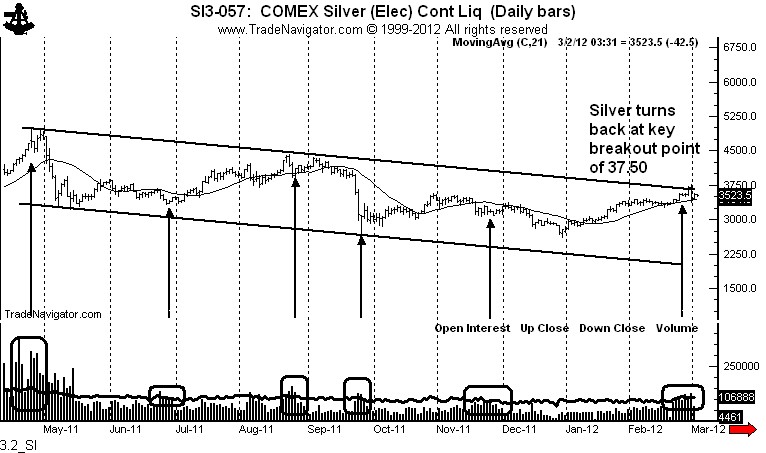

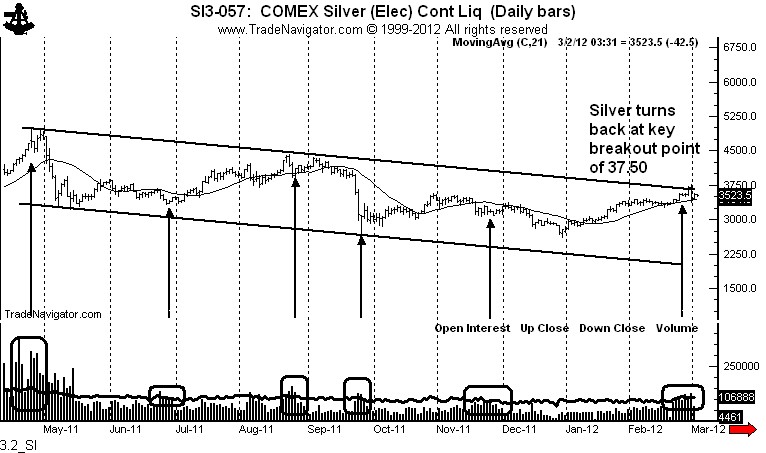

The volume in Silver this week will be the highest since the August top, second highest since the absolute top last April

An enormous slug of volume has entered the Silver market this week. In fact, by the end of trading on Friday the weekly volume will most likely be the highest tally since the August top. So, what does this mean?

Volume nearly always leads price in Silver. Silver trades must always be aware of the volume of trading at the Comex. Whenever the market gets hit with a slug of volume, traders need to ask themselves … “So what does this mean?” The record volume in late April allowed me to announce on this blog that Silver was a bubble and a top was being made. I announced the top on April 29. It was one of the easiest calls in commodities I have ever made. The tip off was volume. The volume and wrath of the hate mail I received after that call was tremendous.

The chart below shows that huge slugs of volume in the past year accompanied the April top, June bottom, August top, September bottom, and the sideways drift in November that resulted in a sharp but brief decline.

I have commented in recent days and weeks about the 10-month down channel in Silver. The market nicked the upper boundary of the channel on Tuesday and Wednesday, only to result in Wednesday’s sweeping key reversal.

While I continue to see the upside resolution of this channel as a strong possibility, the sweeping reversal on Feb. 29 and this massive volume are issues the market must deal with in the short- to intermediate-term. Could the slug of volume this week be part of the buying pressure accompanying the breakout of the channel? This is a possibility. But my guess is that the volume indicates the upside breakout may not yet be ready to occur. In fact, this slug of volume and a sweeping reversal off a key chart point is giving me pause. I know how much you Silver bulls hate it when I switch course, but markets are living and breathing entities that, like ladies, tend to change their minds.

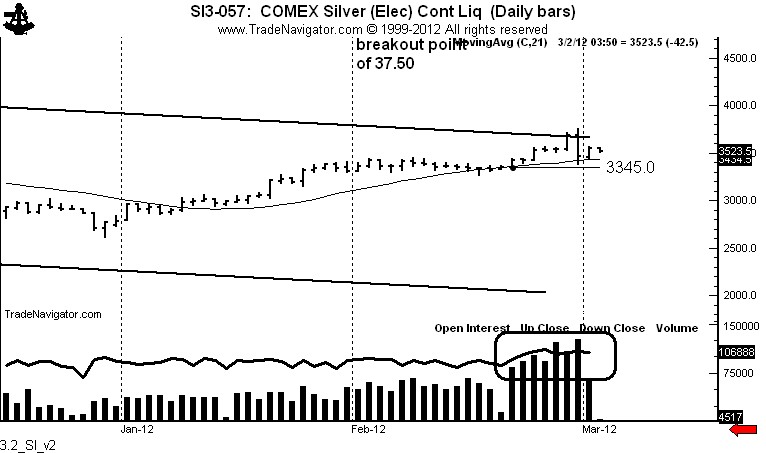

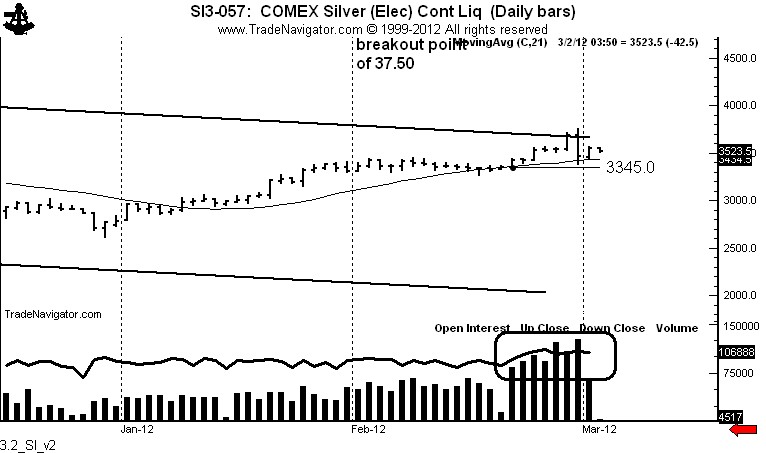

A blow up of the daily chart below shows off this volume more clearly. The huge volume entered the market starting Feb. 21. The low of Feb. 21 was 3345. It would be any decline below this price that would give real signficance to the volume slug during the past nine days — a close below 3345 would mean that the volume was distribution by strong hands and that everyone who bought Silver since Feb. 21 would have a loss.

Big slugs of volume in Silver cannot be ignored. Subsequent price action will tell us much about the next $5 move in the market.

Markets: $SI_F, $SLV

.