The health care system in the U.S. is 40% more expensive per capita than the next most expensive OECD developed countries

As a country, approximately 18.2% of our GDP is devoted to healthcare spending. Switzerland and France (#2 and #3) spend respectively 12.3% of 12.0% of their GDP for health care. The U.S. spends the second greatest amount of GDP for health care among all members of the United Nations, topped only by East Timor.

For its money, the U.S. obtains health outcomes that are near the bottom of the OECD rankings, and, in fact, rival some of the outcomes of Third World countries.

From extensive experience with the U.S. health care system as a medical patient, and in-depth research of the counterpart systems in other developed countries, I can confidentially say that by nearly every measure the U.S. is a failure.

Unfortunately, Obama Care from its very inception addresses few of the flaws within the U.S. health care system. In fact, if anything, the mandates of Obama Care worsen our nation’s health.

As the U.S. Supreme Court begins its hearings today on the constitutional challenge against Obama Care, I would like to share with you what I have experienced and learned during my 28 years of reliance on this nation’s health care system.

I find it beyond belief that the U.S. Supreme Court will pass final judgment using legal arguments on a health care system that has already been declared a failure on its own merit.

The remainder of this post summarizes my personal experience with the U.S. health care system and some vital statistics on its world class expensiveness and failed health outcomes.

My anecdotal experiences

On August 26, 1984, while sleepwalking at 2 AM, I took a “Peter Pan” onto a concrete slab 18 feet below the railing of the deck out our bedroom sliding door. That it was a rude awakening is an understatement. That I did serious damage to my spine is more of an understatement. I ended up in the hospital for 42 days and spent 6 months in a full hard body cast. In the process I needed to relearn the skills of walking and conducting many other routine aspects of living.

At the time of my accident I lacked health insurance. I paid every last cent of my medical bills during the ensuing two years.

During the past 28 years I have: (A.) navigated a burdensome and overly complex and health care delivery system; (B.) endured four major spine surgeries and countless radiological tests and other medical procedures; (C.) relied repeatedly on the false promises of big pharma; and, (D.) pursued numerous experimental and trial treatment protocols. In the process I have learned first-hand how difficult, complicated and expensive U.S. health care system is to navigate. Anyone reading this post whom has experienced an undiagnosed or complicated chronic medical condition knows exactly what I am talking about.

Of course, we hear everyday how the U.S.health care system is the best in the world. Nonsense! Our health care system is a patchwork created by special interest groups (especially “big pharma”) and political ideology, not by the medical needs of a nation. For relatively healthy U.S.residents, the American health care system is superb. But, get really chronically ill and you will find out what the octopus is really like.

Let the data tell the story

I was raised to believe that trees and plants can be judged by the fruit they produce. Good trees produce good fruit, bad trees produce bad fruit. I was raised to believe that facts speak louder than words. So, what are the facts related to the U.S. health care system

Costs

- The cost of the U.S. health care system is approximately $1.7 to $1.8 trillion per year, inclusive of all related costs, including litigation

- The U.S.spends approximately 18.2% of its GDP on health care related expenses

- The cost per capital in the U.S. for health care is approximately 40% to 50% higher than the next most expensive countries (Switzerland, France and Germany) and nearly double the average cost of 30 OECD health care systems

- Despite the present expensiveness of the U.S.system, nearly 50.7 million residents, or 16.7% of the population, are either uninsured or grossly under insured. By contrast, all residents of most other OECD countries are covered by health care insurance

- Medical debt contributed to 46.2% of all personal bankruptcies in the U.S.

Outcomes

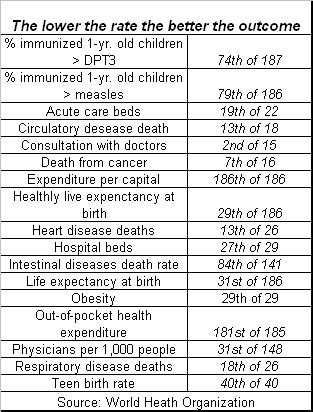

- Despite being the most tested, most hospitalized and most over-pharmaceuticalized citizens in the world, the U.S. health care system produces nearly Third World outcomes by nearly every measure

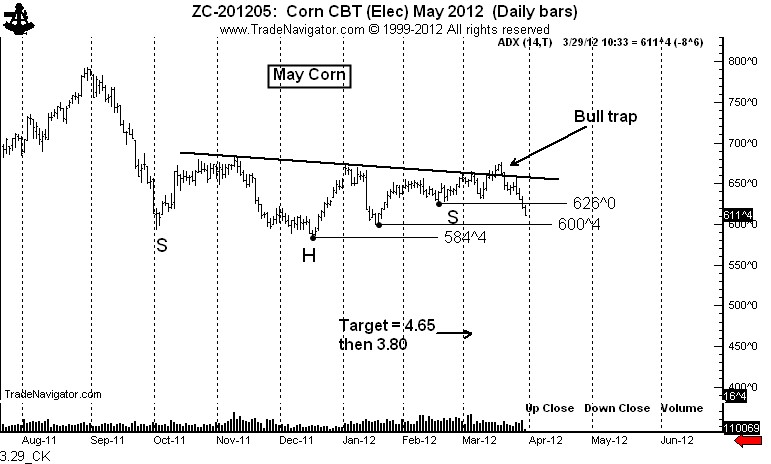

- The comparisons below rank the U.S.to all other countries that maintain apples-to-apples statistical data sets

- The World Health Organization ranks the U.S. system as the highest in cost, 37th in overall performance, and 72nd by overall level of health among 191 member nations included in a study

- The Commonwealth Fund ranked the U.S. last in the quality of health care among similar developed countries

There is nothing in the Obama Care model that will improve the cost/outcome performance of the U.S. health care system. NOTHING!

So, what works?

There are health care models that provide superior outcomes for far less expense (as measured on a percent of GDP basis or cost per person).

The consensus in the U.S. (especially among political conservatives) is that the Canadian and the U.K. health care systems are not the direction the U.S. should go. From my research, I agree entirely. But I disagree completely with my conservative brethren that the government should not play a major role in the health care system. In fact, I believe the U.S. government has a major role to “serve,” just not the role it is presently “playing.”

The countries with the most promising health care systems include Japan, Taiwan, Singapore, Germany, Switzerland, France, the Netherlands, and the Scandinavian countries. By all measures (cost and health outcomes) these countries smoke the U.S. And, contrary to what political conservatives say, the doctors in these other countries are not all trained at U.S.medical schools.

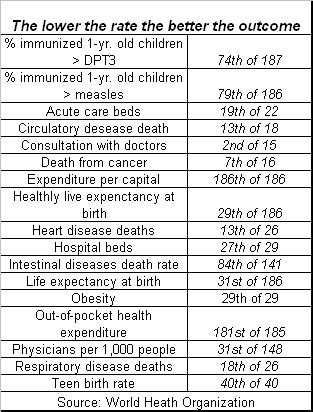

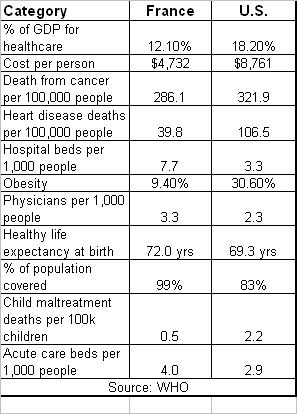

Yet, the majority of the countries cited above tend to be more racially, educationally, socially and economically homogeneous than the U.S. population. Except France! France has more diversity in these measures than the other comparative countries. While wide social, economic and racial diversity does complicate health care delivery to some degree, the problems with the U.S. model are systemic, foundational and political.

The French health care system, while far from perfect, is greatly superior to the U.S. health care system by most measures. It is unacceptable in politically conservative circles to compliment France for anything. Yet, data on the following table speak for themselves.

This harsh critique of the U.S. heath care system is by no means an indictment againts all health care services in this country. My personal search for sane, cost efficient and quality health care services was finally fulfilled when I first visited the Mayo Clinic in Rochester, MN. The Mayo and a few clinics like it, such as the Cleveland Clinic in Ohio, understand how to conduct cost-effective medicine and care for its patients. I applaud the Mayo. I owe whatever qualify of life I now have to the Mayo. I only wish I lived in southern Minnesota.

What few people know is that the Mayo and Cleveland Clinics, along with a few other providers who “get it” provided members of Congress with their own version of health care reform during the original debates. Their proposals and the cost savings they would have brought to this country were research based and verified by the Wharton School of Management.

Unfortunately, it was politics as usual and the Mayo model did not see the light of day in Washington.

Summary

It really does not matter how the U.S. Supreme Court decides on the issue of mandated health insurance. This component of health care is like a fly feeding on the carcass of a dead elephant.

The health care system in the U.S.has already been tried in the courts of “cost” and “outcome” and been found guilty on all counts.

Additional tables that tell the tape

These tables are based on slightly old data, but they still demonstrate the point.

[scribd id=86793940 key=key-24twhk1tjv9uw33hojyk mode=list]

#SCOTUS

###

.