When commercials are heavy in one direction and end up wrong, it is an ugly site.

Markets: $EURUSD, $G6E_F, $UUP

.

Leave a Reply

Want to join the discussion?Feel free to contribute!