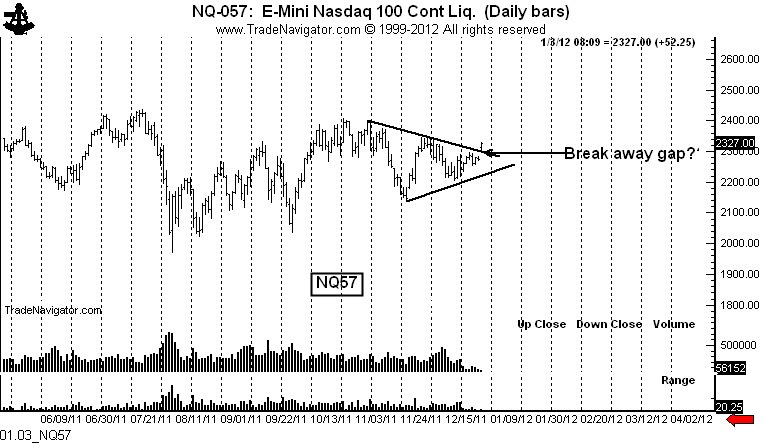

Nasdaq gaps through important resistance — a strong close and big volume will confirm the bullish development

The Nasdaq gapped through the upper boundary of a 4-week triangle early Tuesday. The market attempted a close the gap into the 8:30 AM time period (EST), but new highs have now been registered on expanded volume.

Importantly, the shorts are trapped. Due to CME trading rules, any open order buy stop priced below 2308 has NOT been filled. Shorts may be forced to chase the market in order to go flat.

Today’s close and volume will be important to judge the exact nature of the gap. If the market closes firm and volume is quite expanded ( would say more than 325,000 mini Nasdaq contracts), then there is a strong possibility the gap today is a breakaway gap.

Here is what Edwards and Magee say about breakaway gaps:

“Breakaway gaps also develop at times when prices move out of other t ypes of reversal or consolidation formation….There can be little doubt that a genuine breakout has eventuated when prices jump out of a pattern with a conspicuous gap…..they carry the suggestion that buying demand that produced the gap is stronger than would be indicated by a gap-less breakout.

If high volume developed at the far side of the gap, and great many transactions took place there as prices moved on away from the gap, then the chances are remote that any near-term throwback will close the gap.”

Presently the market looks poised to confirm the breakawa gap, but many hours remain in today’s session and much can happen.

Markets: $QQQ $QQQQ $NQ_F

.