AAPL Part 2 – How to build a fabulous risk/reward trade: 04.08.2011

The Apple is falling — time for the harvest?

I am a trader, not an analyst. Actually, being an analyst is a much harder job. An analyst is pressured to be right. As a trader, I assume I will be wrong 65% of the time. So my job is to find trades with a great risk and reward profile.

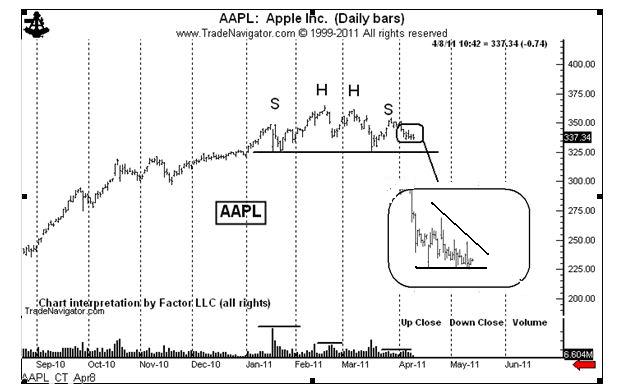

Apple Computer is a great real-time, right-now example of how I approach a trade. I believe that AAPL is building a classic H&S top. If this top works, the AAPL chart will be in the textbooks 50 years from now.

As a trader I want to limit my risk to 75 to 100 basis points per trade (e.g., no more than 1% of capital). So, I want to short Apple and risk no more than $1,000 per $100,000 of trading capital. I always think in terms of units of $100,000.

So, I go short today — 100 shares at 338. My risk is to 345, or a risk of $700 per $100,000. First layer is on.

I will short another 100 shares if the market can penetrate this week’s low and complete a small hourly chart flag. So I have an order to sell stop another 100 shares at 334.40. If I am filled I will risk my entire position to above 340 for a total risk of $750 per $100,000 on the 200 shares.

I will short another 100 shares if the H&S top is completed by a move under 322. I will then protect my entire 300 share position to just above 330. If I fill all three layers and get stopped out, I end up with a small profit.

So the bottom line is this: The most I risk by being a bear on Apple is 75 basis points. But what if I am right in my analysis and timing, and remember, a good trade has to be right on both counts? It is not good enough to be right on one component and wrong on the other. The H&S target for Apple is 285. If the market breaks out of the H&S top and does not have a deep retest, then travels to the target, I will have a trade that yields $14,200 or so per $100,000. I am risking 75 basis points to make 1420 basis points. That’s a risk of 3/4 of 1% to make 14%. I will take a trade like this every day. In fact, right or wrong on AAPL, this is exactly the type of trade I love to find. In fact, I should stop being a chart trader if I ingore Apple. As a trader, being right is secondary to making money. Being right is over-rated!

I think this trade has a good shot at doing what I anticipate. The reason is that nobody really thinks Apple can drop. Yet, it has declined nine out of the past 10 trading sessions, the 50 day MA has rolled over and the volume profile of the H&S pattern is absolutely textbook. It has not completed a top yet, but time will tell the story.

The AAPL is swinging in the wind from the branch. I will stand below the tree with a bushel basket.

###

Leave a Reply

Want to join the discussion?Feel free to contribute!