Next leg of Euro Currency bull trend against the British Pound begins

British Pound could drop significantly against the Euro

The Euro Currency Unit was first created in March 1979 as an accounting currency intended to stabilize exchange rates within Europe (although the idea of a central currency unit within Europe dates back to the 1930s). Officially the Euro Currency was born in January 1999. Great Britain has never joined the EU currency mechanism and thus the British Pound has floated against the Euro.

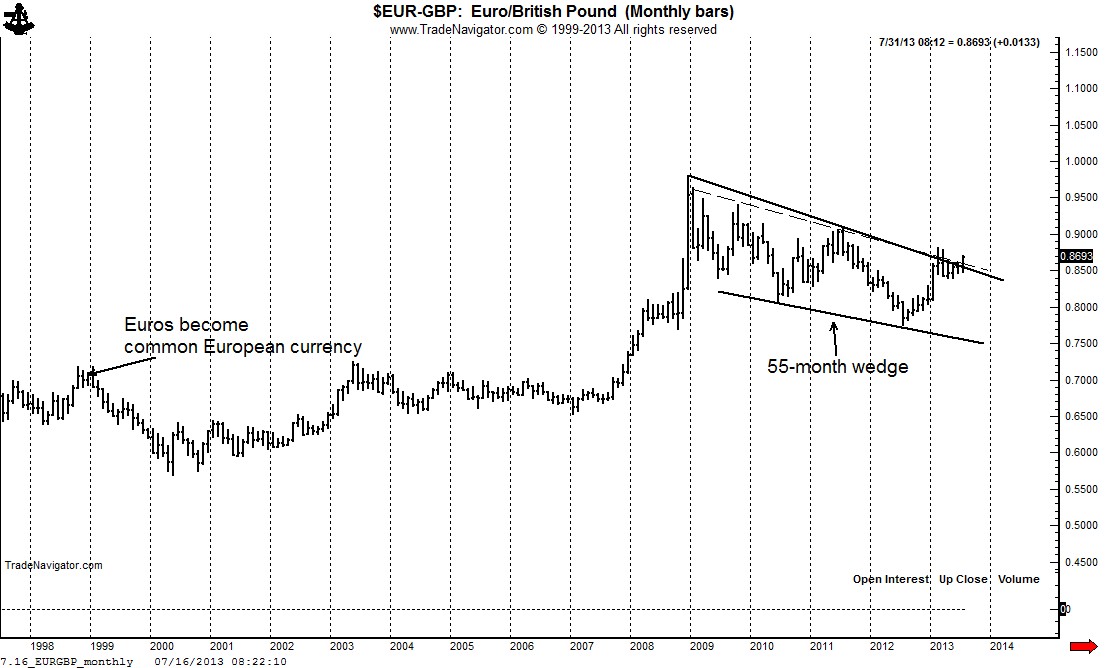

At its formal inception on January 1, 1999, the Euro traded at .7069 Euros per GBP. After bottoming at .5683 in 2000, Euros have been in a 13-year bull trend against the Pound. The charts would indicate that the Euro is embarking on another up leg against the Pound.

The monthly chart displays a 55-month falling wedge pattern. The dashed line represents the Friday closes. The forex cross is attempting to punch through the upper resistance boundaries.

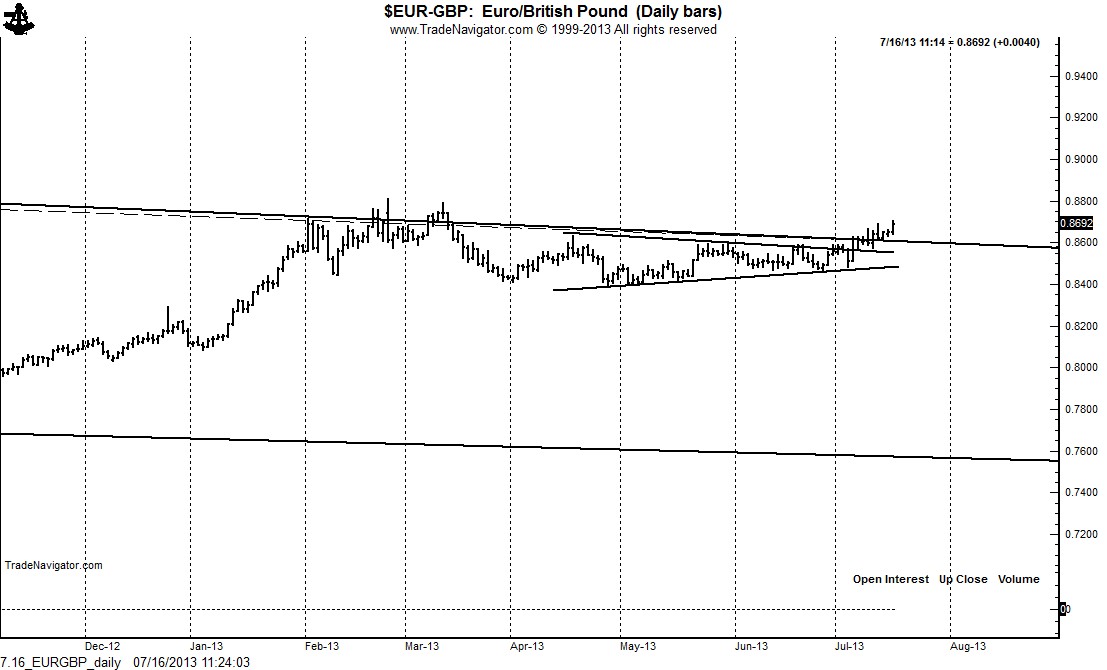

The daily chart below shows in more detail the current attempt to breakout of a multi-year consolidation. The advance on July 4 completed a 3-month triangle. The market has now cleared the boundary from the monthly orthodox highs (solid line) and the weekly closing prices (dashed line). EURGBP should work its way to .9600 in the months ahead. A close under .8550 negates this analysis.

$EURGBP